[ad_1]

A crypto analyst, Eric, believes Ethereum (ETH) may spike to $20,000 within the upcoming bull run. The analyst stated the potential launch of spot Ethereum exchange-traded funds (ETFs) within the United States will propel this upswing.

Ethereum To $20,000 Possible

In a submit on X, Eric cited Ethereum’s historic tendency to reflect Bitcoin (BTC), albeit with a one-cycle lag. In the earlier bull market, the analyst famous that Bitcoin surged 22-fold from $3,100 to $69,000. Therefore, if Ethereum follows the same trajectory, reaching $20,000 can be a practical chance.

As the analyst famous, Ethereum’s current bear market backside of $880 in 2022, if extrapolated utilizing the 22x progress fee seen in BTC, locations the coin at $19,360. However, the analyst believes Ethereum may surpass expectations, making $20,000 a base and a psychological spherical quantity to watch carefully.

Supporting this forecast is the doable approval of a spot Ethereum ETFs. Like the spot Bitcoin ETF, this authorization will possible appeal to institutional buyers and considerably enhance Ethereum costs and liquidity. Institutional buyers can acquire publicity to Ethereum by these complicated by-product merchandise with out the complexities of straight buying and selling or storing the coin.

While the optimism stays, the United States Securities and Exchange Commission (SEC) will possible observe the identical path it took earlier than approving the primary spot of Bitcoin ETFs in January. For context, the strict company did not approve any spot Bitcoin ETF for over ten years, citing market manipulation dangers and the absence of correct monitoring instruments.

Will The US SEC Approve A Spot Ethereum ETF?

However, in a current assertion by The Block, Standard Chartered, a worldwide financial institution, stated the US SEC will possible approve Ethereum ETF’s first spot in May 2023. By then, the financial institution added, ETH costs can be buying and selling at round $4,000, propelled by basic market optimism.

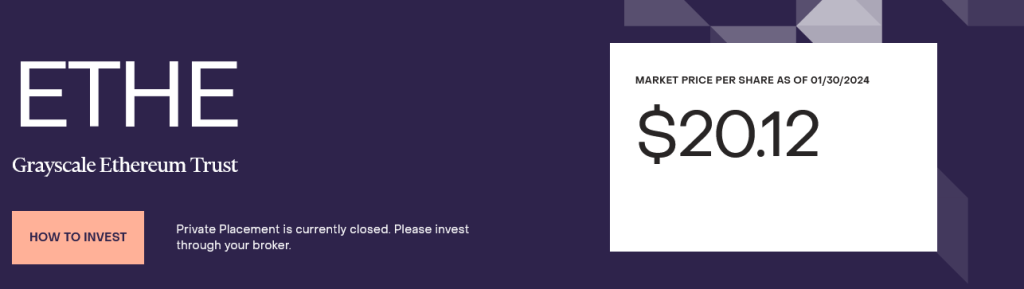

The financial institution notes that the failure of the company to categorise ETH as a safety additional provides weight to this expectation. At the identical time, Grayscale Investments, which is issuing Grayscale Ethereum Trusts (ETHE), needs to transform this product into an ETF. Each share traded at round $20 as of January 30.

Earlier, Grayscale received towards the US SEC’s arguments, wishing to forestall the conversion of their Bitcoin Trust into an ETF. This win set the ball rolling for the eventual approval of the primary spot Bitcoin ETFs within the United States.

Additionally, the truth that Ethereum Futures ETFs have been just lately authorized and listed on the Chicago Mercantile Exchange is a internet optimistic, paving the way in which for a possible itemizing in May 2024.

Feature picture from Canva, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site completely at your individual danger.

[ad_2]

Source link