[ad_1]

Bitcoin value continues to remain afloat above $70,000 regardless of the lengthy vacation weekend. The crypto market largely noticed subdued exercise amid some financial occasions together with the US PCE inflation launch, which got here barely scorching. The complete crypto market quantity over the past 24 hours has dropped over 15%. However, Coinbase premium hole signifies institutional traders are shopping for once more.

Coinbase Premium Gap Indicates Bitcoin Buying

Institutional shopping for began fading on March 27 and the Coinbase premium hole turned inexperienced once more late March 29 after the Fed most popular inflation gauge PCE. Since March 30 morning, the Coinbase premium hole exceeded 50, revealed on-chain analyst Maartunn. He asserts that US establishments could have began to purchase Bitcoin once more.

The metric is often used to find out when US establishments are beginning to buy Bitcoin, as it’s a extremely correct indicator. This suggests odds of excessive influx in spot Bitcoin ETFs within the subsequent week earlier than the Bitcoin halving, anticipated to occur in mid-April.

Coinbase premium hole is the hole between Coinbase Pro value (USD pair) and Binance value (USDT pair). High premium values sometimes point out US traders’ robust shopping for strain on crypto trade Coinbase. Traders can maintain a detailed watch on the metric and buying and selling volumes to verify the market route.

Analysts Remains Bullish on BTC Price

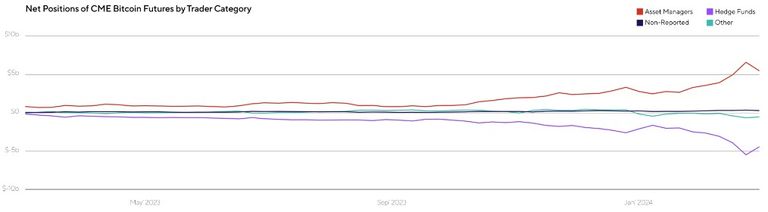

Analysts at Ryze Labs revealed the hole between hedge funds (in purple) and asset managers (in purple) continues to widen. “This divergence indicates that while asset managers continue to purchase Bitcoin futures, hedge funds are increasingly short-selling. In the current bullish climate, this dynamic hints at a potential short squeeze, which could propel Bitcoin’s next upward movement,” they mentioned.

Popular analyst Michael van de Poppe mentioned the sideways motion for Bitcoin triggered a consolidation close to $70K. However, he assures that Bitcoin nonetheless following the final 4-year cycle path. He added,”Honestly, this cycle is probably going going to shock many individuals. In a 5 years time, $70,000 per Bitcoin is assessed low cost.”

Meanwhile, futures and choices shopping for stay boring resulting from holidays and merchants awaiting additional drop in BTC value. CME BTC futures open curiosity fell 0.32% to $11.64 billion. Total BTC choices open curiosity dropped from $32.31 billion to $21.52 billion.

BTC price shifting sideways, with the worth presently buying and selling at $70,189. The 24-hour high and low are $69,076 and $70,513, respectively. Furthermore, buying and selling quantity is down by over 25%.

Also Read:

The offered content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link

✓ Share: