[ad_1]

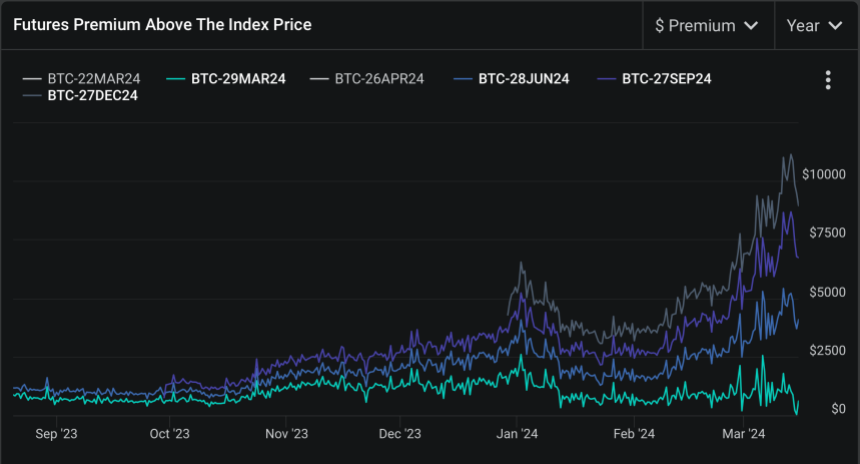

Bitcoin’s futures market is showcasing indicators which have traditionally signalled bullish sentiment. Analysts are turning their consideration to the Bitcoin futures basis—a metric representing the differential between the futures value of Bitcoin and its spot value.

Recent knowledge has revealed that this foundation has escalated to unprecedented ranges since Bitcoin’s all-time high of $69,000 in November 2021.

Bullish Indications From Bitcoin Futures

Deribit’s Chief Commercial Officer, Luuk Strijers, has highlighted the present state of the Bitcoin futures foundation, which ranges between 18% to 25% yearly, a charge harking back to the market circumstances in 2021.

According to Strijers’s remark, this elevated foundation is not only a quantity however a profitable alternative for derivatives merchants.

By partaking in trades that contain shopping for Bitcoin within the spot market and concurrently promoting futures contracts at a premium, merchants can safe a “dollar gain” that can materialize on the contract’s expiry, no matter Bitcoin’s value volatility.

Strijers additional famous that this technique is especially interesting within the present local weather, fueled by the inflow of latest investments following the approval of Bitcoin ETFs and anticipation surrounding the Bitcoin halving occasion.

The significance of the heightened futures foundation extends past the mechanics of derivatives buying and selling. It additional displays broader market optimism, “bolstered” by current regulatory approvals and macroeconomic components influencing cryptocurrency.

The disparity between Bitcoin’s spot and futures costs suggests a assured market outlook, propelled by the anticipation of continued funding inflows and the impression of the upcoming Bitcoin halving.

Such circumstances create a fertile floor for Bitcoin’s worth to surge, as historic precedents have usually linked bullish futures foundation charges with durations of substantial price appreciation.

Market Sentiment And Halving Cycles

While Bitcoin’s present market performance displays a bearish trajectory, with a 3.9% dip bringing its value to $68,203, market analysts advise in opposition to decoding this as a detrimental sign. Rekt Capital, a revered determine in crypto evaluation, views the current value correction as a “positive adjustment” previous the much-anticipated Bitcoin halving in April.

Halving occasions, which cut back the block reward for miners, thus slowing the speed of latest Bitcoin coming into circulation, have historically catalyzed important value rallies as a result of ensuing provide constraints.

Rekt Capital’s evaluation parallels current market movements and historic patterns noticed in earlier halving cycles.

According to the analyst, regardless of the swift tempo of those cycles, they exhibit a constant sequence of a pre-halving rally adopted by a retracement part—each of which align with Bitcoin’s present trajectory. This cyclical perspective means that the current dip is merely a brief setback, setting the stage for the subsequent bullish part post-halving.

Though there are indicators of BTC experiencing an Accelerated Cycle…

History nonetheless continues to repeat, nonetheless$BTC broke out right into a “Pre-Halving Rally” proper on schedule

And now, #Bitcoin is transitioning into its “Pre-Halving Retrace” proper on schedule#Crypto https://t.co/Egqxs9ritl pic.twitter.com/lj0IdQtBEE

— Rekt Capital (@rektcapital) March 15, 2024

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site fully at your personal danger.

[ad_2]

Source link