[ad_1]

The crypto area witnessed a historic second yesterday with the approval of 11 spot Bitcoin Exchange-Traded Funds (ETFs), a growth that’s been eagerly anticipated for the reason that Winklevoss twins filed for the primary proposed Bitcoin ETF again on July 1, 2013. This pivotal occasion coincides with the fifteenth anniversary of Hal Finney’s tweet “Running Bitcoin,” marking a symbolic milestone within the digital foreign money’s journey.

Despite the monumental approval by the US Securities and Exchange Commission (SEC), Bitcoin’s value response was muted, sustaining stability across the $46,000 mark. This means that the approval had already been factored into the market value. However, the panorama might shift dramatically with at this time’s graduation of buying and selling for these ETFs.

Spot ETFs, versus future ETFs, necessitate the acquisition of bodily Bitcoins by the issuers, thereby exerting direct shopping for strain available on the market. This facet, mixed with the high conviction among long-term investors (“hodlers”) and the historic low Bitcoin reserves on crypto exchanges, units the stage for probably unstable value actions.

Staggering Bitcoin Inflow Projections For Day 1

Projections for ETF inflows are staggering. Bloomberg anticipates a record-breaking $4 billion influx on the primary buying and selling day for spot Bitcoin ETFs, with issuers collectively contributing $312.8 million in Bitcoin seeding. BlackRock’s ETF is especially notable, with an anticipated $2 billion in inflows, as per Bloomberg Intelligence.

Standard Chartered lately projected that 2024 might see $50-100 billion in spot Bitcoin ETF inflows, with a possible Bitcoin value reaching $200,000 by the top of 2025. Mike Alfred, a Bitcoin professional, commented on the potential scale of those inflows:

Bitwise has confirmed they’ve $100M+ of investor commitments for tomorrow on day 1. I’m sure Blackrock is hoping for $3-4B. Invesco/Galaxy will even come out swinging. That’s plenty of corn. Hope the exchanges are prepared.

Tuur Demeester of Adamant Research highlighted the importance of the continued price struggle amongst issuers, suggesting that the extraordinary competitors displays expectations of considerable capital inflows. “The intensity of this Bitcoin ETF bidding war is telling me the issuers believe that the winner’s low fees will be compensated by HUGE $$ inflows,” he remarked.

Alistair Milne from Altana Digital echoed these sentiments, anticipating record-breaking inflows and a resultant surge in world curiosity in Bitcoin. “Tune in tomorrow when we’ll try to break the record for first day ETF inflows, create global FOMO and initiate the Bitcoin supercycle,” Milne wrote by way of X.

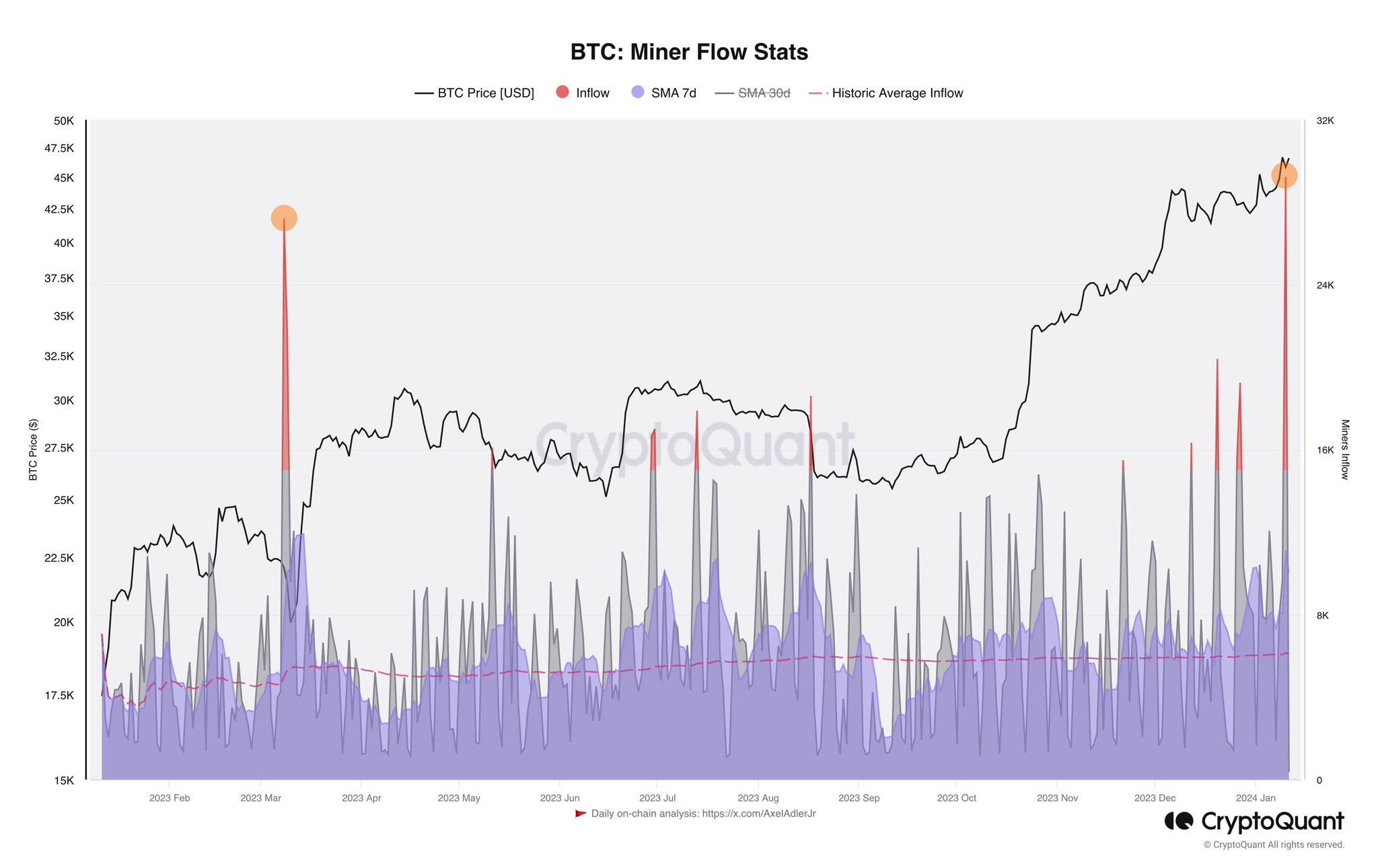

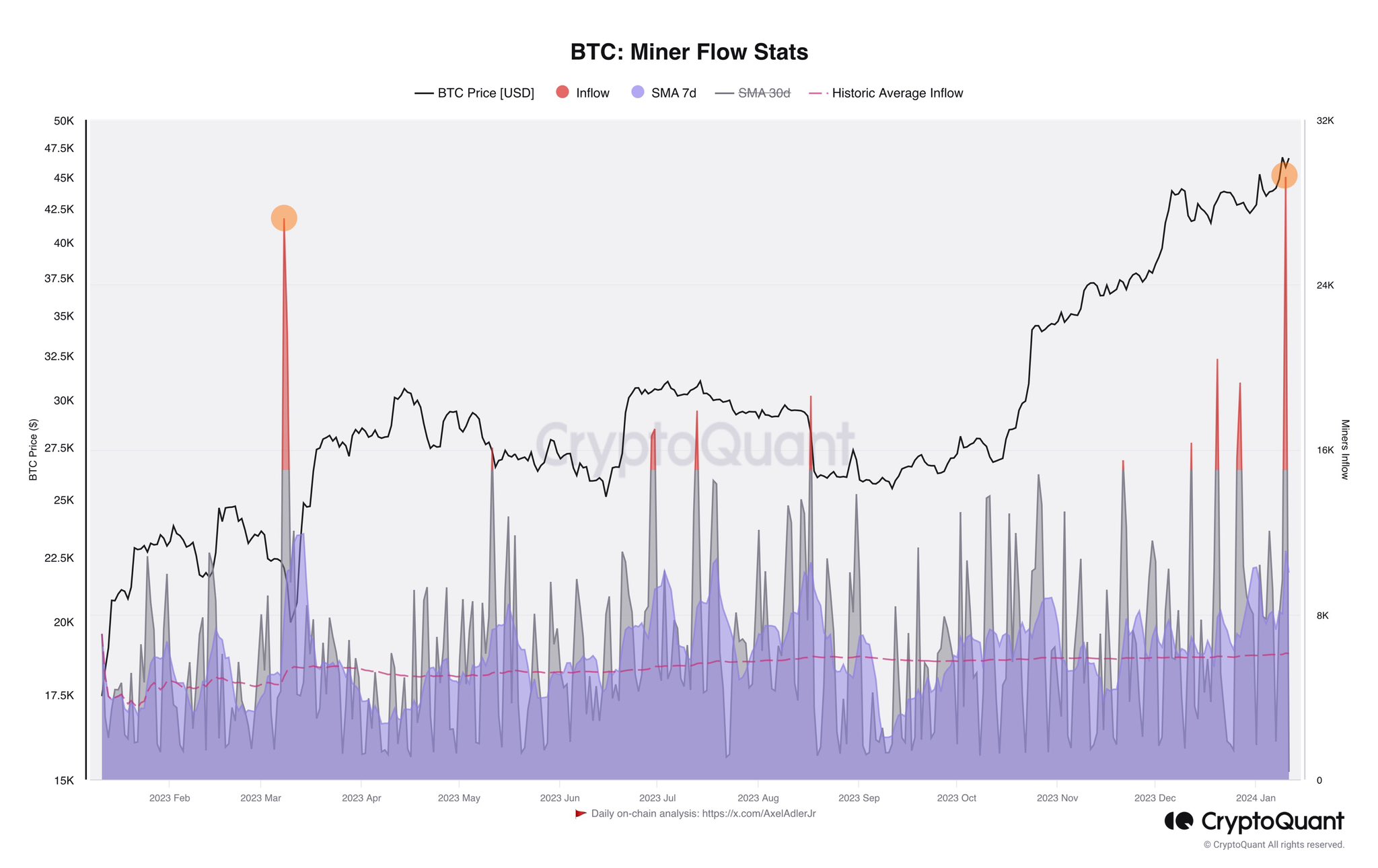

Meanwhile, on-chain analyst Axel Adler Jr. might have found a motive for Bitcoin’s lagging efficiency thus far. He identified that “miners have decided to take advantage of the cash inflow into the market.”

Next Target $50,000?

Raghu Yarlagadda, CEO of FalconX, in an interview with Bloomberg Technology, emphasised the essential affect of internet inflows on BTC’s value within the coming week:

What we’ve been listening to is most individuals are pricing in internet inflows into Bitcoin within the first week or so at $1 to $2 billion. So if the online inflows are much less $1 to $2 billion, it would have an antagonistic impact on value, and whether it is greater than $1 to $2 billion, it would have a optimistic impact on value.

1/ Based on buyer conversations, $1 to $2 billion of spot #BitcoinETF inflows within the first week are priced into Bitcoin at $45K. Inflows may very well be extra with ETF price wars starting this morning. 2024 is setup effectively for crypto with ETF approval, BTC halving, Ethereum improve, and… pic.twitter.com/L71Lkscfh5

— Raghu Yarlagadda (@2Ragu) January 8, 2024

British HODL, a recognized analyst on X, supplied a deeper perception into the present market dynamics, explaining the dearth of rapid value motion post-ETF approval and outlining situations for vital value modifications relying on the inflows after the ETFs begin buying and selling.

“For anyone wondering, Bitcoin price has not moved because: Leverage was wiped out yesterday, everyone who wanted in before the ETF, seems to be in. Only after 9.30am tomorrow can the ETFs actually start accepting capital and thus start acquiring Bitcoin,” he stated and added that if Bloomberg is true with $4 billion coming in on the primary day, “we *could* see a price of $50k-$57k by close of trading on Friday. The buying pressure has not even STARTED yet.”

At press time, BTC continued its sideways pattern and traded at $46,267.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site totally at your personal threat.

[ad_2]

Source link