[ad_1]

- Standard Chartered Bank says the SEC may approve spot Ethereum ETFs on May 23, the ultimate deadline for functions at present earlier than the regulator.

- Ethereum worth may surge to over $4,000 by then, the financial institution stated in a report.

The US Securities and Exchange Commission (SEC) is likely to offer a nod to the primary spot Ethereum ETF in May, the Standard Chartered Bank stated in a report on Tuesday.

In explicit, the financial institution’s analysts see the regulator approving the ETH spot ETFs on May 23. According to the financial institution’s be aware shared with shoppers and reported on by The Block, the May date is the ultimate deadline for functions earlier than the SEC.

“We expect pending applications for ETH U.S. spot ETFs to be approved on May 23, the final deadline for the first of the ETFs under consideration — the equivalent date to Jan. 10 for BTC ETFs,” Geoffrey Kendrick, Head of Forex and Digital Assets Research at Standard Chartered Bank, stated.

ETH worth may surge to $4,000

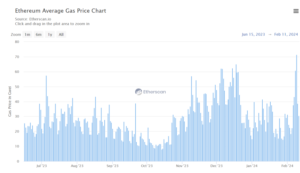

The SEC not too long ago delayed spot Ethereum ETF functions for BlackRock and Fidelity. However, ought to the regulator approve the ETF proposals earlier than it, the price of Ethereum may skyrocket. In the lead as much as the approval, Standard Chartered sees a possible spike to $4,000.

“If ETH prices perform similarly to how BTC prices performed in the lead-up to BTC ETF approval, ETH could trade as high as $4,000 by then.”

Bitcoin worth rallied following BlackRock’s spot Bitcoin ETF utility, surging from round $25k to hit a a excessive of $49k. While costs are again to lows of $43k, after rebounding from round $38.6k final week, the market is bullish as the subsequent BTC halving approaches.

Ethereum surged after BlackRock filed for a spot ETH ETF in November, reaching highs above $2,700. The main altcoin’s worth is at present close to $2,375, up 3% up to now hour because the altcoin market seems to be to bounce alongside the benchmark cryptocurrency.

[ad_2]

Source link