[ad_1]

Bitcoin and Ethereum costs take respite throughout unstable market situations, with merchants principally staying away from making new trades amid uncertainty within the crypto market. Also, merchants and traders are bracing for over $2 billion in Bitcoin and Ethereum choices expiry on Friday.

Bitcoin and Ethereum Options Expiry

After the market noticed one of many largest crypto options expiry of over $15 billion final Friday, the crypto market awaits the over $2 billion choices expiry to settle some uncertainty.

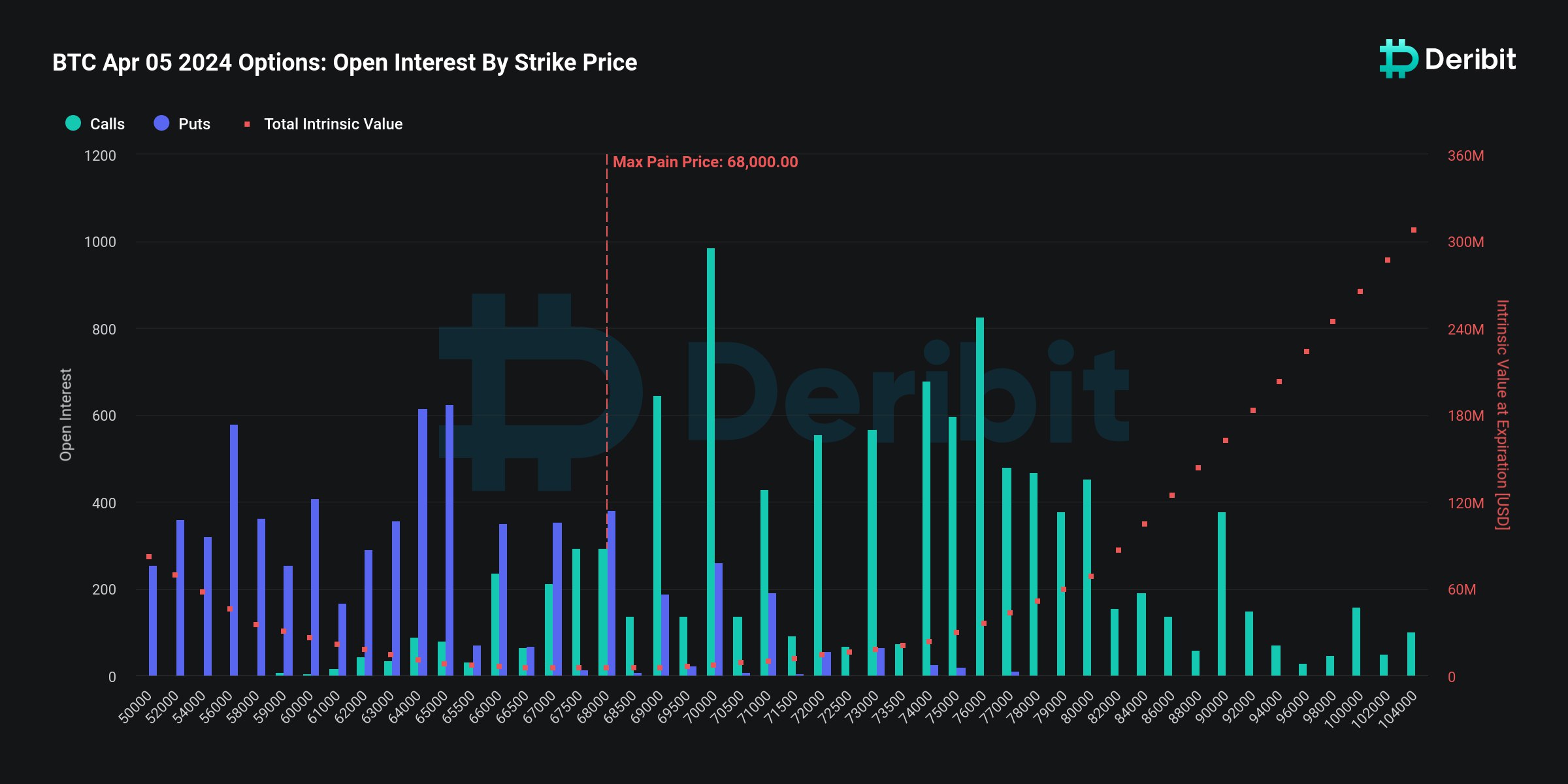

Over 18,060 BTC choices of notional worth $1.21 billion are set to run out, with a put-call ratio of 0.63. The max ache level is $68,000, indicating strain on Bitcoin at present. Volatile value actions are nonetheless anticipated regardless of a launch of downward strain on implied volatility (IV). Traders stay optimistic a few restoration in BTC value above $70,000 this week.

In the final 24 hours, BTC name quantity is increased at 10,817 than put quantity of 8,076. The put-call ratio is 0.75.

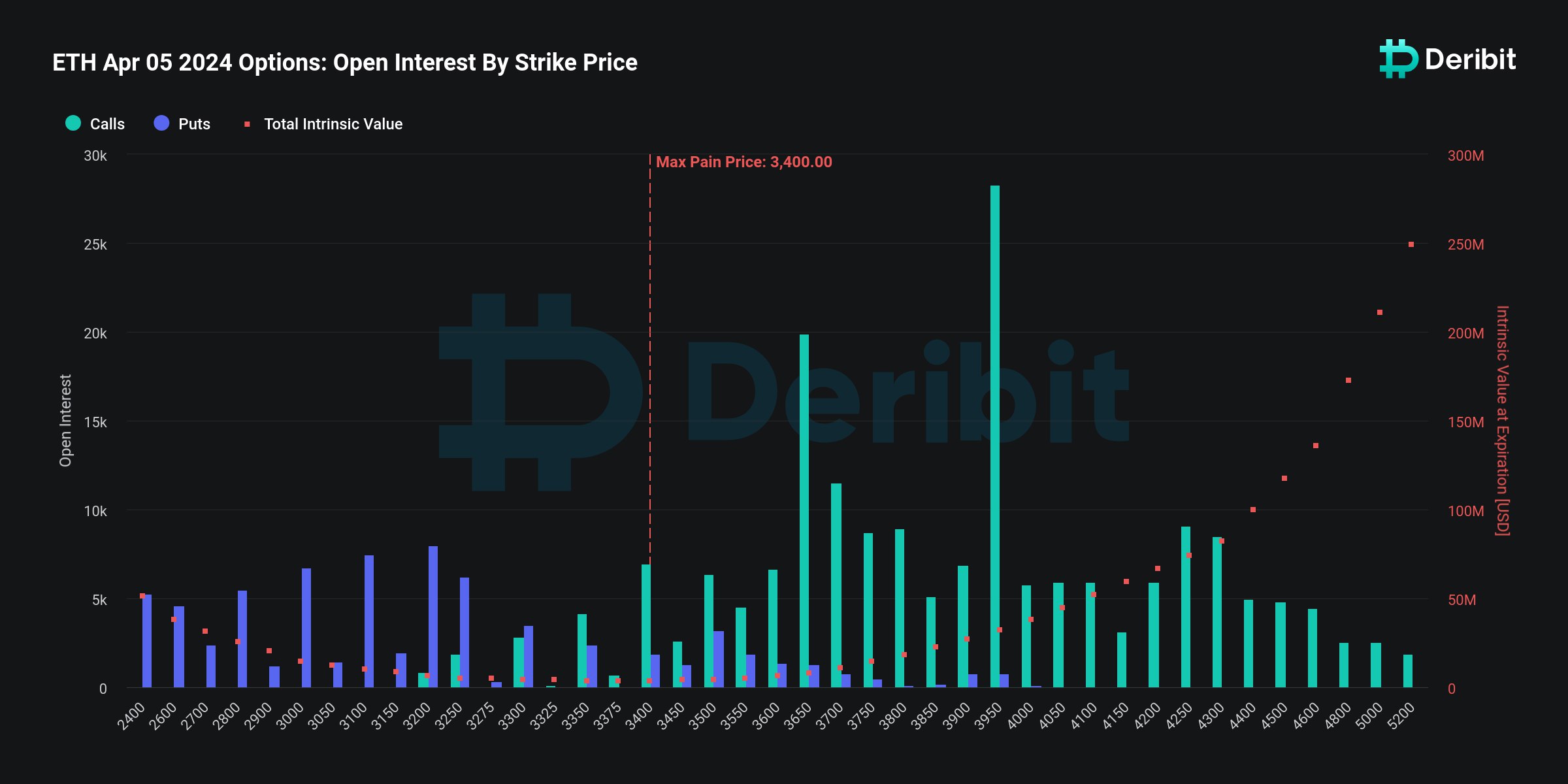

Meanwhile, 270,441 ETH choices of notional worth of virtually $0.89 billion are set to run out, with a put-call ratio of simply 0.38. The max ache level is $3,400, which can also be increased than the present value of $3,287. This signifies ETH value might fall decrease if it fails to rise above max ache level. Keeping an eye fixed on buying and selling volumes is required for additional steering on instructions in ETH value.

In the final 24 hours, ETH name quantity is 155,690 and the put quantity is 49,100. The name open curiosity are increased than put open curiosity, with a put-call ratio of 0.31.

Also Read: Bitcoin Options Market — Volatility Declines Amidst BTC Price Pullback

Bitcoin Rise to $70,000 to Trigger Broader Market Recovery

QCP Capital analysts stated BTC value is caught in tight rage after falling under $70K and there’s not sufficient Bitcoin ETF circulate to catalyze value motion in both path. However, the demand for BTC lengthy positions continues.

This BTC topside demand together with some upward momentum in spot Bitcoin ETF inflows ought to “support BTC price and perhaps, even take BTC above 70k by the end of the week.”

ETHBTC examined a essential assist stage after breaking under 0.05. There has been ongoing massive promoting of ETH calls which have crushed volumes and in addition put some draw back strain on ETH value.

ETHBTC is now at a 2-year low as Bitcoin halving approaches, analysts nonetheless expects a bounce from these ranges however requested to hedge beneficial properties for doable additional downfall.

BTC price at present trades at $67,105, with a 24-high of $69,291. Whereas, ETH price is buying and selling at $3,285, dropping from $3,443 after Fed official hawkish feedback.

Also Read: Bitcoin Cash (BCH) Price Hits 3-Year High Above $700, More Steam Left?

The introduced content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.

[ad_2]

Source link

✓ Share: