[ad_1]

Bitcoin miners have been flocking to mine BTC forward of the most-awaited Bitcoin halving this month because the mining reward to half. Whales additionally proceed to purchase BTC and haven’t bought their Bitcoin holdings but. However, a crypto analysis agency by prime analyst Markus Thielen predicts bitcoin miners might promote Bitcoin price billions after halving.

The selloff by miners and whales can shadow bearish sentiment within the crypto market regardless of consultants suggesting a $100K value goal for Bitcoin by year-end.

Bitcoin Miners Can Sell $5 Billion Bitcoin

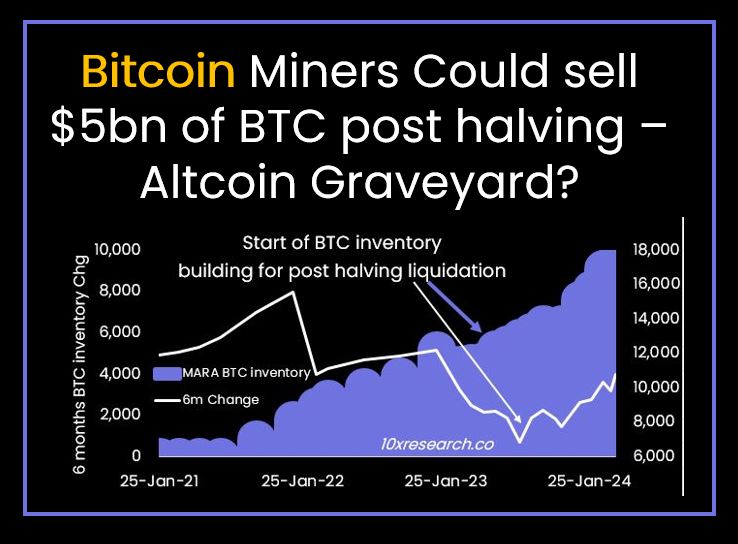

In a dire warning for the crypto group, Markus Thielen, CEO of 10x Research, mentioned Bitcoin miners are almost definitely to promote BTC price $5 billion. The transfer will come after Bitcoin halving, as miners progressively promote their holdings in response to rising mining problem and monetary wants.

10x Research predicts a six-month lull after the Bitcoin halving in April. This might be a significant difficult time for the crypto market as “Bitcoin miners prepare to sell off substantial portions of their BTC inventories.”

Thielen believes the inventories constructed over the previous couple of months amid bullish market sentiment disrupt the market dynamics. Bitcoin halving, anticipated on April 20, usually witnesses miners stocking up their BTC holdings. It results in a supply-demand imbalance and a subsequent rally in Bitcoin costs.

Markus Thielen earlier predicted that Bitcoin to rally 32% into the halving. However, the report suggests $5 billion price of potential BTC liquidations by miners after the halving.

“The overhang from this selling could last four to six months, explaining why Bitcoin might go sideways for the next few months—as it has done following past halvings, he added.”

CryptoQuant knowledge reveals miner reserves fell considerably within the bear market and spot Bitcoin ETFs have elevated demand for Bitcoin, making a provide crunch.

Also Read: Solana Network Congestion — Anza Deploys Crucial Upgrade

Whales Selloff After Bitcoin Halving

CryptoQuant CEO Ki Young Ju revealed in a put up on X at this time that BTC whales will not be but promoting their Bitcoin holdings. However, whales have a tendency to modify from Bitcoin to altcoins or proceed to commerce BTC after halving occasions as value drops after halving.

$BTC whales will not be promoting. pic.twitter.com/MIcGknPNkU

— Ki Young Ju (@ki_young_ju) April 12, 2024

While consultants predicted a $100K value goal for Bitcoin this yr, some components can set off a short-term selloff. Bitcoin to see a paradigm shift in costs and volumes after the halving because of demand from spot Bitcoin ETFs.

Meanwhile, Ali Martinez revealed that just about $23 million Bitcoin positions dangers liquidation as if Bitcoin jumps to $71,700.

BTC price at present trades at $70,776, up simply 0.50% within the final 24 hours. The 24-hour high and low are 24-high of $69,571 and $71,256. However, buying and selling volumes has declined over 22% within the final 24 hours, indicating lack of curiosity amongst merchants.

Also Read: Bitcoin Options Expiry: How Traders Are Pricing For Bitcoin Halving

The offered content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

[ad_2]

Source link

✓ Share: