[ad_1]

Crypto and inventory market traders awaited the consumer price index (CPI) inflation information for January by the U.S. Bureau of Labor Statistics for additional cues on Fed charge cuts. Bitcoin value fell under $50,000 regardless of a large shopping for in spot Bitcoin ETFs that triggered a considerable crypto market rally. BTC value can nonetheless hit $55K after hotter CPI inflation information.

With spot Bitcoin ETF recording $494 million internet influx on Monday, specialists similar to MicroStrategy’s govt chairman Michael Saylor imagine a excessive demand will push BTC value increased in a couple of weeks.

Also Read: Bitcoin Slips As US CPI Comes At 3.1%, Fed Swaps Rate Cuts to July

CPI and Core CPI Expectations by Wall Street Giants

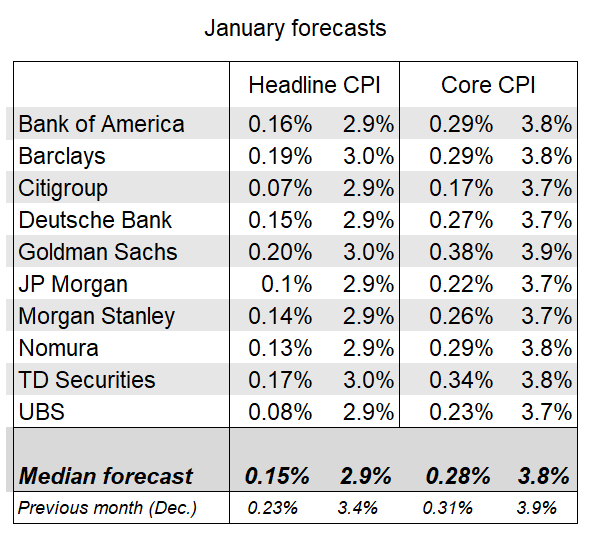

Wall Street giants count on a serious fall in each CPI and core CPI inflation, particularly after the latest CPI revision. While Fed officers are cautious on charge cuts in March, the upcoming financial information will information higher on the financial coverage outlook.

JPMorgan, Bank of America, UBS, Morgan Stanley, Citigroup, Deutsche Bank, Nomura, and RBC estimate headline CPI inflation cooling to 2.9% from 3.4%. However, Barclays, Goldman Sachs, TD Securities, and Wells Fargo anticipate a decline to three%.

Whereas for core CPI, specialists from banks together with Citigroup, Deutsche Bank, JPMorgan, Morgan Stanley, and UBS estimate a drop to three.7% from 3.9%. Moreover, Bank of America, Barclays, TD Securities and Nomura anticipate 3.8%, and Goldman Sachs expects the next annual core charge of three.9%.

Thus, the market estimated annual inflation charge cooling to 2.9% in January, which might be the bottom studying since March 2021. Also, annual core inflation is predicted to gradual to three.7%, the bottom studying since April 2021. The estimates for month-to-month charges for each CPI and core CPI stay regular at 0.2% and 0.3%.

Bitcoin Price to $55,000?

The cooling CPI inflation will give the U.S. Federal Reserve proof to contemplate charge cuts within the months forward. The CME FedWatch Tool shows an virtually 50% chance of 25 bps charge cuts in June after the CPI launch, with no chance of charge cuts in March.

Macro information exhibits volatility lately, making it essential for merchants to maintain a watch. The US greenback index (DXY) is falling from 104.25 to 104. A drop under 104 is what crypto merchants count on for additional upside transfer in BTC value to $55,000.

Moreover, the 10-year treasury yield (US10Y) is falling however stays above 4%. The latest treasury payments’ auctions and Fed officers’ cautious outlook on charge cuts.

The derivatives market seems robust as futures and choices merchants made contemporary bets to additional upside in BTC value. Bitcoin futures open curiosity rises over 7% to $47.32 billion, with futures quantity rising 70% within the final 24 hours.

Total choices open curiosity bounce 4% to $24.29 billion after a large 7.20% rise in CME BTC Futures open curiosity and large influx in spot Bitcoin ETFs.

Options merchants making increased bets for $56K, $60K, and even $70K for February. It signifies BTC value probably staying above $50,000 after the CPI launch.

BTC price jumped 4% prior to now 24 hours, with the value at the moment buying and selling at $50,100. The 24-hour high and low are $47,745 and $50,358, respectively. Furthermore, the buying and selling quantity shoots to virtually 100% within the final 24 hours, indicating an increase in curiosity amongst merchants.

Also Read:

The introduced content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

[ad_2]

Source link

✓ Share: