[ad_1]

On-chain information exhibits the most important of the Ethereum whales have continued to purchase extra just lately as their provide units one other new all-time excessive.

Largest Ethereum Wallets Have Been Rapidly Accumulating

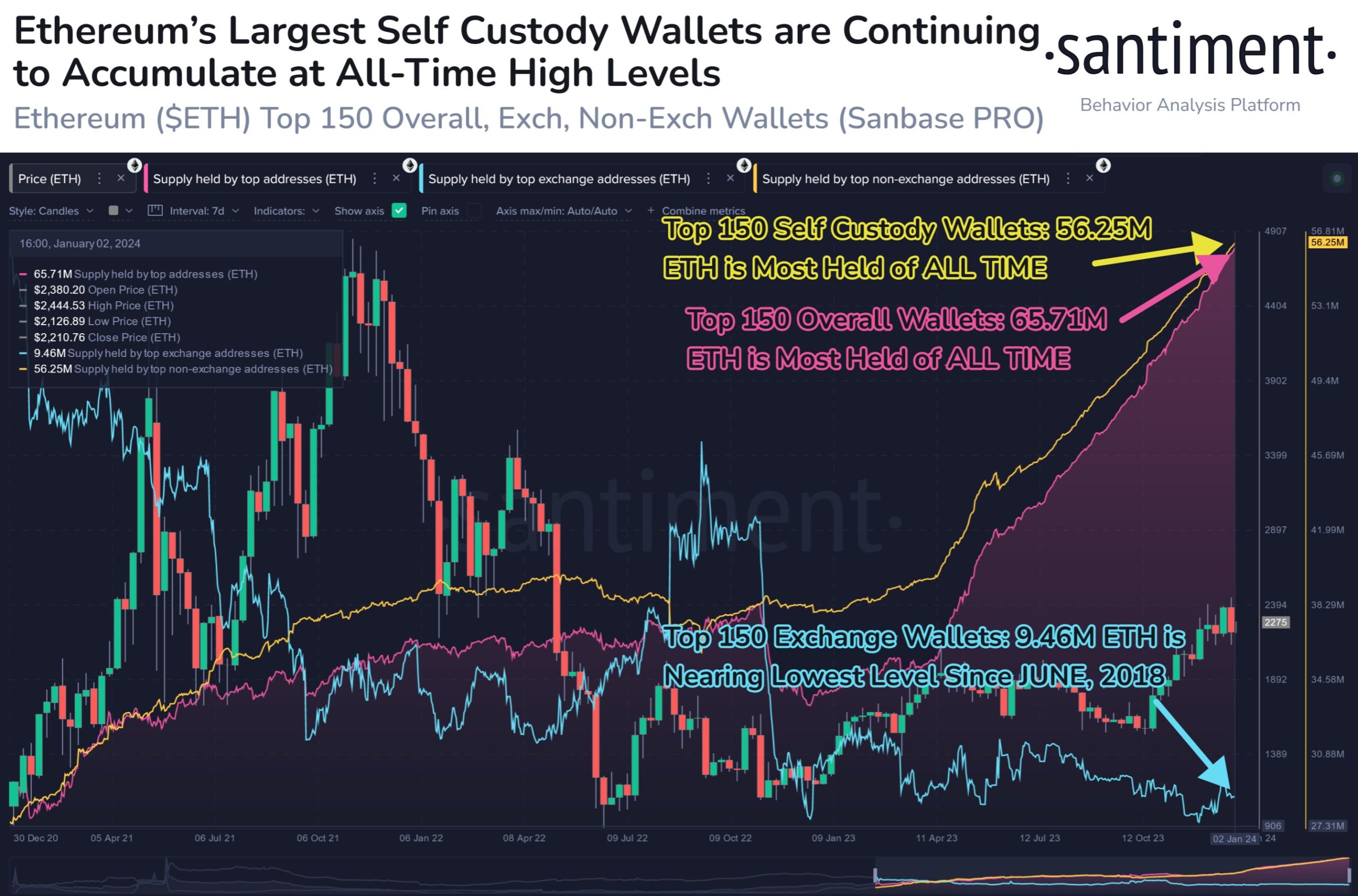

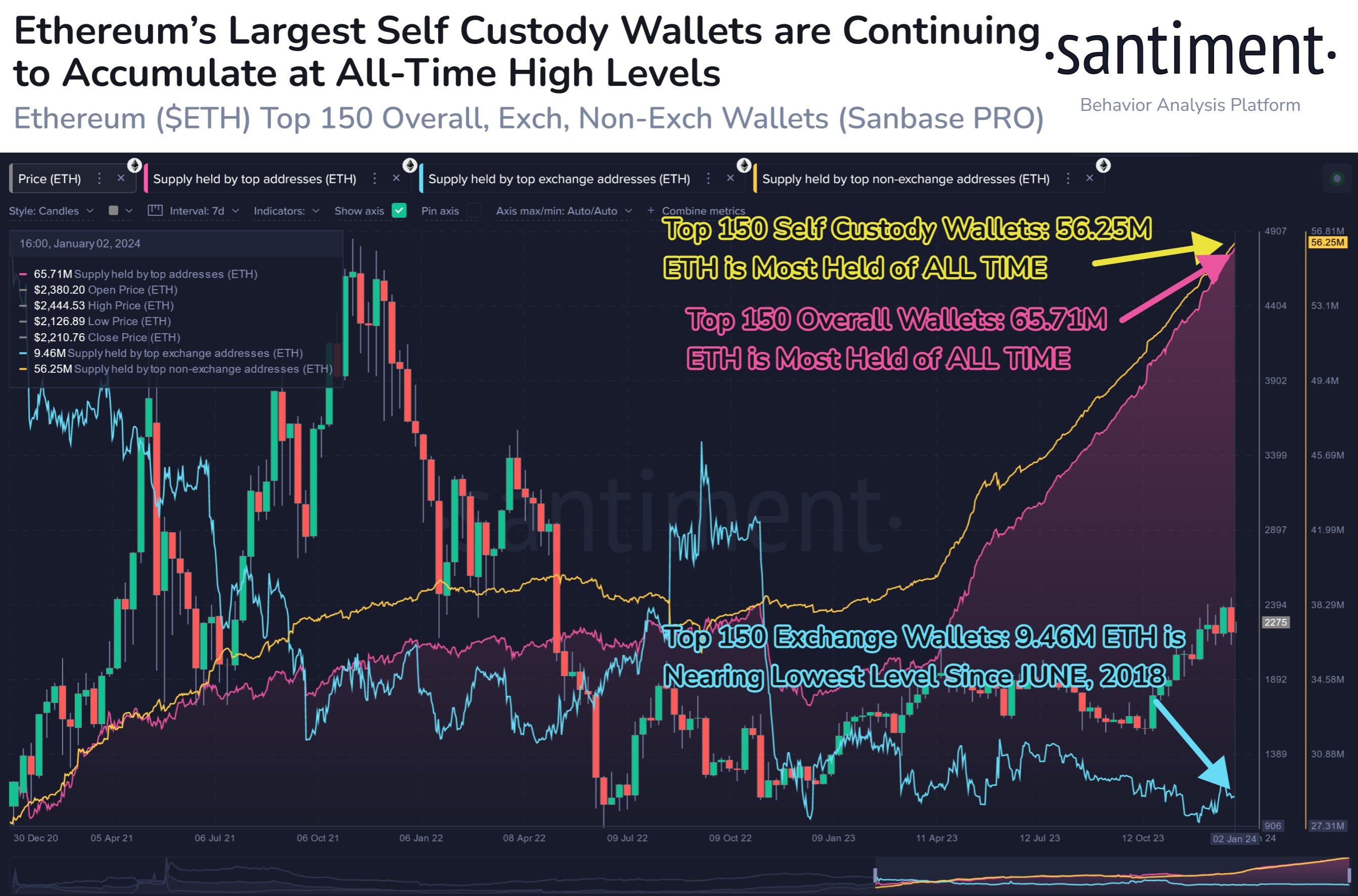

According to information from the on-chain analytics agency Santiment, the most important non-exchange Ethereum wallets have continued to indicate some fast accumulation just lately.

The related indicator right here is the “supply held by top non-exchange addresses,” which retains observe of the whole quantity of Ethereum that the 150 largest self-custodial wallets are carrying of their mixed stability proper now.

Naturally, the 150 largest non-exchange wallets would belong to the highest whale entities of the community. As such, the development within the metric can present hints in regards to the sentiment across the cryptocurrency amongst these humongous holders.

When the indicator goes up, it implies that these whales are increasing their holdings presently. Such a development naturally means that they’re bullish on the asset for the time being.

On the opposite hand, the metric registering a decline may be dangerous information for the cryptocurrency’s worth, because it implies that these massive traders have determined to take part in some promoting.

Now, here’s a chart that exhibits the development within the provide held by the highest non-exchange Ethereum addresses over the previous couple of years:

Looks just like the metric's worth has been always going up throughout the previous few months | Source: Santiment on X

As displayed within the above graph, the availability held by these prime 150 whales has been quickly going up since April 2023. This would counsel that the rally within the early months of the 12 months caught the eye of those massive entities, main them to build up.

Interestingly, the droop between August and October was additionally not sufficient to dissuade these holders, as they solely continued to purchase extra. Likewise, these whales have continued to push by means of the most recent plunge within the cryptocurrency’s worth as effectively.

After the latest shopping for spree, the availability of those prime non-exchange Ethereum wallets has reached 56.25 million ETH, which is a brand new all-time excessive for the indicator.

In the identical chart, the analytics agency has additionally connected the info for the availability held by the highest exchange addresses. This metric naturally measures the whole variety of cash that wallets connected to centralized platforms are carrying presently.

While the self-custodial whales have ramped up their provide, the highest 150 exchange-bound wallets have moved flat in the identical interval. At current, this indicator has a worth of 9.46 million ETH proper now, which is almost the bottom degree noticed since June 2018.

Generally, one of many primary explanation why traders deposit their cash to exchanges is for promoting functions. So the availability of those trade whales remaining low is a optimistic signal.

The fast accumulation that the self-custodial whale entities are exhibiting, mixed with the truth that the highest trade wallets are at low ranges, might imply the long-term outlook could also be optimistic for Ethereum.

ETH Price

While Bitcoin has already made some restoration from its crash, Ethereum has solely been in a position to rebound a bit thus far, as its worth is buying and selling across the $2,250 degree.

The worth of the asset seems to have been principally shifting flat for the reason that plummet | Source: ETHUSD on TradingView

Featured picture from Flavio on Unsplash.com, charts from TradingView.com, Santiment.internet

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site fully at your individual danger.

[ad_2]

Source link