[ad_1]

The digital asset funding panorama skilled a resurgence as Bitcoin Exchange-Traded Funds (ETFs) rallied final week, bolstering confidence among the many crypto market lovers. Notably, in line with James Butterfill, CoinShares’ Head of Research, the latest surge in Bitcoin ETFs has propelled a major influx into the digital asset section, reaching a notable milestone of $862 million final week.

Bitcoin ETF Fuels Digital Asset Inflow Surge

James Butterfill’s latest report highlights a exceptional turnaround for Bitcoin ETFs, marking a considerable inflow of $862 million prior to now week. Notably, this resurgence in funding indicators renewed confidence amongst stakeholders.

Meanwhile, Bitcoin led the influx with $865 million, emphasizing its continued dominance within the digital asset market. Additionally, Solana noticed a noteworthy influx of $6.1 million amid hovering curiosity within the crypto itself in addition to the Solana-based meme coins.

However, Ethereum skilled an outflow of $18.9 million amid hovering tensions over the SEC’s scrutiny of ETH’s safety standing. Besides, the regulatory pressure on Ethereum’s standing has additionally sparked issues over a possible delay within the Ethereum ETF approval by the regulators.

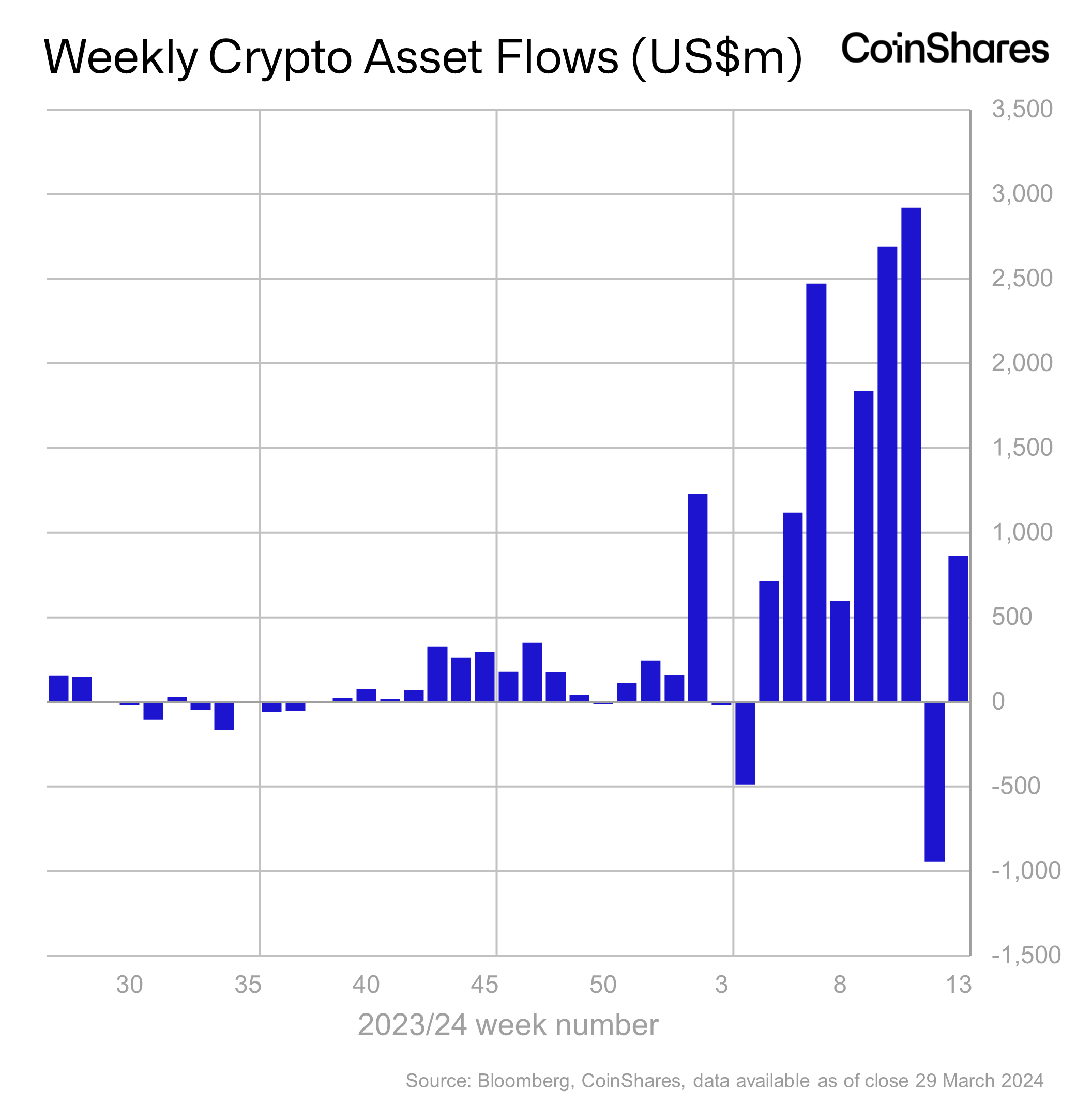

Despite Ethereum issues, the surge in Bitcoin ETFs revitalizes investor sentiment whereas propelling the general digital asset sector’s influx. Butterfill’s report underscores the pivotal position of U.S. Spot Bitcoin ETFs in driving this momentum, following a earlier week of outflows.

Notably, final week noticed an inflow of $845 million into Spot Bitcoin ETFs, considerably reversing the pattern from the prior week’s BTC ETF outflow of roughly $900 million. Furthermore, the cooling outflow from Grayscale’s GBTC provides to the optimistic market sentiment.

Also Read: Ethereum Co-Founder Unveils Protocol Simplification Strategy “The Purge”

Global Trends in Digital Asset Inflow

Amid the surge in Bitcoin and cryptocurrency investments, world developments in digital asset influx reveal intriguing dynamics. The United States emerges as the highest contributor, with an influx of $897 million, indicating strong market participation.

However, Canada and Switzerland witnessed outflows of $20.3 million and $15.6 million, respectively. Notably, these divergent developments underscore the various regulatory landscapes and investor sentiments throughout totally different areas.

Meanwhile, Butterfill’s insights make clear the evolving nature of digital asset investments, influenced by regulatory developments and market dynamics. Despite challenges, the latest surge in Bitcoin ETFs and general influx indicators resilience and rising acceptance of cryptocurrencies in mainstream finance.

Also Read: TON Blockchain’s PoW-Token GRAM Now Available for Trading on MEXC Exchange

The introduced content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link

✓ Share: