[ad_1]

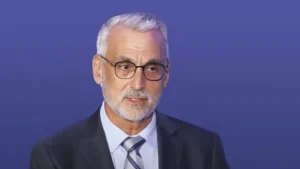

Horst Jicha, the CEO of USI Tech, is going through extreme charges for orchestrating a fraudulent scheme that deceived buyers out of $150 million. Jicha, a 64-year-old German nationwide, was arrested in December, marking a major flip in a saga that started in 2018 with stop and desist letters from U.S. and Canadian regulators.

Promises Too Good to Be True

USI Tech, underneath Jicha’s management, marketed itself as an accessible funding platform for each novice and seasoned buyers. The firm attracted hundreds of thousands in investments by promising a 140% return over 140 days.

Jicha’s technique concerned promoting 50-euro Bitcoin packages, which have been purported to yield 1% returns each day. However, the underlying mechanisms of those returns, vaguely attributed to crypto mining and algorithms, wanted to be clearly defined.

Regulatory Red Flags and Downfall

The operation started to unravel when regulatory authorities within the U.S. and Canada issued stop and desist orders to USI Tech, citing the unlawful sale of unregistered securities. Instead of complying and safeguarding buyers’ pursuits, Jicha allegedly transferred $150 million to offshore accounts.

However, after 5 years of evading U.S. authorities, Jicha’s run got here to an finish. His arrest, simply earlier than a deliberate trip to Miami. This arrest underscores the dedication of the U.S. authorized system to carry people accountable, whatever the complexity of their crimes or their worldwide mobility.

USI Tech’s CEO Legal Proceedings and Defense

Scheduled for arraignment in a federal court docket in Brooklyn, Jicha faces securities fraud and cash laundering prices. His attorneys have hinted at a extra complicated situation, suggesting different important gamers behind the scenes. This angle may doubtlessly reshape the case’s narrative because it unfolds in court docket.

This incident is a stark reminder of the perils lurking within the largely unregulated world of cryptocurrency investments. The promise of excessive returns typically masks the inherent dangers and the opportunity of fraudulent schemes. As the trade continues to evolve, it turns into crucial for buyers to train due diligence and for regulators to tighten oversight to forestall such misleading practices.

Read Also: AI News: Google DeepMind Experts Plots Breakout for New Venture

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty for your private monetary loss.

[ad_2]

Source link

✓ Share: