[ad_1]

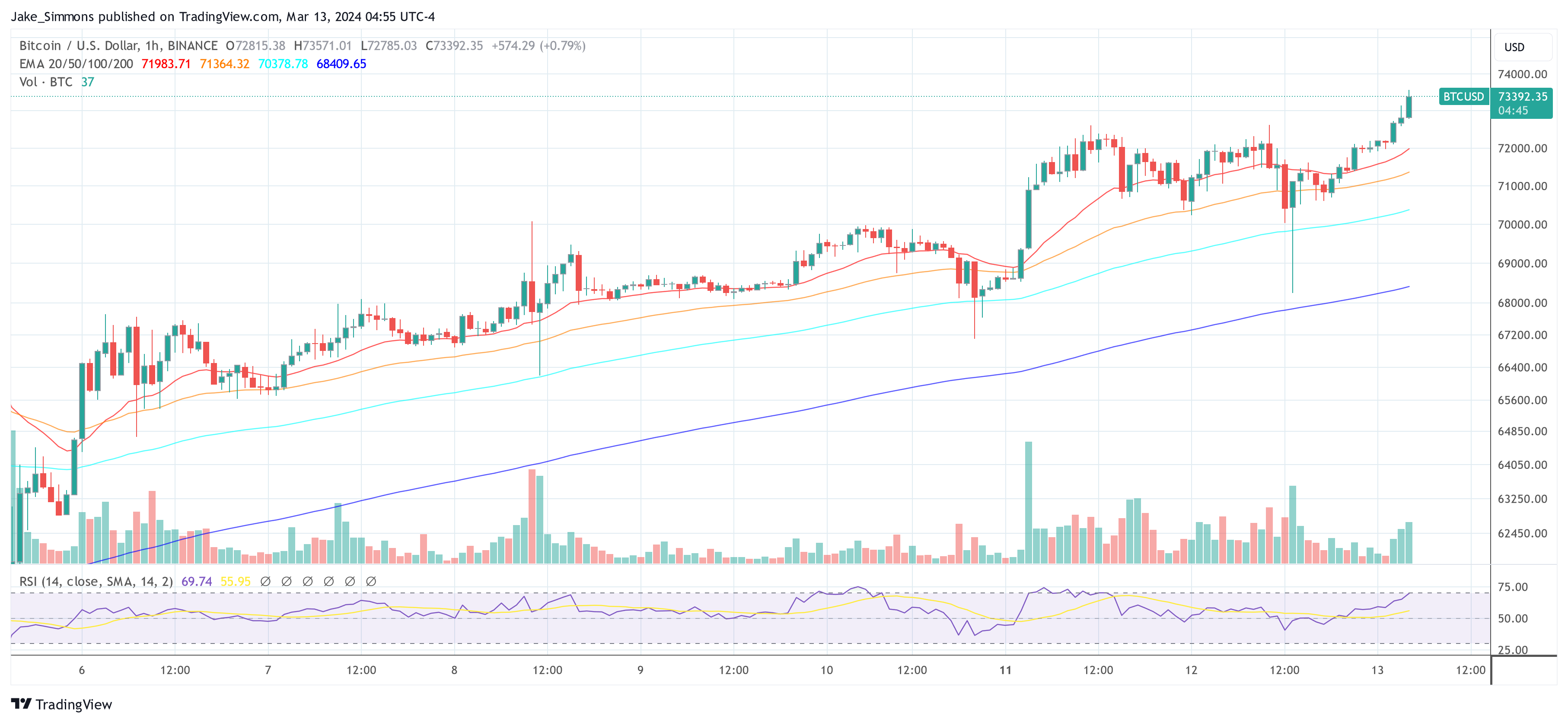

Yesterday, the Bitcoin value journey resembled a high-intensity rollercoaster experience, initially hovering previous the $73,000 mark earlier than encountering a tumultuous liquidation occasion. This occasion noticed over $361 million price of leveraged trades unwound, compelling the BTC value to retract sharply to under $68,300.

The drastic value fluctuation primarily affected lengthy place holders—buyers who speculated on a continued value rise—with a staggering $258 million worn out. Subsequently, Bitcoin’s value staged a outstanding V-shaped restoration, throughout which quick sellers discovered themselves on the dropping finish, with simply over $103 million in positions liquidated.

This data by Coinglass marks the occasion as probably the most important purge of lengthy positions since March 5. At that point, Bitcoin skilled a decline to $60,800 following its climb to a then all-time excessive of roughly $69,000.

Bitcoin ETFs Register Record $1 Billion Inflows

Perhaps spurred by the chance offered by the worth dip, buyers in spot Bitcoin Exchange-Traded Funds (ETFs) engaged in a shopping for spree, unprecedented in its depth. For the primary time, spot Bitcoin ETFs witnessed a day by day influx surpassing $1 billion on Tuesday, March 12, primarily pushed by an influx of $849 million to BlackRock’s IBIT. According to detailed data launched by Farside Investors, the whole web inflows throughout all Bitcoin ETFs have been at $1045 million (or $1.045 billion).

The second largest Bitcoin ETF thus far, Fidelity, noticed a reasonably quiet day with FBTC taking in solely $51.6 million, whereas Ark Invest ($93 million), Bitwise ($24.6 million), Valkyrie ($39.6 million) and VanEck ($82.9 million) noticed comparatively sturdy capital inflows. Notably, Grayscale‘s GBTC noticed a waning outflow of simply $79 million.

Bitcoin analyst Alessandro Ottaviani shared his insights on X, underscoring the magnitude of those inflows, “1 Billy of Total net Inflow! ONE BILLION DOLLARS! […] In the last twelve trading days, The Nine inflow has been $9.2b, with an average of $768m per day. Just imagine if we keep this pace and it is confirmed that GBCT outflow is almost exhausted.”

Crypto Quant analyst Maartunn offered further context to the influx’s influence, revealing, “JUST IN: The Bitcoin Exchange-Traded Fund (ETF) has experienced its highest inflows ever, with an additional 14,706.2 BTC.” This assertion additional emphasizes the substantial enhance in Bitcoin’s demand, doubtlessly setting it up for a significant supply squeeze.

🚨🚨 JUST IN: The Bitcoin Exchange-Traded Fund (ETF) has skilled its highest inflows ever, with a further 14,706.2 BTC. https://t.co/xg7wADbRzy pic.twitter.com/IUAyt1jzGE

— Maartunn (@JA_Maartun) March 13, 2024

Adding to the dialog, crypto analyst @venturefounder suggested potential future value actions based mostly on the present development, “Absolute Bitcoin madness […] The 5-day moving average net inflow has fully recovered to peak. So… probably HIGHER. If this continues, $80-90k by the end of month is not far fetched. No correction has lasted longer than 24 hours on the weekdays. Interestingly, the first major correction of the 2021 cycle came when price went 2x previous ATH. So could we see no major correction until $120k?”

At press time, BTC already surpassed the $73,500 mark and traded at $73,392.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site solely at your personal danger.

[ad_2]

Source link