[ad_1]

Tuur Demeester, a Bitcoin OG and researcher for Adamant Research shared his bullish outlook for Bitcoin through X (previously Twitter), anticipating its worth might escalate to between $200,000 and $600,000 by 2026. Demeester’s prediction is based on the inflow of trillions of {dollars} via international bailouts and stimulus measures, which he believes will considerably propel Bitcoin’s valuation.

He remarked through X (previously Twitter), “In ’21 bitcoin topped at $69k. I’m targeting $200-$600k by 2026. Fueled by $ trillions in global bailouts/stimulus,” indicating a robust conviction within the cryptocurrency’s future amidst expansive financial insurance policies.

In ’21 bitcoin topped at $69k. I’m focusing on $200-$600k by 2026. Fueled by $ trillions in international bailouts/stimulus. https://t.co/ULslIMgzee

— Tuur Demeester (@TuurDemeester) February 12, 2024

In response to the query of whether or not the Bitcoin worth will peak in 2025 or 2026, Demeester added: “It’s hard to say. We might get a bull cycle in two parts, like in 2013 – that could draw it out longer.”

Demeester’s monitor document lends weight to his forecasts. Notably, in September 2019, he precisely anticipated the earlier bull run’s momentum, suggesting Bitcoin might attain $50,000 to $100,000. The actuality surpassed expectations as Bitcoin peaked above $69,000 in November 2021, validating his prediction vary’s higher finish.

Why The Bitcoin Rally Is Far From Over

Adding depth to his newest prediction, Demeester pointed to Google traits knowledge, which frequently serves as a barometer for retail investor curiosity in Bitcoin. Despite Bitcoin hitting $50,000 yesterday, Yassine Elmandjra, a researcher at Ark Invest, highlighted that Google search volumes relative to Bitcoin’s worth are at all-time lows, suggesting a scarcity of widespread retail frenzy at this stage.

Bitcoin hit $50k.

Meanwhile, Google search volumes relative to cost are in any respect time lows.

This is a brand new period. pic.twitter.com/8DnsadIclt

— Yassine Elmandjra (@yassineARK) February 12, 2024

This statement led Demeester to recommend, “I expect for retail to start waking up soon. Remember, there is no fever like Bitcoin fever,” indicating his anticipation of a surge in retail engagement as soon as Bitcoin’s worth momentum gathers tempo.

Demeester additionally shared sage recommendation for traders, cautioning towards the perils of debt and overexposure given Bitcoin’s infamous volatility. He emphasised the psychological resilience required to ‘HODL’ via market turbulence, stating, “The HODL attitude requires psychological & emotional work. The unprepared investor cannot sit tight, only the one who has worked to imagine the market relentlessly punching him in the face.”

Addressing inquiries in regards to the future trajectory of Bitcoin, Demeester expressed uncertainty relating to the continuation of the four-year cycle sample, suggesting that market dynamics are too complicated for such predictable cycles to persist indefinitely. “I don’t know if the four-year cycle will hold. That sounds too good to be true tbh. All patterns seem to eventually break,” he commented, highlighting the unpredictable nature of markets.

On the subject of the anticipated financial bailouts, Demeester clarified his stance, pointing to the unsustainable fiscal practices of banks and governments as a catalyst for financial enlargement.

“Of banks and governments. For example, the US government today is already spending more on interest payments than on their military. Only way to keep going is to print an ocean of money,” he defined, offering a grim outlook on the monetary stability of key establishments and the potential for BTC to learn from these circumstances.

Money Printing = Numbers Go Up

To perceive Demeester’s claims, it’s important to know the broader financial dynamics at play. Economic stimulus packages and bailouts, significantly in response to crises, inject liquidity into monetary markets, probably devaluing fiat currencies via inflation.

Hard property like Bitcoin, with their capped provide, stand in distinction to potential inflationary pressures, providing a hedge towards foreign money devaluation. This dynamic, coupled with growing institutional adoption by spot ETFs and the rising recognition of Bitcoin as a ‘digital gold,’ might ship BTC’s worth to unprecedented heights, aligning with Demeester’s projections.

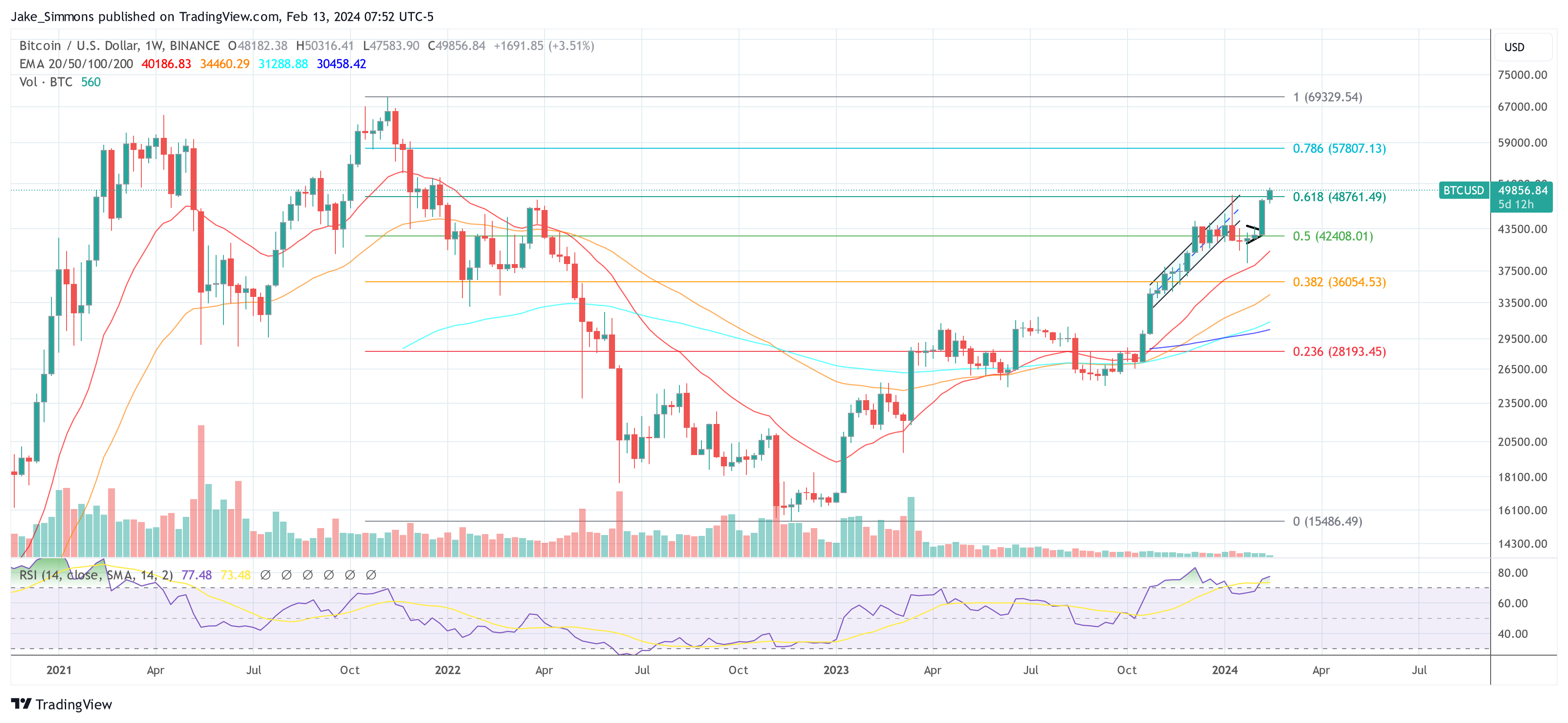

At press time, BTC traded at $49,856.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site solely at your individual danger.

[ad_2]

Source link