[ad_1]

Despite considerations over community congestion and excessive fuel charges, Ethereum stays bullish in the long run, based on borovik.eth–a companion at Rollbit, who posted on X on December 26. The key components driving the optimistic outlook are pointing to Ethereum’s developer ecosystem, its position within the broader blockchain ecosystem, and the launch of quite a few Layer-2 options (L2s).

Will Layer-2 Activity Drive ETH To New Highs?

Borovik.eth remained deviant and optimistic about ETH, even with Solana (OSL) and different layer-1 cash like Cardano (ADA) hovering in 2023. In the analyst’s view, Ethereum’s scaling challenges are manageable, believing that builders will discover methods of “resolving this concern permanently over the long term.”

Based on this optimism, the Rollbit companion believes that ETH will seemingly get well strongly within the coming classes contemplating the extent of improvement, particularly of layer-2 scaling choices meant for the pioneer good contract platform. According to Borovik.eth, the event of layer-2 off-chain choices backed by large firms, as an illustration, Coinbase, a crypto trade, and enterprise capitalists (VCs), positions Ethereum (ETH) favorably for a bull run.

As of December 26, ETH stays in an uptrend however is cooling off after strong positive aspects in This fall 2023. At spot charges, ETH is underperforming most layer-1 platforms like Injective Protocol (INJ) and Solana (SOL), whose costs rallied, reaching new 2023 highs. ETH costs are nonetheless trending under $2,400, a vital resistance degree. If bulls overcome this line, ETH could fly in the direction of $3,500 or higher within the months forward.

The spike in SOL’s valuation, particularly in H2 2023, has led to a comparability with ETH. Even so, most merchants are optimistic. Arthur Hayes lately acknowledged that customers ought to start rotating funds from SOL to ETH, an endorsement of the second most respected coin by market cap.

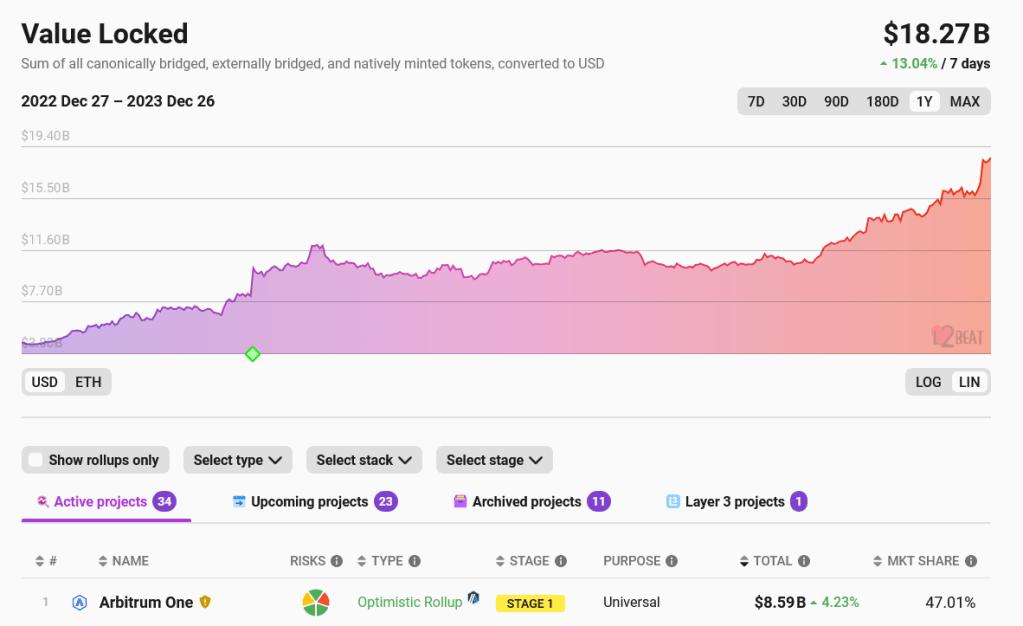

Ethereum Layer-2s Manage Over $18.8 Billion

While Ethereum faces challenges round on-chain scaling, builders have been working laborious to resolve this challenge. The launch of layer-2 off-chain choices utilizing rollups has been key on this drive. Most of those options, together with Arbitrum and Optimism, have been vital in assuaging strain from the mainnet, thus lowering fuel charges. According to L2Beat, layer-2 protocols handle over $18 billion as complete worth locked (TVL). There are additionally 34 energetic tasks, with 23 extra being developed.

Among the massive firms hitching the layer-2 journey is Coinbase, the place by Base, customers can transact cheaply whereas counting on the Ethereum mainnet for safety. According to Borovik.eth, over 60% of Base’s income is from rollup charges charged, highlighting the significance of their scaling answer and the position Ethereum performs in all this.

Related Reading: Shiba Inu Whale Moves $45 Million In SHIB, Bullish?

The upcoming Dencun Upgrade set for integration subsequent 12 months will additional slash layer-2 charges. Developers plan to launch this replace within the Goerli check community as early as mid-January 2024.

Feature picture from Canva, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site solely at your personal danger.

[ad_2]

Source link