[ad_1]

Cryptocurrency alternate KuCoin has introduced a considerable $10 million airdrop of Bitcoin (BTC) and its native token, KuCoin Shares (KCS). This growth is in response to authorized points the alternate has been going by means of recently, with allegations from each the U.S. Department of Justice (DOJ) and the Commodity Futures Trading Commission (CFTC).

Thanks for standing by and trusting KuCoin throughout this time. It means so much to us.

With nice gratitude, we’ll launch a particular $10M airdrop in $KCS & $BTC to the customers who skilled longer-than-expected wait instances in the course of the withdrawal course of prior to now 2 days.

Details…

— Johnny_KuCoin (@lyu_johnny) March 27, 2024

KuCoin’s Response to Legal Challenges

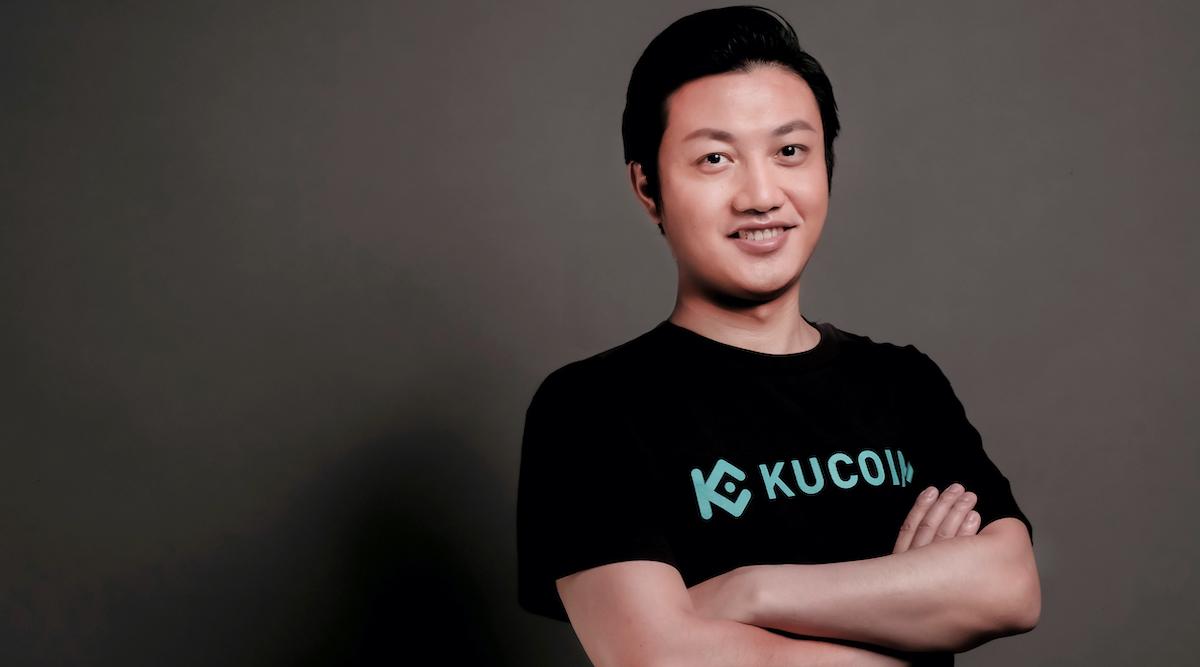

Following a Department of Justice’s submitting of costs for the Bank Secrecy Act violations and working an unlicensed money-transmitting enterprise and a CFTC’s civil case for the Commodity Exchange Act violation, Johnny Lyu, KuCoin CEO, has introduced this airdrop.

In Lyu’s opinion, the airdrop is supposed to thank the loyal customers of KuCoin for supporting them and presenting them with challenges. The airdrop’s laws are anticipated to be printed inside three days.

Surge in Withdrawals and Assurance of Safety

After the authorized accusations, KuCoin skilled greater than $1 billion in crypto withdrawals, which precipitated a 20% drop in property below administration. Nevertheless, the alternate comforted its prospects, saying that every one techniques are working easily and the person funds are protected.

This confidence retention is essential in protecting the person’s confidence in addition to stability within the platform’s operations.

Risks and Regulatory Scrutiny of Airdrops

The idea of airdrops, though in style within the crypto neighborhood, carries its dangers, particularly from a regulatory standpoint. The “Framework for ‘investment contract’ Analysis of Digital Assets by the Securities and Exchange Commission (SEC) has outlined that airdrops may nonetheless fulfill the standards of funding of cash below the Howey test.

This signifies that such actions could be topic to the securities legal guidelines that will add one other layer of complexities to the challenges KuCoin faces.

In addressing these current challenges, KuCoin has reiterated its dedication to correct person asset safety and operational adherence to regulatory requirements. The alternate has a observe file of proactively resolving issues, as seen from their motion in response to the Confido rug pull incident in 2017, the place they refunded the buyers.

Read Also: Prosecutors Seek 64-Month Jail for Tornado Cash Developer

The offered content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link

✓ Share: