[ad_1]

Bitcoin (BTC), the world’s largest and oldest cryptocurrency, has been grappling with a significant pullback currently. The Bitcoin worth lately prolonged decrease than the $40,000 degree earlier than bouncing again. However, the rebound isn’t important as BTC continues to be buying and selling 19% under the excessive attained after the Spot Bitcoin ETF approval. Amidst the crash frenzy, a crypto analyst even warned in opposition to a BTC worth dip to $38,130

Analyst Insight On Bitcoin Price Crash To $38,130

A well-liked crypto insights supplier on X, Ali Martinez, advised that the latest Bitcoin worth dip may prolonged under $38,130. In a latest put up on X, he additionally acknowledged that it will set off panic promoting mode amongst quick buyers. The analyst famous that the value crash under the above-mentioned threshold would point out losses for short-term BTC holders.

Hence, he anticipates a “new wave of panic selling” to happen as these quick merchants would search methods to reduce their losses. However, the bearish flip is momentarily as Martinez expects the Bitcoin bull cycle to high in late 2025.

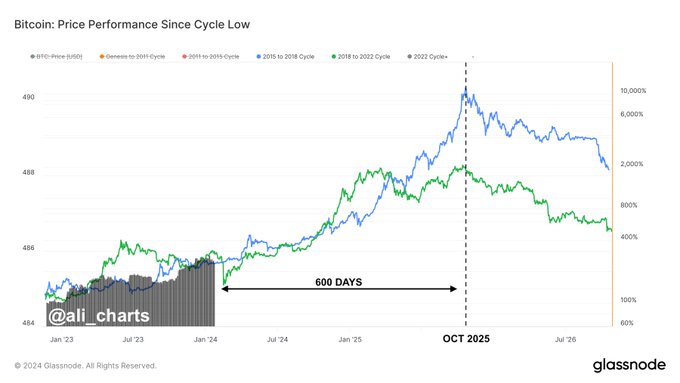

In one other put up, he talked about that Bitcoin is at present mirroring historic bull runs stretching from 2015-2018 and 2018-2022. Thereafter, he famous that market projections point out a possible peak in October 2025. He went on to conclude, “This implies $BTC still has 600 days of bullish momentum ahead!” Therefore, long-term Bitcoin HODLers can calm down and revel in humongous good points when this bull cycle tops.

In addition, Martinez additionally talked about that each one Bitcoin worth corrections throughout a bull run are adopted by an upswing, in accordance with historic patterns. He suggested that merchants who need to capitalize on Bitcoin’s potential progress may leverage the “buy the dip” alternative.

Also Read: Bitcoin Eyes $42K Surge as BlackRock’s Head Sees ETF Impact

BTC Price Struggles To Rebound

The Bitcoin price is struggling to maintain over the $40,000 mark because it’s hit by a pullback after each try to rebound. BTC was buying and selling at $40,111.13 at press time on Thursday, January 25, indicating a 0.25% enhance. Whilst, the crypto boasted a market cap of $786.18 billion.

On the opposite hand, the 24-hour commerce quantity for Bitcoin plummeted 34.75% to $20.09 billion. Also, it plunged as little as $39,508.80 earlier than rebounding. Furthermore, the Bitcoin worth is significantly decrease than its 10-day and 50-day EMAs of 41038 and 41749, respectively, in accordance with information from TradingView.

Earlier, Martinez underscored the importance of the $38,000 threshold on the weekly chart. The analyst cautioned {that a} shut under this significant degree could function a sign for a possible downturn in Bitcoin’s worth, which may goal the robust assist cluster round $33,000.

This vital zone is predicated on a bunch of key technical indicators, together with the decrease boundary of a parallel channel, the 0.5 Fibonacci retracement degree, and the 50-week easy SMA. However, the analyst famous that these “factors together form a significant line of defense that could potentially halt further #BTC price declines.” This implies {that a} BTC worth drop under $32,000 isn’t on the playing cards as of now.

Also Read: Bitcoin Whales Have Been Buying Every Dip, BTC Price Recovers to $40,000

The offered content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link

✓ Share: