[ad_1]

After the U.S. Securities and Exchange Commission (SEC) greenlights spot Bitcoin ETF listing and buying and selling, the most important asset supervisor BlackRock’s iShares Bitcoin Trust ETF (IBIT) debuts with a bang by skyrocketing almost 25% in pre-market hours on Nasdaq. Experts anticipate an enormous influx within the Bitcoin ETFs from the primary day itself.

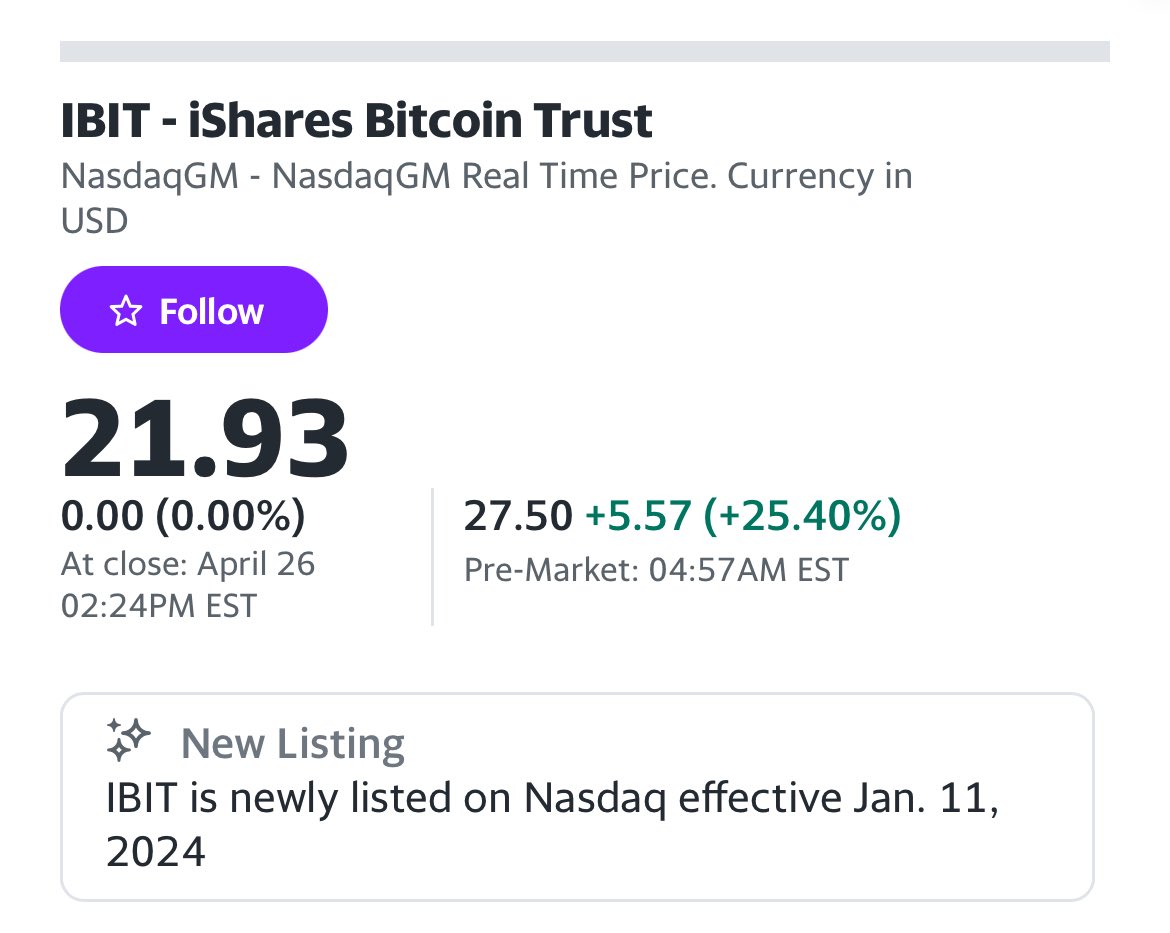

BlackRock Spot Bitcoin ETF Up 25%

BlackRock’s iShares Bitcoin Trust (IBIT) exchange-traded fund is buying and selling at $27.50, up over 25% in pre-market hours on January 11. The BlackRock spot Bitcoin ETF web asset worth (NAV) was at $26.12 on the approval date.

Bloomberg predicts $4 billion may circulation into spot Bitcoin ETFs on the primary day, with BlackRock grabbing almost $2 billion influx immediately.

BlackRock spot Bitcoin ETF is stay on their iShares web site, Nasdaq, and throughout 175000 Aladdin investor platforms after the itemizing. BlackRock introduced to cut back the payment to 0.25% and waive part of the payment for the primary 12 months. Thus, the payment might be 0.12% of the web asset worth (NAV) of the primary $5 billion of the Trust’s property.

“Through IBIT, investors can access bitcoin in a cost-effective and convenient way,” stated Dominik Rohe, head of Americas iShares ETF and Index Investing enterprise at BlackRock.

BlackRock spot Bitcoin ETF will assist take away some obstacles and operational burdens that stop buyers, from asset managers to monetary advisors, from immediately investing in Bitcoin.

Also Read: Bitcoin ETF Live Updates – US SEC Approves All 11 Spot Bitcoin ETFs, What’s Next?

The introduced content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

[ad_2]

Source link

✓ Share: