[ad_1]

The world’s largest cryptocurrency Bitcoin (BTC) has skilled substantial promoting stress not too long ago with the BTC price crashing to $40,000 earlier at present. This has occurred as there have been giant outflows from the Grayscale Bitcoin Trust (GBTC) shifting into the newly launched Bitcoin ETFs.

Bitcoin Price Can Correct to $34,000

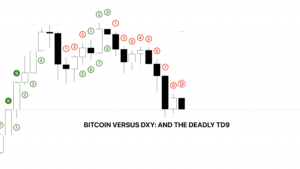

Renowned crypto analyst Ali Martinez has identified the adherence of Bitcoin’s worth actions to a parallel channel. According to Martinez, this means that Bitcoin encountered resistance on the higher boundary of the channel, located at $48,000.

The analyst anticipates a retracement for Bitcoin, projecting a decline to the decrease boundary at $34,000. Subsequently, Martinez foresees a rebound, with Bitcoin aiming to revisit the higher boundary, which is ready at $57,000. This statement supplies invaluable insights into the potential worth trajectory of Bitcoin, providing a perspective on key assist and resistance ranges inside the established parallel channel.

Santiment, a outstanding on-chain information supplier, stories that merchants proceed to preserve optimism relating to the long-term implications of the approval of 11 preliminary Spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) on January tenth. However, Santiment highlights a notable shift in sentiment, suggesting that the Fear of Missing Out (FOMO) surrounding the approvals might have contributed to a neighborhood cryptocurrency market prime.

Experts posit that the broadly anticipated approvals have been already factored into market costs on the time of the bulletins, main to a subsequent decline in Bitcoin’s worth. After Bitcoin skilled a big drop to $40.6K, representing a 16.9% lower from its peak market worth the earlier week, Santiment observes that the narrative surrounding these ETFs may shift.

There is a eager curiosity in monitoring whether or not the group’s sentiment turns unfavorable, associating phrases like “scam,” “ripoff,” or “disaster” with the accepted ETFs. If a bearish sentiment emerges across the topic that originally drove costs larger from October by way of December, Santiment anticipates that Fear, Uncertainty, and Doubt (FUD) may set off selloffs from novice merchants.

Expect Multi-Month Stagnation

In a latest evaluation, On-chain College suggests {that a} multi-month correction or stagnation for Bitcoin worth may very well be within the making. Such a development, in accordance to the evaluation, doesn’t essentially sign an impending bear market and will doubtlessly pave the way in which additional for a sturdy bull run sooner or later as cash transition to stronger fingers inside the market.

Amidst the present market situations, consideration stays on the short-term price foundation for Bitcoin, at present located at $37.8K. Historically, this stage has additionally served as a assist stage throughout bull markets and a resistance stage throughout bear markets, including significance to its position in shaping market dynamics. The insights supplied by On-chain College additional provide a nuanced perspective on the potential trajectories for Bitcoin worth, acknowledging the historic implications of key worth ranges in influencing market developments.

The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.

[ad_2]

Source link

✓ Share: