[ad_1]

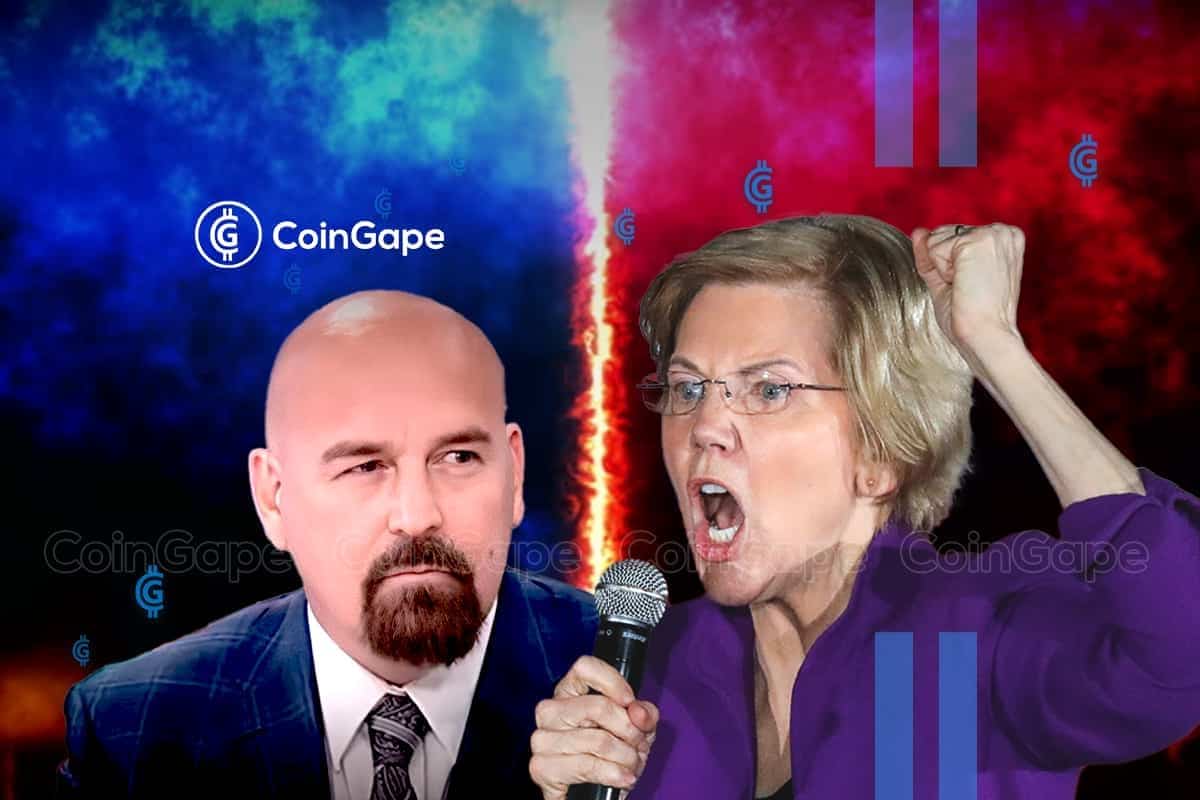

XRP lawyer John Deaton has expressed his views on platform X on Wednesday, elevating considerations over a letter penned by Senator Elizabeth Warren to House Financial Services Committee Chair Patrick McHenry and Representative Maxine Waters.

The letter to the U.S. Federal Reserve, which considerations the attainable dangers from stablecoins, has ignited a dialogue within the crypto area concerning the path of regulatory actions.

Warren’s Caution on Stablecoin Legislation

Senator Elizabeth Warren’s letter expressed concern concerning the introduction of stablecoins into the banking system. Her worries middle on the menace this might impose on the monetary system and the nation’s safety. The stablecoin market, valued at $157 billion, is on the middle of those discussions.

She emphasised the potential dangers that stablecoins could pose, stating that new regulatory frameworks may “amplify and entrench these risks rather than mitigate them.” Her perspective is in step with the Treasury Department’s warnings that stablecoins could also be used for illicit finance, together with terrorist financing.

Deaton’s Critique of Warren’s Approach

John Deaton, after studying the letter, criticized Senator Warren’s stance. He doubted her intentions and urged that she is likely to be influenced by banking business lobbyists.

Deaton’s criticism is consultant of a extra normal view inside the crypto neighborhood, the place many take into account Warren’s stance a menace to the advance and effectiveness of the monetary business.

I simply learn @ewarren’s letter to @PatrickMcHenry and @RepMaxineWaters addressing the FSC’s efforts to introduce a stablecoin invoice. My first query to Senator Warren is whether or not Jamie Dimon and the Bank Policy Institute wrote this letter just like the way in which they wrote her… https://t.co/zuLPlCcnwT

— John E Deaton (@JohnEDeaton1) April 10, 2024

Moreover, the stablecoin bill, which had beforehand superior by way of the House Financial Services Committee, has been topic to bipartisan disagreements. Warren’s place, emphasizing the gravity of the dangers concerned, could affect the invoice’s progress, significantly inside the Senate Banking Committee, the place she serves as a member.

Consequently, Deaton contends that over a decade after Elizabeth Warren got here to Washington, D.C., vowing to carry the banking business accountable, her actions now look extra like these of the business.

Stablecoins Regulation

The debate round stablecoin regulation underscores a fancy concern dealing with policymakers. On one hand, there’s a want to guard the monetary system and customers from potential dangers related to these digital property.

On the opposite hand, there may be an rising demand for rules that promote innovation and effectiveness within the increasing crypto market. The stability between these two goals is a really essential one and the strategy adopted by the regulators can have extreme penalties for the way forward for digital property.

Senator Warren additionally outlined the significance of Anti-Money Laundering (AML) legal guidelines to be prolonged to the crypto sector. The concern she raised was that the international locations underneath sanctions, like Iran, may get some profit from the validation means of cryptocurrency transactions.

Concurrently, Cardano founder Charles Hoskinson has expressed views on anti-money laundering (AML) rules in validators, elevating questions concerning the implementation and practicality of such rules.

Read Also: Apple Pay Joins #Coinbase for Secure UK Cryptocurrency Transactions

The offered content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link

✓ Share: