[ad_1]

Bitcoin Spot ETFs are gunning for a new record after an unbelievable begin to the brand new week. The value of BTC has risen 8% within the final day, and this has brought about euphoria out there. There could possibly be quite a lot of elements behind this; nonetheless, institutional buyers appear to be enjoying a giant position as each day inflows proceed to rise.

Spot Bitcoin ETF Inflows Cross $400 Million

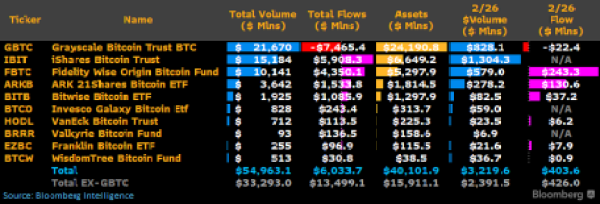

According to Bloomberg analyst James Seyffart, the Spot BTC ETF inflows usually are not slowing down. In a screenshot shared by the analyst on Tuesday, Seyffart reveals that inflows into Spot BTC ETFs climbed above $400 million.

The picture reveals that the Fidelity Wise Origin Bitcoin Fund is main the cost with $243.3 million in inflows, which accounts for greater than 50% of the whole influx. The ARK 21Shares Bitcoin ETF follows behind with important inflows of $130.6 million. The third-largest influx to a single fund for the day was recorded within the Bitwise Bitcoin ETF, which noticed $37.2 million in inflows.

Source: X

Other funds, together with the Franklin Bitcoin ETF, VanEck Bitcoin Trust, and the WisdomTree Bitcoin Fund, all noticed minor inflows of $7.9 million, $6.2 million, and $0.9 million, respectively. In whole, the inflows to all six funds got here out to $426 million.

However, the Grayscale Bitcoin Trust (GBTC) continues to bleed throughout this time, with outflows of $22.4 million within the 24-hour interval. This introduced the whole internet flows to $403.6 million. At the identical time, funds such because the iShares Bitcoin Trust, the Invesco Galaxy Bitcoin ETF, and The Valkyrie Bitcoin Fund all noticed negligible inflows throughout this timeframe.

Gunning For A New Record

The inflows into the Bitcoin Spot ETFs over the past day are a testomony to the demand that these merchandise are getting from the market. With institutional buyers gaining extra publicity to BitBTCcoin, demand is anticipated to rise, particularly because the BTC value continues to do properly.

The influx volumes, whereas not the biggest single-day inflows to date, are important when measured as much as others. For instance, Seyffart factors out that the each day document was from the primary day of buying and selling when inflows climbed as excessive as $655 million. The second-largest single-day internet move was then recorded earlier within the month on February 13 with $631 million. “A big day from $IBIT could push us beyond that Day 1 record,” Seyffart declared.

At the time of writing, the BTC price is experiencing a retracement after reaching a new 2-year high of $57,000. It has seen 8.58% features within the final 24 hours to commerce at $55.900, in response to information from CoinMarketCap.

BTC value establishes help above $56,000 | Source: BTCUSD on Tradingview.com

Featured picture from U.Today, chart from Tradingview.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site fully at your personal danger.

[ad_2]

Source link