[ad_1]

Bitcoin value briefly rallied over $57,000 triggering a broader crypto market rally. The international crypto market cap leaped 7% to $2.25 trillion, backed by an enormous enhance in buying and selling volumes. This triggered greater than $380 million in crypto liquidation within the final 24 hours, with Bitcoin and altcoins funding charges clinching fairly excessive.

Crypto Market Saw $380 Million in Liquidations

Crypto market witnessed 88K merchants liquidated during the last 24 hours, in accordance with Coinglass. Over $380 million in internet liquidations, with $274 shorts and $106 longs liquidated. The largest single liquidation order ETHUSDT valued at $10.38 million occurred on crypto change Binance.

Traders received hammered as BTC, ETH, SOL, PEPE, ORDI, and THETA shorts have been most liquidated. WLD, UNI, FIL, and XRP longs have been additionally impacted by the sudden shift amid the biggest quick liquidations seen since December 4.

The crypto market restoration amid a renewed bullish sentiment after Bitcoin price rally triggered funding charges to hit greater once more. Funding charges are the charges charged by cryptocurrency exchanges for perpetual or futures contracts buying and selling, with excessive funding charges can erode income when merchants are lengthy or bullish on a crypto asset.

#Bitcoin funding charges are fairly excessive.

👉https://t.co/iyLrhuoty0 pic.twitter.com/6SKbS8Q8sv

— CoinGlass (@coinglass_com) February 27, 2024

The Bitcoin rally has pushed a firestorm within the block market, with greater than 50 block orders with a notional worth greater than $5 million, reported choices buying and selling knowledgeable Greekslive. Also, the biggest of those orders are energetic open positions, which occurred only some instances in historical past.

With solely practically 50 days left in Bitcoin halving, choices merchants are making requires $60K and even $70K strike value. Derivatives merchants are completely bullish on Bitcoin and Ethereum, with BTC futures open pursuits on Binance and CME hitting report greater. The 24-hour futures quantity jumped over 133% to over $208 billion.

Also Read: Bitcoin ETFs Saw $520M Inflow As BTC Price Rally Eyes $60K

BTC Price to Hit $60K?

Spot Bitcoin ETFs began the week strongly with one other main day, recording an influx of $520 million and quantity of $3.84 billion. Considering excessive BTC demand and low provide dynamics, BTC value could make new all-time excessive close to Bitcoin halving date.

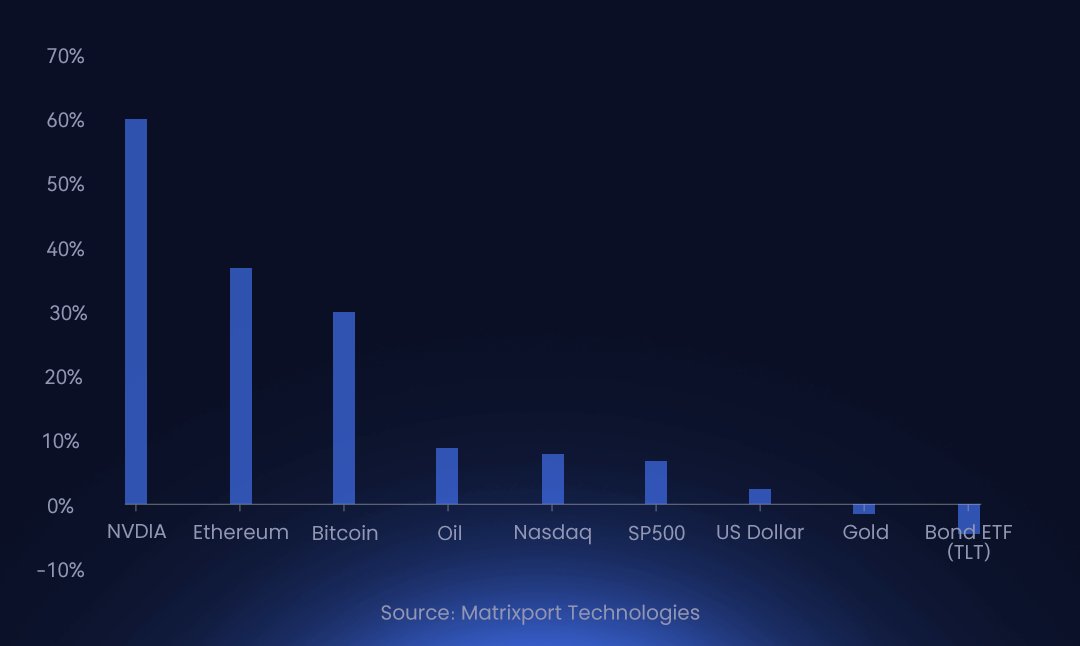

Matrixport stated BTC value will hit $60K earlier than Bitcoin halving. Year-to-date, Bitcoin and Ethereum are performing effectively and are up 30-36%. In a brand new publish, Matrixport predicts crypto returns will drive FOMO amongst conventional traders, as they carry out higher than oil, S&P 500, gold, and bond ETF.

BTC price skyrocketed its option to a market worth as excessive as $57,250, reaching inside 19.9% of the $68.6K excessive established 27 months in the past. The value is at present buying and selling at $56,325, up over 10% within the final 24 hours.

Also Read: Binance Waives Fees For BTC, ETH, XRP, SOL, But There’s A Catch

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

[ad_2]

Source link

✓ Share: