[ad_1]

Bitcoin has been on an upward trajectory for some time now, witnessing a major rally inside the broader crypto market and reaching the $64,000 threshold on Sunday, as analysts have recognized traits that would determine the asset’s subsequent course.

Bitcoin Poised To Witneesed A Rally Or Dip In Short Term

Cryptocurrency analyst and dealer Ali Martinez has taken to the social media platform X (previously Twitter) to share his insights on Bitcoin’s value motion within the quick time period with the crypto group.

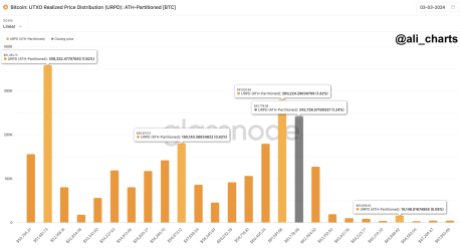

Martinez has noticed an space that would both result in an uptick or a correction. Ali Martinez highlighted that greater than half one million Bitcoins have been transacted inside the vary of $61,100 and $61,800, and because of this, the crypto asset has shaped a “substantial support area.”

According to the analyst, BTC is predicted to rise in direction of $65,900, if it manages to carry above this degree. However, the consultants count on this to occur contemplating the shortage of obstacles that lie forward.

Furthermore, Martinez has additionally identified the potential for Bitcoin to endure a correction if it falls beneath the help degree. The crypto analyst acknowledged that if this occurs, BTC may decline to “$56,970 or even deeper to $51,500.”

The Post learn:

Over 500,000 BTC have been transacted within the vary of $61,100 to $61,800, which has created a considerable help space. If Bitcoin stays above this threshold, it may climb in direction of $65,900, given the minimal resistance forward. Conversely, ought to BTC dip beneath help, a correction may lead it all the way down to $56,970 and even $51,500.

Ali Martinez’s predictions got here in gentle of the broader crypto market experiencing a major rally. Presently, the whole crypto market is seeing a considerable capital inflow not recorded in over 2 years.

Martinez famous in one other X post that roughly $48.54 billion is getting into the crypto market, indicating an increase in buyers’ curiosity in crypto. He additional underscored that the event marks the “largest inflow of capital since October 2021.”

So far, consultants forecast that within the upcoming months, there will probably be greater monetary inflows resulting from extra lucid cryptocurrency regulatory frameworks.

BTC ETFs To Control 10% Of The Crypto Asset’s Supply

Bitcoin Spot Exchange-Traded Funds (ETFs) proceed to realize traction as BTC maintains its upward momentum. Due to this, SkyBridge founder Anthony Scaramucci has predicted that the merchandise may “take control of 10% of BTC’s supply.”

Scaramucci famous that a whole lot of BTCs have been “lost since the ETFs were introduced.” Consequently, ETFs now boast about 776,000 BTC for the reason that merchandise started buying and selling.

However, he expects the merchandise to take management of the aforementioned % “when it hits 1.7 million BTC.” Anthony Scaramucci is assured that when this occurs, there will probably be a swift rise in Bitcoin’s value.

Currently, the value of Bitcoin is buying and selling at $65,184, demonstrating a rise of over 5% within the final 24 hours. Meanwhile, its market cap and buying and selling quantity are each up by 5% and 79% respectively previously day.

Featured picture from iStock, chart from Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site fully at your individual threat.

[ad_2]

Source link