[ad_1]

Bitcoin and Ethereum costs rebounded barely however are nonetheless beneath promoting stress as value momentum fades as Bitcoin and Ethereum choices value almost $2.5 billion are set to run out at present. The volatility forward of Bitcoin halving has elevated as merchants are pricing low upside momentum amid headwinds comparable to macro and promoting by whales.

Bitcoin and Ethereum Options Worth $2.5 Billion to Expire

Crypto market to stay unstable earlier than and after Bitcoin halving as specialists pointed to promoting sentiments within the crypto market as a result of buildup of adversarial situations like scorching CPI knowledge this week and an enormous drop in volumes within the derivatives market.

Greekslive revealed that promote contracts have been probably the most dominant commerce of the month and halving expectations showing to be overdrawn. With the latest slowdown in ETF inflows, the “lack of new hot spots in the market and a more subdued sentiment.” They anticipate promoting medium-term is certainly the higher possibility, and quick time period is value it as a result of sentiment surrounding Bitcoin halving.

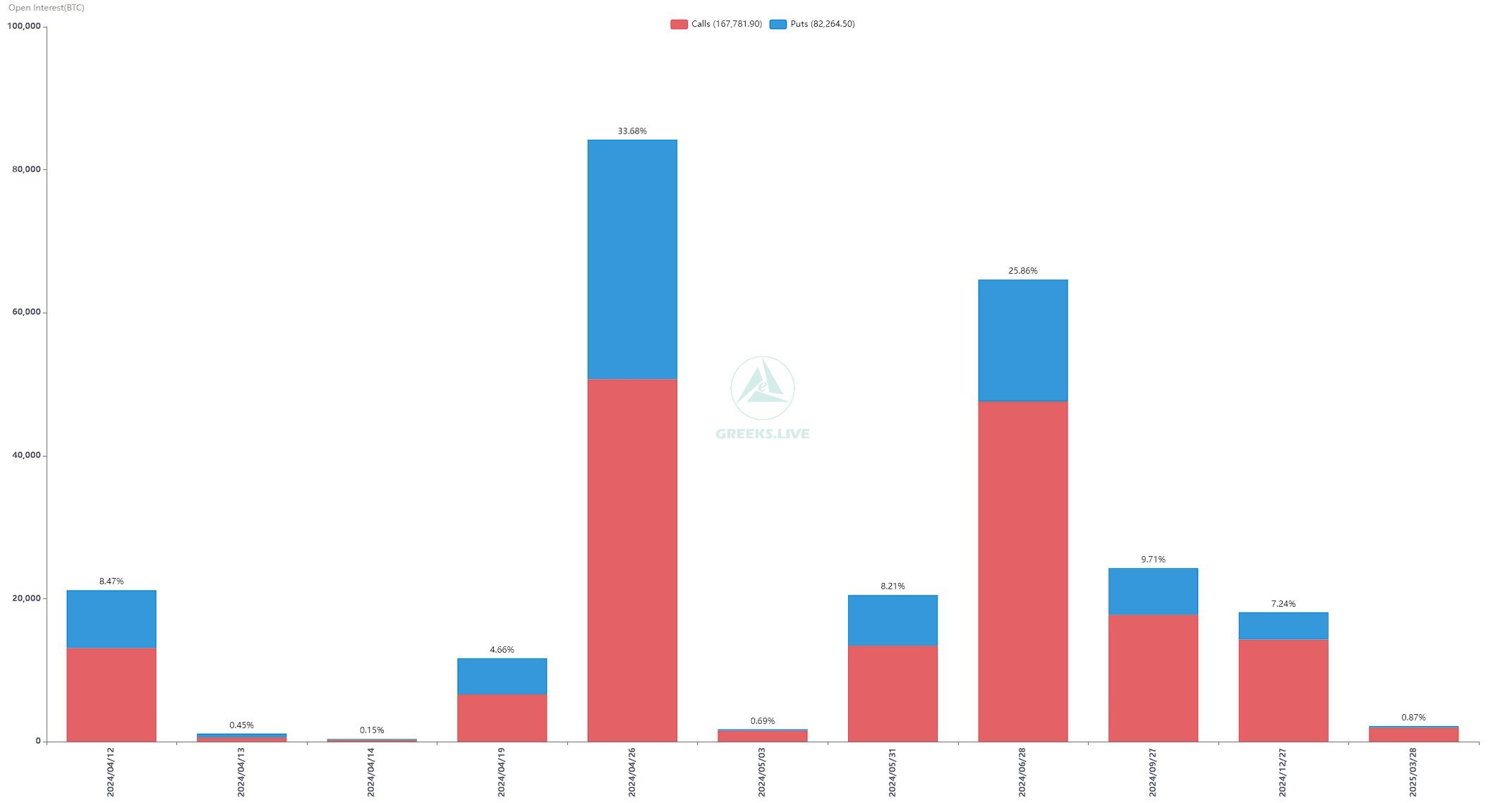

Over 21,162 BTC choices of notional worth $1.51 billion are set to run out, with a put-call ratio of 0.62. The max ache level is $69,000, indicating Bitcoin value stays beneath promoting stress as per the present value. Implied volatility (IV) witnessing vital declines throughout all main phrases, which suggests unstable value actions will see BTC value tumble under $70,000.

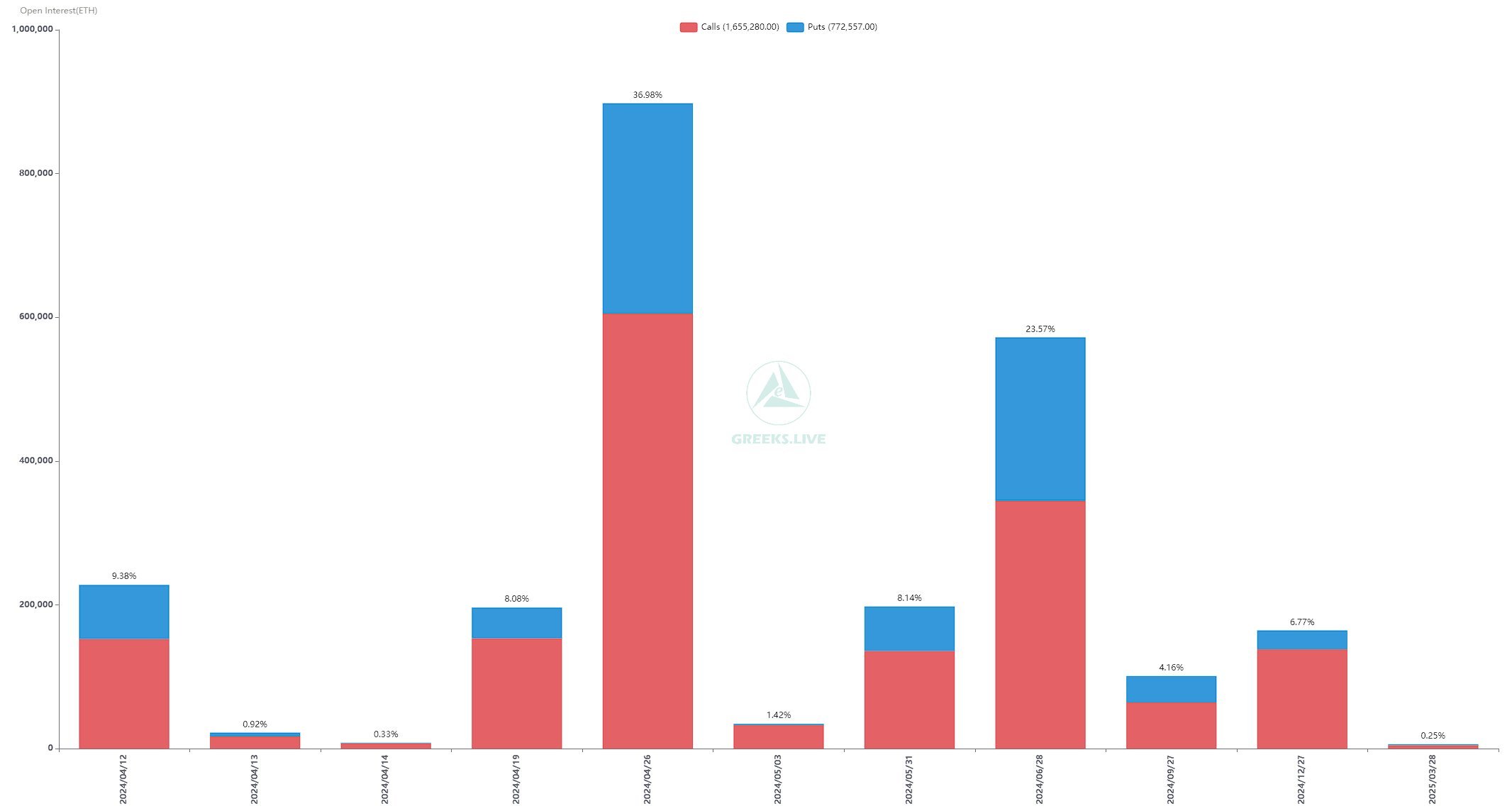

Meanwhile, 227,785 ETH choices of notional worth of just about $0.81 billion are set to run out, with a put-call ratio of 0.49. The max ache level is $3,425, which can also be decrease than the present value of $3,535. This signifies merchants nonetheless have alternatives to commerce the worth decrease. Keeping a watch on buying and selling volumes is required for additional steerage on instructions in ETH value.

Also Read: Pepe Meme Coin Futures Launch on Coinbase, Price Climbs 5%

BTC Futures OI Stays Strong But Volatile

BTC price presently trades at $70,888, up simply 0.50% within the final 24 hours. The 24-hour high and low are 24-high of $69,571 and $71,256. However, buying and selling volumes has declined over 22% within the final 24 hours, indicating lack of curiosity amongst merchants.

Total BTC Futures Open Interest has elevated by 2% within the final 4 hours, however exhibits volatility within the final hour. CME BTC futures OI fell 1% within the final hour.

Whereas, ETH price is buying and selling at $3,539, dropping 0.80% within the final 24 hours. The 24-hour high and low are $3,477 and $3,616. Moreover, buying and selling quantity has declined by over 16% within the final 24 hours, indicating an absence of curiosity amongst merchants.

Total ETH Futures Open Interest fell 2% within the final 24 hours, however rose 1% within the final 4 hours. The futures buying and selling exercise stays unstable forward of choices expiry.

Also Read: 3 Altcoins Whales Are Buying To Make Millions

The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

[ad_2]

Source link

✓ Share: