[ad_1]

Recent shifts in BTC miner reserves spark Bitcoin worth hypothesis, with specialists foreseeing a doable correction to $42,000 earlier than a halving rally. Meanwhile, miners appear to be fortifying their steadiness sheets in preparation for April’s halving occasion, hinting at impending market shifts.

Notably, as Bitcoin’s worth hovers round $43,000, issues about miner promoting strain and outflows persist, influencing market sentiment and investor selections.

Miner Reserves Decline Weighs On Bitcoin Price

According to a current Bloomberg report, Bitcoin miners have been decreasing their reserves in anticipation of the upcoming halving occasion in April. The discount in miner reserves, coupled with elevated promoting exercise, suggests a strategic transfer by miners to optimize their monetary positions amidst impending income declines.

Bitcoin miner reserves have decreased by 8,400 tokens since 2024’s begin, signaling elevated token gross sales. Notably, now the miner reserves stood at 1.8 million, its lowest degree since June 2021. This transfer displays miners’ proactive stance amidst the approaching discount in transaction verification rewards.

Meanwhile, Matthew Sigel, head of digital-asset analysis at VanEck, highlights the importance of miners’ actions within the present market panorama. He notes that miners are preemptively promoting their holdings to mitigate potential margin pressures post-halving, emphasizing the significance of scale in navigating future challenges.

Notably, this strategic shift amongst miners underscores the evolving dynamics of the Bitcoin ecosystem and its broader implications for market stability and investor sentiment. In addition, evidently the current surge in Spot Bitcoin ETFs within the United States has additional influenced miner habits and market dynamics.

Bitfinex’s Alpha market report reveals a considerable outflow of Bitcoin from miner wallets to exchanges following the launch of Bitcoin ETFs, signaling heightened market exercise and investor curiosity. This inflow of Bitcoin to exchanges displays a posh interaction of things, together with miners’ liquidity wants and broader market sentiment surrounding ETF adoption and regulatory developments.

Also Read: Dogecoin Whale Dumps 100 Mln DOGE To Robinhood, Price Dip Ahead?

Other Factors That Could Impact The Price

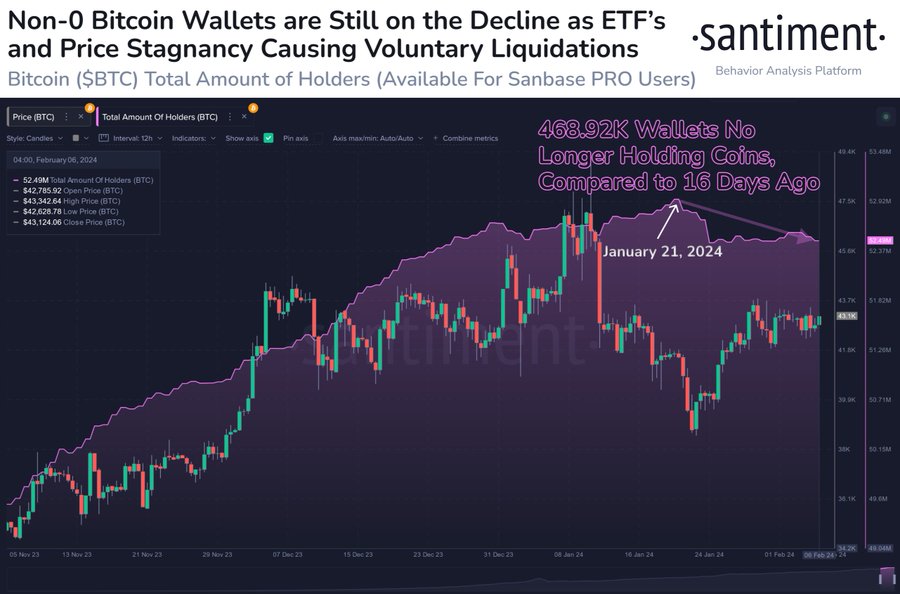

Recent information from Santiment on the X platform reveals a decline in Bitcoin wallets holding greater than 0 cash. This pattern persists practically 4 weeks after the SEC’s approval of 11 Spot ETFs for crypto, elevating speculations among the many crypto market fans.

Meanwhile, the Santiment report mentioned that this decline could stem from crowd FUD and diversification into different investments, signaling dynamic shifts within the crypto market sentiment and funding methods. On the opposite hand, prime crypto analyst Michael van de Poppe suggests Bitcoin might consolidate, doubtlessly correcting to $42,000 earlier than rallying in direction of the $48-50K mark pre-halving.

However, the updates come amid a time when the Bitcoin Futures Open Interest soared notably during the last 24 hours, suggesting a bullish sentiment available in the market. Meanwhile, Bitcoin OI surged 1.17% during the last 24 hours to 419.93K BTC or $18.05 billion. Notably, the CME change topped the checklist, with a 4.65% surge in Bitcoin Open Interest to 106.09K BTC or $4.55 billion.

Despite a surge in Bitcoin OI, the BTC price traded close to the flatline during the last 24 hours at $42,918.68. Notably, during the last 24 hours, the Bitcoin worth has touched a excessive of $43,344.15 and a low of $42,625.90.

Also Read: South Korea to Bring Strict Digital Assets Act With Life Imprisonment for Violators

The introduced content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.

[ad_2]

Source link

✓ Share: