[ad_1]

Bitcoin’s historic chart patterns and traits point out that Bitcoin has four-year cycles, divided into bull and bear cycles. Historically, this interprets to 3 years of bullish run adopted by one yr of bearish correction. In the final bear market, BTC worth tumbled from $68.8k in November 2021 to $16.4k in December 2022.

Bitcoin Bull Run To Continue Another Two Years

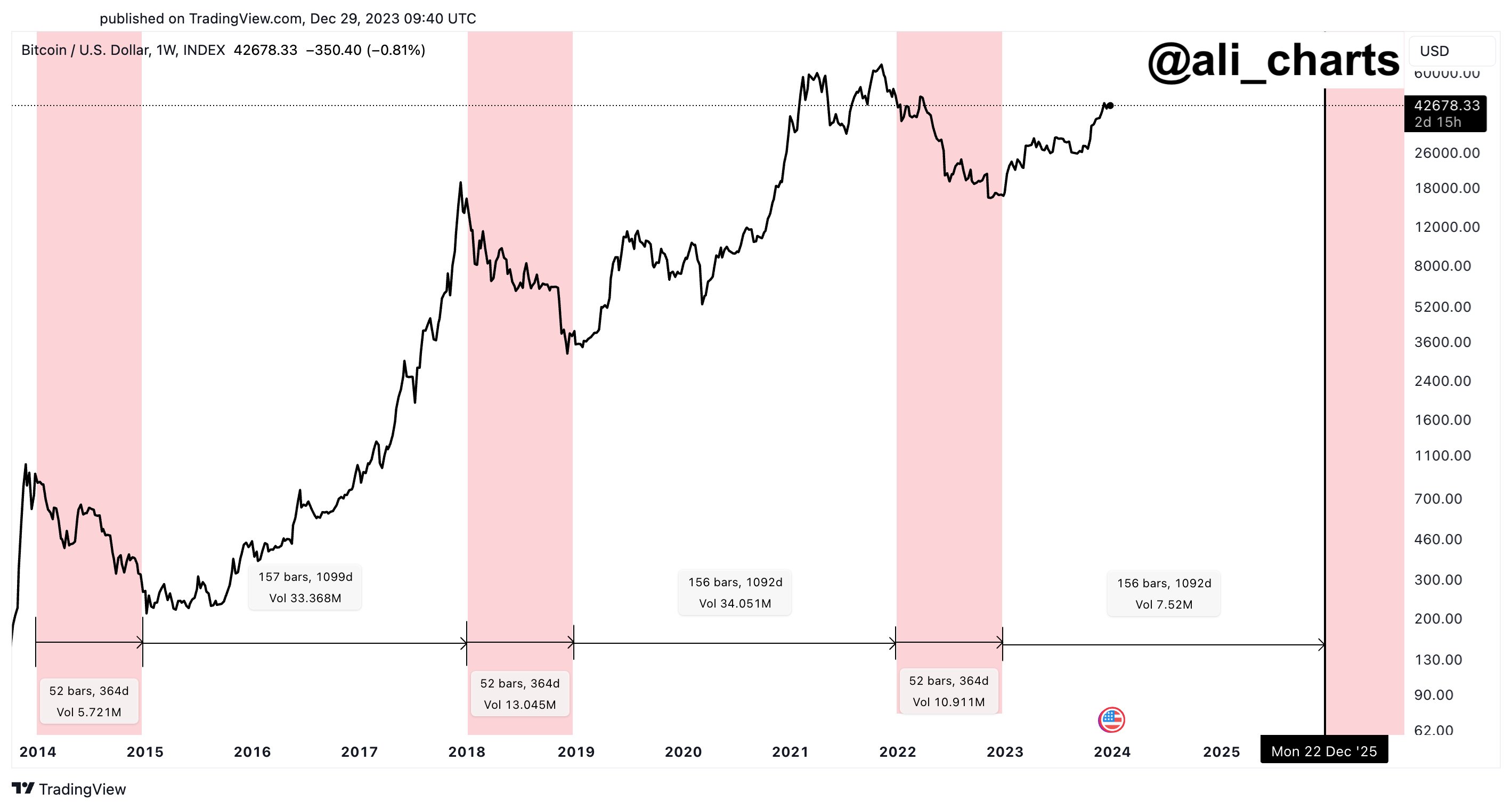

Popular analyst Ali Martinez shared a Bitcoin cycle chart indicating BTC worth patterns from 2014 to 2025. He mentioned Bitcoin is designed round four-year cycles, which is pushed by Bitcoin halving occasions occurring night 4 years.

Bitcoin halving occasions normally led to an enormous rally in Bitcoin worth. The four-year cycle has 3 years of bullish traits adopted by 1 yr of bearish correction. Bitcoin worth patterns have been related traditionally.

Martinez predicts Bitcoin is at present in a bullish section since January 2023 and can doubtlessly proceed its bullish run till December 2025. BTC worth rallied 170% in 2023 regardless of a number of lawsuits, regulatory challenges, and heightened scrutiny.

The subsequent Bitcoin halving is estimated to occur on April 20, 2024, as per the countdown data by NiceHash. Bitcoin block reward will lower from 6.25 BTC to three.125 BTC. Bitcoin worth has already began rallying larger within the final 2 months in response to the upcoming halving occasion.

Also Read: LUNC News – Terra Classic Community Votes On 8 Million USTC Burn Proposal

BTC price buying and selling sideways within the 24 hours, with the worth at present buying and selling at $42,916. The 24-hour high and low are $42,216 and $43,202, respectively. Furthermore, the buying and selling quantity has decreased by 7% within the final 24 hours, indicating a decline in curiosity amongst merchants.

Spot Bitcoin ETF approval by the US SEC and constructive sentiment because of price cuts by the US Federal Reserve are additionally components influencing Bitcoin worth rally.

Also Read:

The introduced content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.

[ad_2]

Source link

✓ Share: