[ad_1]

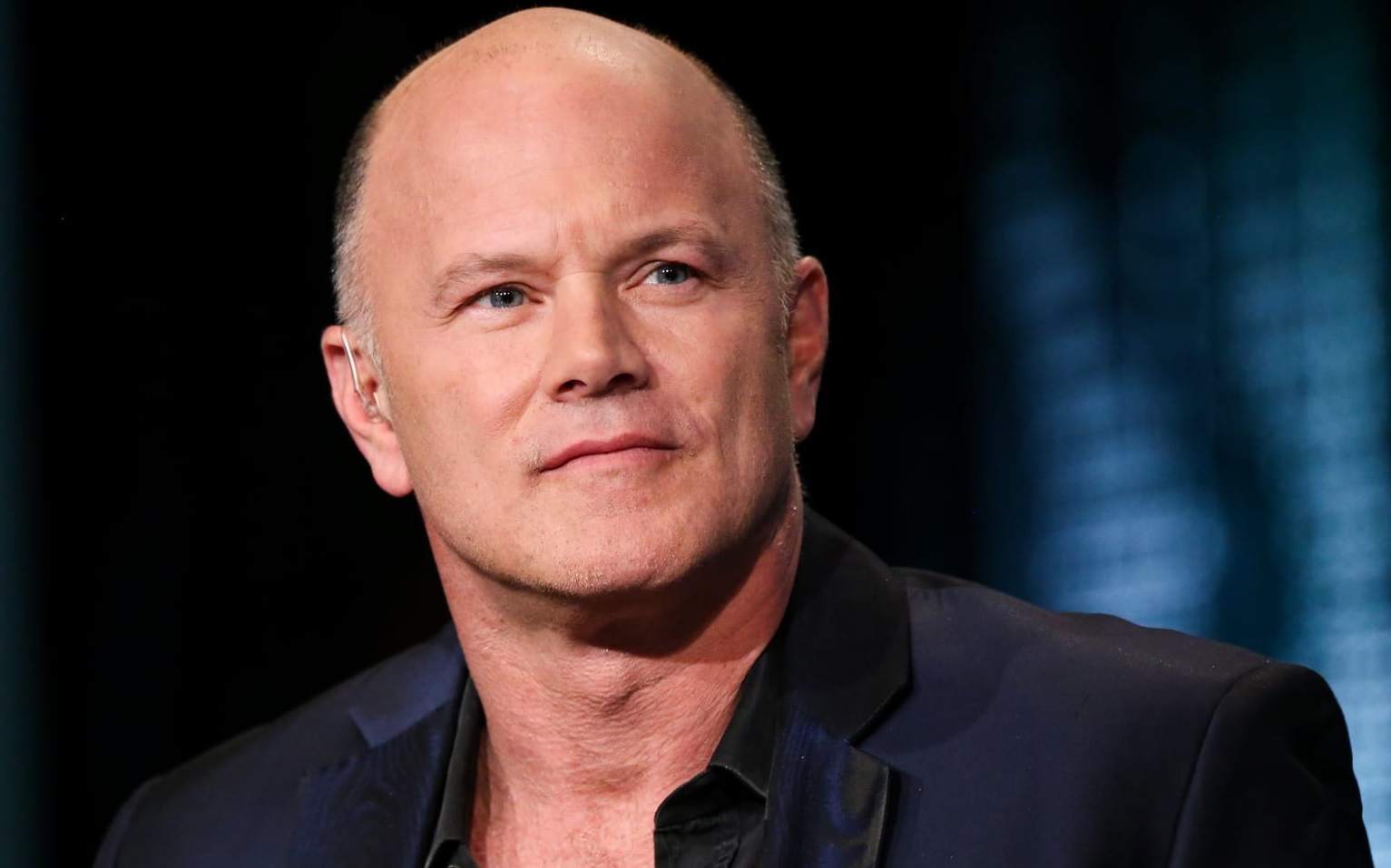

The latest regulatory inexperienced mild for 11 Bitcoin spot exchange-traded funds (ETFs) has triggered fierce competitors amongst asset administration giants. Mike Novogratz, CEO of Galaxy Digital, anticipates a showdown between Invesco, Fidelity, and BlackRock, whose IBIT traded $7.5M shares in the first 10 minutes of the launch

Amidst this crypto turbulence, Everlodge, a disruptor in fractional vacation home ownership, is making waves with its ongoing ELDG token presale.

Bitcoin ETF warfare unleashed

The approval of 11 Bitcoin spot ETFs has set the stage for a high-stakes battle amongst business behemoths. According to Mike Novogratz, a outstanding determine within the crypto sphere, the ETF panorama is turning into a hotbed of competitors. In a recent CNBC interview, Novogratz highlighted that success on this rising market is determined by execution, liquidity, and hidden charges, slightly than simply specializing in expense ratios.

Novogratz’s insights stem from his expertise, as Galaxy Digital, his agency, has partnered with Invesco to launch its cryptocurrency ETF. He predicts a fierce wrestle for dominance, emphasizing that the ETF market just isn’t one-size-fits-all. The latest regulatory approvals have ignited a race for patrons, with Invesco, BlackRock, and Fidelity rising as key contenders within the crypto showdown.

Everlodge: unlocking vacation home ownership

In a parallel narrative, Everlodge is disrupting the vacation home business with its ongoing ELDG token presale. This progressive platform permits customers to take a position fractionally in motels, luxurious villas, and vacation properties on the blockchain. Everlodge’s strategy to fractional investing eliminates the complexities related to conventional actual property funding, offering a seamless expertise for customers.

The ELDG token, designed as a real utility token, incentivizes and advantages the Everlodge neighborhood and traders. Early adopters stand to realize from options resembling passive revenue by way of staking, unique month-to-month rewards, and eligibility for the Everlodge personal members membership. Token holders can even leverage their ELDG tokens for reductions on buying and selling charges and purchases inside the Everlodge ecosystem.

Is Everlodge a great funding?

The query on many minds is whether or not Everlodge and its ELDG token signify a sound funding alternative. Everlodge’s distinctive strategy to democratizing vacation home ownership, coupled with the combination of blockchain know-how, positions it as a disruptor within the business. The ongoing ELDG token presale gives early traders with an opportunity to take part on this groundbreaking enterprise.

Investors on the lookout for an different asset class could discover Everlodge interesting. The platform’s emphasis on offering passive revenue, reductions, and unique rewards provides an enticing layer to the funding proposition.

However, as with all funding, potential members ought to conduct thorough analysis, contemplating elements like market traits, Everlodge’s roadmap, and broader financial circumstances.

Conclusion

The cryptocurrency panorama is witnessing macro-level battles amongst business giants like Invesco, BlackRock, and Fidelity, and micro-level disruptions by way of progressive platforms like Everlodge. The regulatory approval of Bitcoin spot ETFs has not solely intensified competitors but additionally highlighted the evolving nature of the crypto market.

As traders navigate this dynamic surroundings, Everlodge is a testomony to the continuing transformation in how folks make investments and have interaction with rising applied sciences within the digital age.

[ad_2]

Source link