[ad_1]

In the newest improvement within the U.S. Securities and Exchange Commission (SEC) lawsuit towards Ripple Labs, defendant Ripple opposed the SEC in search of audited monetary statements, post-complaint contracts for the sale or switch of XRP to

“non-employee counterparties”, and particulars on the quantity of “XRP Institutional Sales proceeds” obtained after the lawsuit submitting.

Ripple Opposes SEC’s Requests

According to a court docket filing late January 19, Ripple opposed the U.S. SEC’s movement to compel sure post-complaint discovery. Ripple attorneys have been tackling the SEC’s transfer within the XRP lawsuit, urging Judge Analisa Torres to rule of their favor as a result of irrational arguments by the SEC.

The SEC requested the court docket to compel Ripple to submit audited monetary statements for 2022-2023, contracts for the sale or switch of XRP to “non-employee counterparties”, and quantity of “XRP Institutional Sales proceeds” obtained after the submitting.

However, Ripple gave two causes to disclaim the request. Firstly, the SEC has did not request discovery whereas reality discovery was open and now lacks good trigger for additional discovery regarding post-complaint gross sales.

“The SEC never argued that post-complaint discovery was relevant to remedies but instead took the position that post-complaint conduct was entirely irrelevant to the case. That motion was resolved after Ripple agreed,” argues Ripple.

Secondly, the SEC requests are irrelevant and has no bearing on the court docket’s cures willpower. The SEC’s contemplating whether or not Ripple’s post-complaint conduct violated the legislation will want a prolonged reality discovery interval or a brand new litigation.

The SEC’s interrogatory specifically, the SEC has used all of its interrogatories within the case and can’t unilaterally grant itself extra.” Ripple urges the court docket to disclaim irrelevant post-complaint discovery.

CoinGape earlier reported that the SEC’s motion to compel is grounded in a July 2023 ruling, the place it was decided that XRP tokens qualify as a safety when offered to institutional traders.

Also Read: Bitcoin Price Sees Mild Bounce back, Whale Activity at 15-Month High

Lawyers Claim the Discovery As Irrelevant In XRP Lawsuit

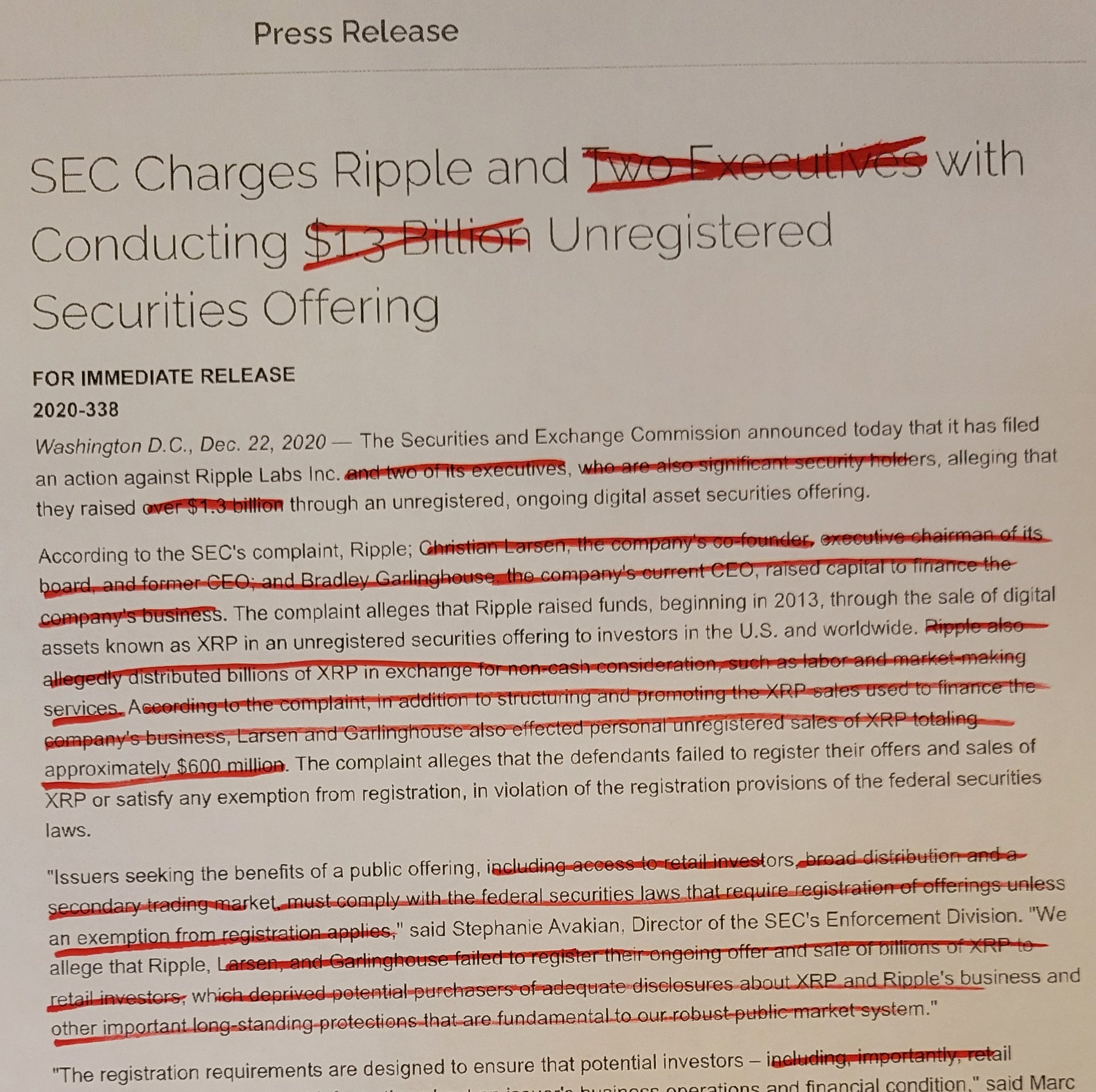

Attorney Jeremy Hogan mentioned the SEC now in search of comparatively minor discovery dispute will not be all that legally fascinating. He additionally appears at the SEC‘s grand press launch from 2020 when it filed the lawsuit and it exhibits the SEC is dropping its grip on the lawsuit.

Attorney Bill Morgan identified that the SEC would require litigating whether or not post-complaint gross sales meet the Howey check. He claims ODL clients will elevate a problem as he referred to in his a number of earlier posts. “How does an ODL customers expect profits from using XRP.”

Also Read: US SEC Acknowledged Options for Spot Bitcoin ETFs, Approval By Feb End?

The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

[ad_2]

Source link

✓ Share: