[ad_1]

Bitcoin’s latest surge to just about $74,000 has been met with a major pullback, dropping roughly 8% and hovering across the $66,000 mark. Notably, the traders’ sentiment seems divided as some capitalize on earnings, whereas others tread cautiously forward of the Federal Open Market Committee (FOMC) coverage charges’ resolution subsequent week.

Meanwhile, amid this backdrop, well-liked analysts have supplied insights into BTC’s potential worth actions, key help, and resistance ranges.

Bitcoin Price Might Face Further Decline

The latest retracement in Bitcoin worth has sparked considerations among the many crypto market fans. Notably, a lot of the main altcoins additionally adopted Bitcoin’s worth momentum, leading to an enormous sell-off within the crypto market.

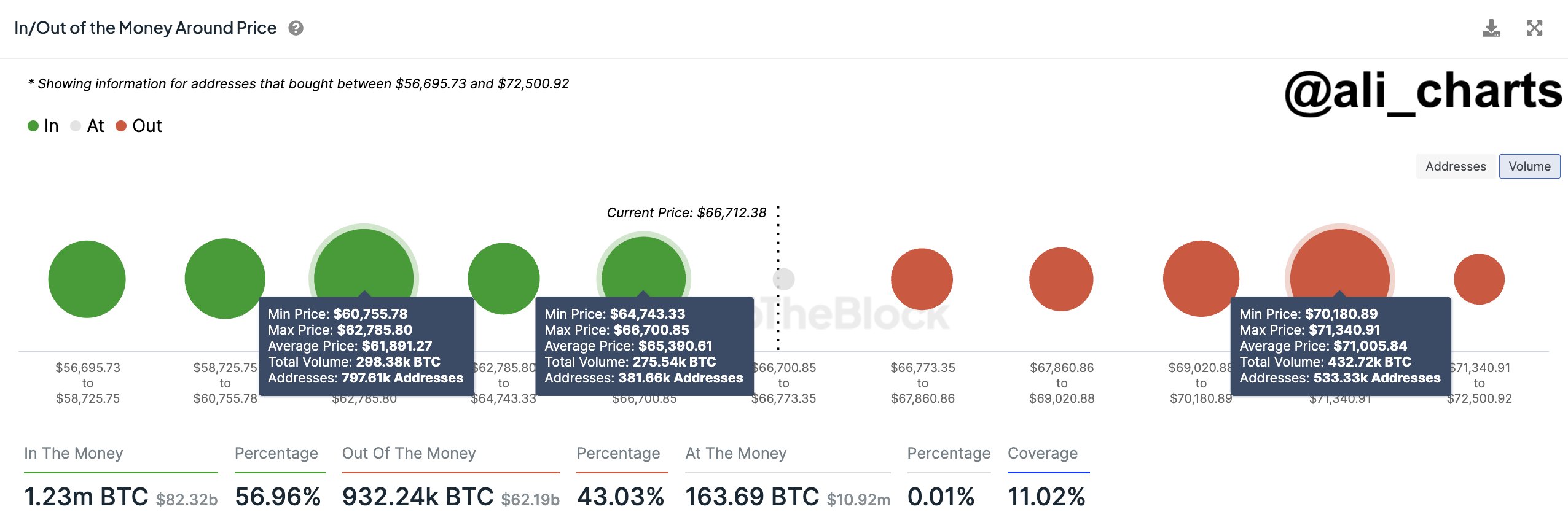

Amid the uncertainties, outstanding crypto analysts have supplied key insights on Bitcoin’s worth in a latest X put up. Notably, based on famend crypto market analyst Ali Martinez, Bitcoin has established a sturdy help vary between $64,750 and $66,700.

Meanwhile, Martinez emphasizes the significance of monitoring this degree carefully, as a breach might result in a shift in the direction of the following important demand zone between $60,760 and $62,790. Conversely, Bitcoin faces formidable resistance between $70,180 and $71,340, fortified by a considerable variety of addresses holding important BTC quantities.

However, in one other social media put up, Martinez emphasised the latest dip in Bitcoin’s worth as a shopping for alternative, echoing sentiments of optimism from different market pundits anticipating a possible rally.

Market Sentiment Amid Uncertainty & Halving Anticipation

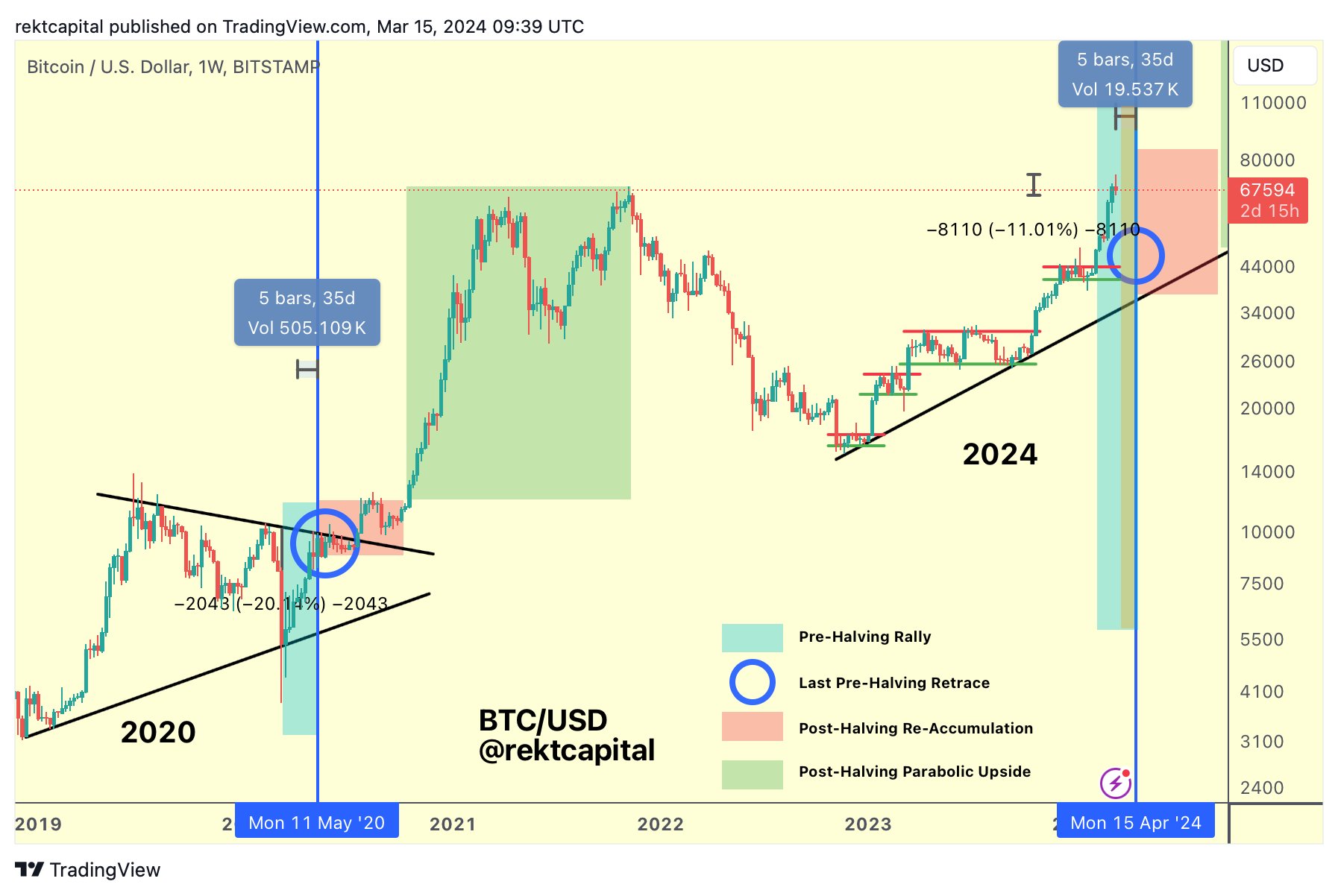

Another notable analyst, Rekt Capital, presents a cautionary perspective, suggesting that Bitcoin is nearing the “Danger Zone” traditionally related to pre-halving retraces. In a latest X put up, Rekt Capital shared an evaluation, which confirmed that Bitcoin is poised to enter the “Danger Zone” in 4 days.

Meanwhile, he notes that the earlier information signifies retraces of 20% in 2020 and 40% in 2016, occurring 14-28 days earlier than the Bitcoin Halving. With Bitcoin at present round 32 days away from the occasion and experiencing an 11% pullback this week, traders await developments eagerly.

However, regardless of short-term fluctuations, a number of market pundits stay optimistic, fueled by anticipation over the upcoming halving occasion. However, analysts warning towards overlooking the potential affect of market dynamics and exterior components on Bitcoin’s worth trajectory.

Meanwhile, as BTC approaches vital help and resistance ranges, market contributors stay vigilant, carefully monitoring developments for insights into potential worth actions. Whether Bitcoin dips under $61,000 or surges to new highs, the market continues to navigate with a mix of warning and anticipation, looking for readability amid the evolving panorama of digital property.

Notably, the Bitcoin price was down 7.11% and traded at $67,684.23 throughout writing, with its buying and selling quantity hovering 91.21% to $85.58 billion. The crypto has touched a low of $65,630.69 and a excessive of $73,063.22 within the final 24 hours, reflecting the unstable situation available in the market.

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link

✓ Share: