[ad_1]

BlackRock lately unveiled its extremely anticipated IBIT spot Bitcoin exchange-traded fund (ETF), marking a major milestone in integrating cryptocurrencies into mainstream finance.

Rachel Aguirre, the U.S. Head of BlackRock’s iShares Products, shared in an interview with Yahoo Finance the exceptional success this ETF has achieved shortly after its launch. The IBIT, simply inside its preliminary two weeks of buying and selling, skilled a hovering buying and selling quantity, reaching $3 billion, a testomony to its quick market affect.

Surge in Investor Interest

The launch of the IBIT ETF has been successful when it comes to buying and selling quantity and attracting substantial investor curiosity. The fund amassed over $1.6 billion in inflows, highlighting the rising urge for food amongst buyers for cryptocurrency-related merchandise.

Aguirre emphasised BlackRock’s dedication to offering easy accessibility to Bitcoin, and the IBIT ETF stands as a chief instance of this technique. BlackRock backs the ETF with a major holding of 16,361 BTC, additional underlining its confidence within the cryptocurrency market.

Resilience of Bitcoin

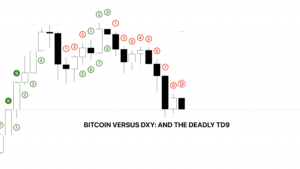

Concurrently, Bitcoin (BTC) has proven exceptional resilience. The market has stabilized BTC costs because the launch of U.S.-based Bitcoin ETFs, together with BlackRock’s IBIT. The cryptocurrency lately witnessed a slight uptick, momentarily touching $40,527. This efficiency aligns with a possible bullish sample on Bitcoin’s charts, suggesting a rally to $42,000, supplied present tendencies proceed.

The cryptocurrency market underwent a speculative surge main as much as the approval of Bitcoin ETFs, adopted by a slight downturn, a typical ‘sell-the-news’ occasion. However, this latest lower of round 20% from the excessive of $49,021 is comparatively modest in comparison with previous corrections, indicating a rising maturity and stability within the Bitcoin market.

BTC/USD Potential Trend

Applying Elliott’s wave principle, market analysts recommend that Bitcoin may discover a secure base within the $36,000 to $38,000 vary, setting the stage for a possible future surge. This principle, coupled with historic information, means that value declines in Bitcoin are sometimes adopted by notable upward tendencies, presenting potential alternatives for buyers.

Read Also: Grayscale Moves Fresh $579M Bitcoin to Coinbase as Market Stabilizes

The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link

✓ Share: