[ad_1]

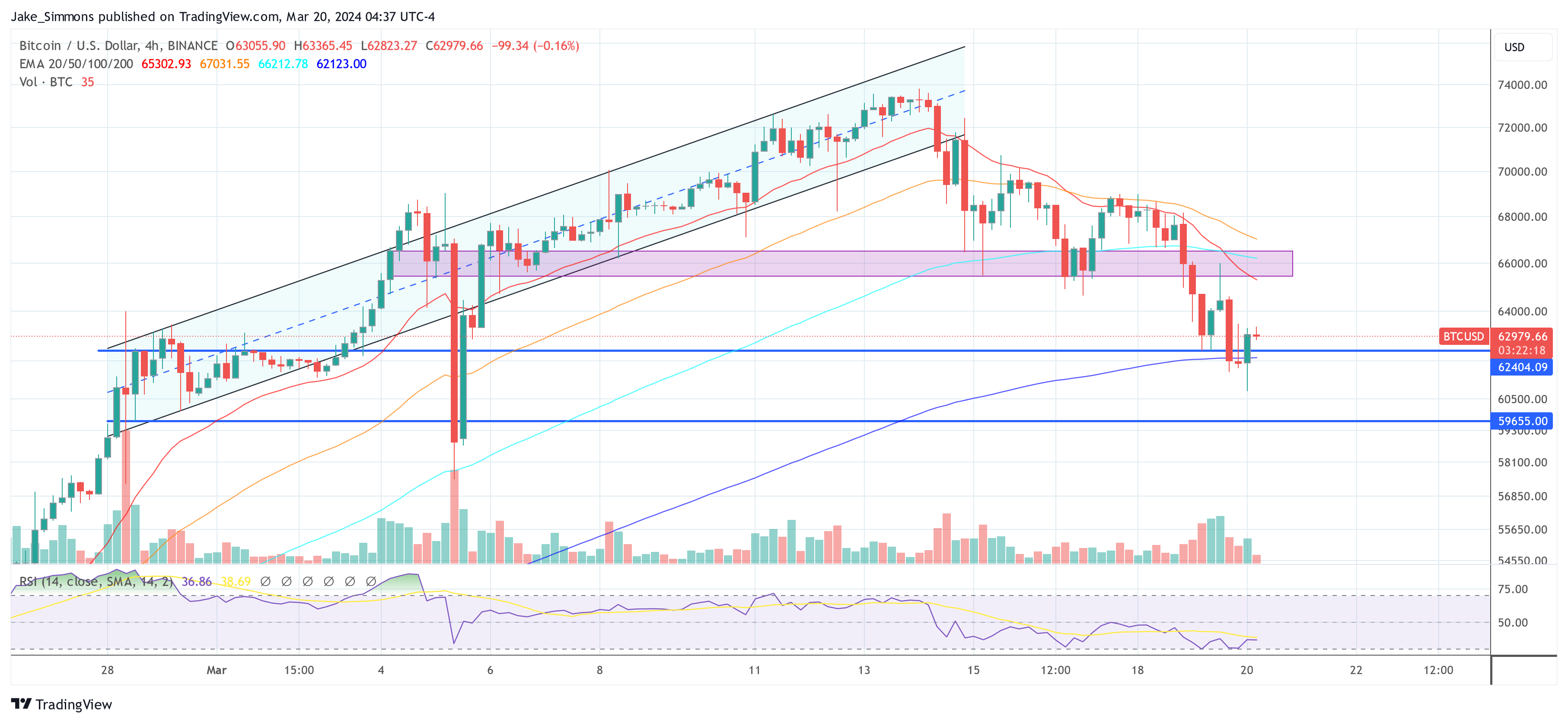

Bitcoin has skilled a pointy decline from its March 14 excessive of over $73,600 to at the moment’s low of below $60,800, translating to a -17% loss in worth. This important drop has prompted a flurry of exercise on social media platforms, significantly X (previously Twitter), the place crypto specialists have been fervently discussing the potential causes behind this downturn and speculating on what the longer term holds for the world’s main cryptocurrency.

Unpacking The Bitcoin Crash: Expert Opinions

Alex Krüger, a revered determine in each macroeconomics and crypto, was fast to establish the first elements contributing to Bitcoin’s worth collapse. According to Krüger, the crash might be attributed to a number of key elements: extreme leverage available in the market, Ethereum’s detrimental affect on total market sentiment because of ETF speculations, a notable lower in Bitcoin ETF inflows, and the irrational exuberance surrounding Solana memecoins, which he refers to disparagingly as “shitcoin mania.”

Reasons for the crash, so as of significance

(for individuals who want them)

#1 Too a lot leverage (funding issues)

#2 ETH driving market south (market determined ETF not passing)

#3 Negative BTC ETF inflows (cautious, knowledge is T+1)

#4 Solana shitcoin mania (it went too far)— Alex Krüger (@krugermacro) March 20, 2024

WhalePanda, one other influential voice throughout the crypto area, identified the alarming charge of ETF outflows, with a report $326 million leaving the market yesterday. This motion has been significantly detrimental to GBTC, which noticed outflows of $443.5 million.

In distinction, Blackrock’s inflows stood at a mere $75.2 million, marking its second lowest up to now. Also, Fidelity noticed simply $39.6 million in inflows. “Not much to say, this is bad for the price and we’ll probably see lower now because this news affects the sentiment as well. Let’s see what the flows are tomorrow. Positive thing is that we’re roughly 30 days from halving, and GBTC is getting rekt,” he remarked.

Yesterdays ETF flows by @FarsideUK.

We had $326 million in outflows. Biggest outflow up to now.

Blackrock did not save us from $GBTC, which sort of was apparent with the value motion.$GBTC had $443.5 million outflows, Blackrock had $75.2 million inflows, their 2nd lowest to… pic.twitter.com/hIingoYMly

— WhalePanda (@WhalePanda) March 20, 2024

Charles Edwards, founding father of crypto hedge fund Capriole Investments, provided a historic perspective on Bitcoin’s latest worth transfer, suggesting {that a} 20% to 30% pullback is throughout the norm for Bitcoin bull runs.

“A normal Bitcoin bullrun pullback is 30%. Back in December, we were already in the longest winning streak in Bitcoin’s history. A 20% pullback here takes us to $59K. A 30% pullback would be $51K. These are all levels we should be comfortable expecting as possibilities,” he said.

Rekt Capital supplied an evaluation of Bitcoin’s worth retracements for the reason that 2022 bear market backside, noting that the present pullback is simply the fifth main retrace, with all earlier ones exceeding a -20% depth and lasting from 14 to 63 days. In sum, there are two key takeaways about this present retracement

The nearer Bitcoin will get to a -20% retrace, the higher the chance turns into.

Retraces want time to completely mature (a minimum of 2-3 weeks, at most 2-months).

Since the November 2022 Bear Market Bottom…

Bitcoin has skilled the next retraces:

• -23% (February 2023) lasting 21 days

• -21% (April/May 2023) lasting 63 days

• -22% (July/September 2023) lasting 63 days

• -21% (January 2023) lasting 14 days

This… pic.twitter.com/cQyQOLA5Zv

— Rekt Capital (@rektcapital) March 19, 2024

Alex Thorn, head of analysis at crypto large Galaxy Digital had beforehand warned of the probability of great corrections throughout bull markets, suggesting that the present retrace is comparatively normal. “Two weeks ago i warned that big corrections aren’t just possible but *likely* in Bitcoin bull markets. At -15%, this is pretty standard historically. Bull markets climb a wall of worry.”

Macro analyst Ted (@tedtalksmacro) targeted particularly on the implications of the upcoming Federal Open Market Committee (FOMC) meeting. He highlighted the large outflows from spot BTC ETFs, attributing them to merchants’ cautious stance forward of the FOMC determination and the potential affect of tax season within the US.

However, following the drop to $60,800, Ted recommended that the market might need totally priced within the worst-case situation, hinting at a possible bullish reversal if the FOMC’s selections align with market expectations for rate of interest cuts by the top of the yr. He said:

Time to bid. FOMC hedging carried out, worst case priced. Only factor that occurs from right here is that these protecting positions unwind into or on the occasion at the moment. Bulls ought to step up right here quickly. […] The market has totally priced in one other maintain from the Fed at at the moment’s assembly, and is pricing 3 charge cuts from them by the top of the yr. Anything that strays away from this from at the moment’s new financial projection / dot plot materials will make the market transfer sharply.

At press time, BTC traded at $62,979.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site solely at your individual threat.

[ad_2]

Source link