[ad_1]

Crypto market has misplaced over $430 billion in market worth as Iran-Israel tensions grow to be extra intense. The world crypto market cap by 20% from $2.64 trillion to a low of $2.21 trillion amid panic promoting. The market response on Monday might be necessary because the sudden crash erodes confidence.

What occurs between Iran and Israel? Iran is threatening retaliation, with preliminary drone assaults on Israel, after claiming that an airstrike on the Iranian consulate in Damascus, Syria killed officers together with high-ranking generals. Israel neither confirmed nor denied its involvement within the assault.

The week was unhealthy for the crypto market spurring detrimental sentiment, whereas some stay calm as a consequence of anticipated correction pre-Bitcoin halving much like previous halving occasions. BTC price fell additional to a low of $60,660 however rebounded to $64,300 resistance stage in a number of hours. BTC value is now buying and selling at $64K.

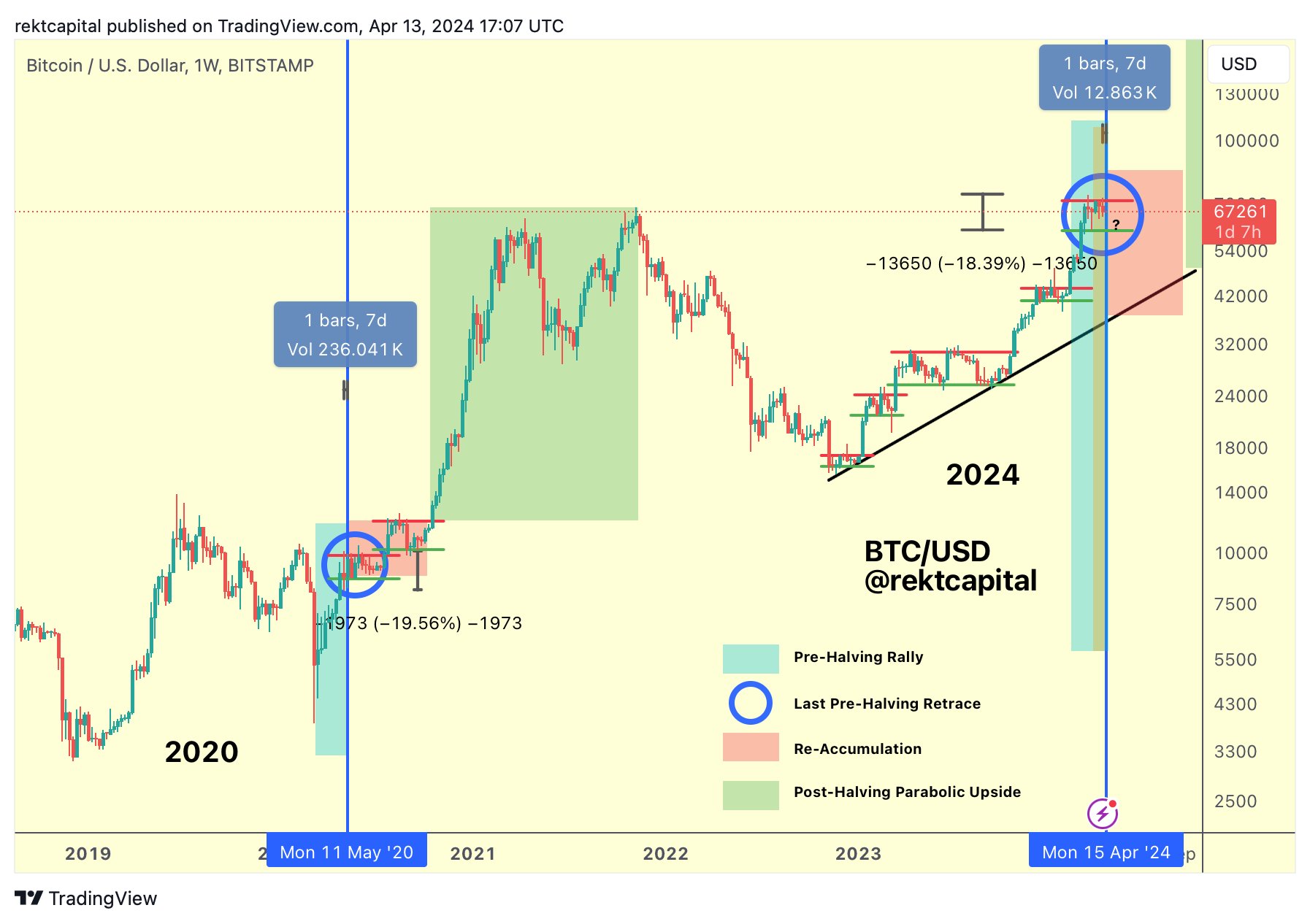

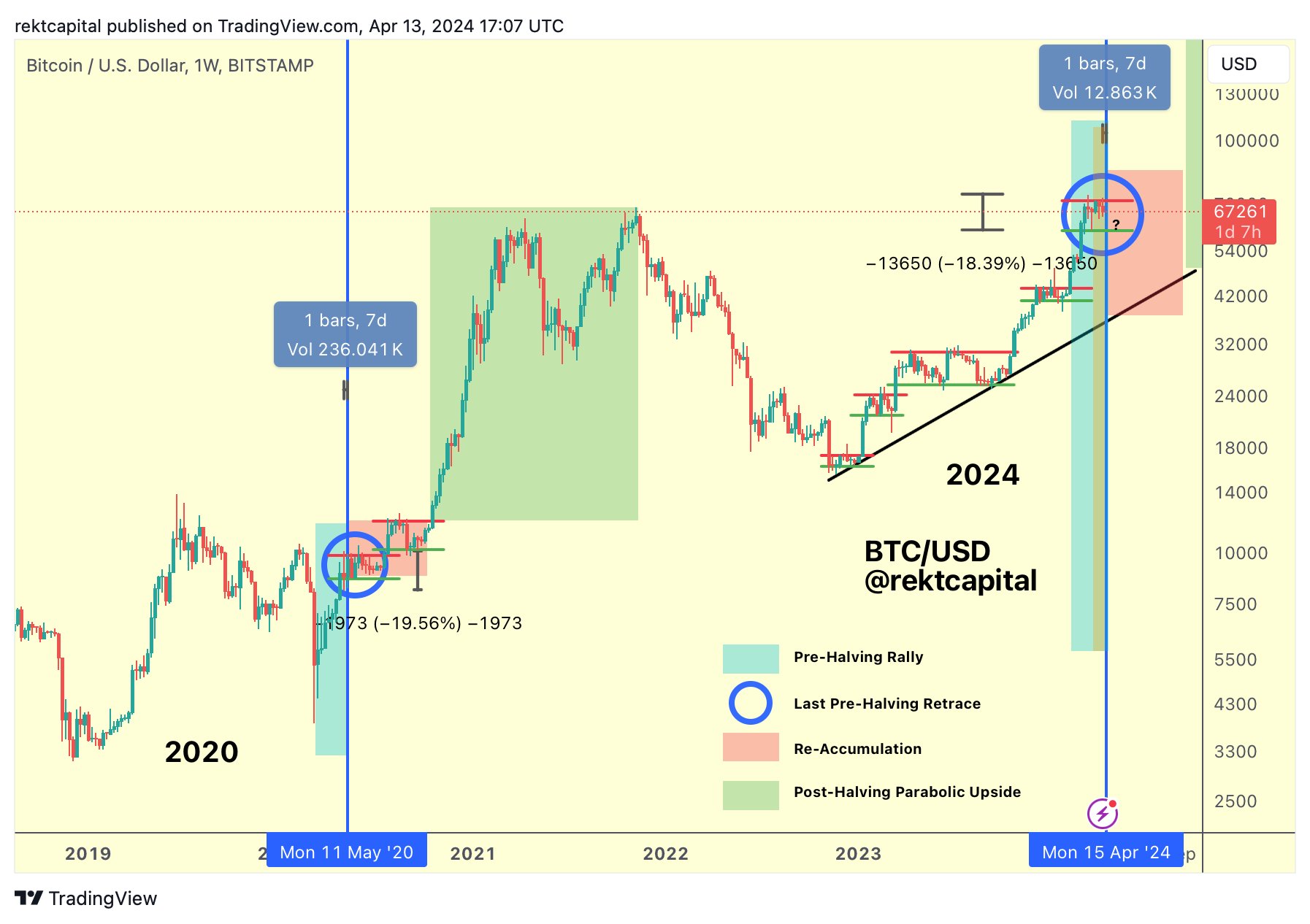

Rekt Capital asserts the present Bitcoin cycle has been accelerated in comparison with earlier ones. He mentioned “New all time highs before the halving is an apparent sign of that. But this current retrace and sideways movement in the Re-Accumulation Range is exactly what is needed to decelerate and slow down the cycle.” These retraces and durations of consolidation to get this present cycle nearer to resynchronizing with historic cycles, he added.

ETH price has additional dropped 9% to tug the value beneath $3,000. This induced altcoins SOL, XRP, ADA, DOGE, SHIB, and others to increase their downfall to 20-50%.

As ETHBTC plunges to the 2021 ranges of 0.46, analyst Benjamin Cowen predicts ETH/BTC may backside this summer time. Last cycle, ETHBTC bottomed after the first fee minimize after it broke assist and “dropped for 2 months straight, then bottomed.”

While whales are shopping for contemplating the buy-the-dip alternative, a significant threat arises within the DeFi market. As CRV fell to $0.42, Curve founder Michael Egorov faces liquidation of his lending positions. Michael pledged a complete of 371 million CRV (approx. $156 million) by 5 addresses on 6 lending platforms to borrow $92.54 million in stablecoins. Currently, the well being fee has dropped to round 1.1, risking liquidation.

Coinglass knowledge exhibits greater than $2 billion had been liquidated throughout the crypto market amid this sturdy panic promoting. Of these, almost $1.5 billion lengthy positions had been liquidated and almost $500 million brief positions had been liquidated since Friday. On Saturday, the crypto market witnessed one other $950 billion liquidation.

In the previous 24 hours, Over 252K merchants had been liquidated and the most important single liquidation order occurred on crypto trade Binance as somebody bought BTC valued at $8.46 million.

CoinGape has reported the crypto market crash intimately, giving insights into the way it began, different causes for the correction, and consultants’ prediction on how low can Bitcoin fall earlier than it begins to bounce. Traders and traders should stay cautious earlier than the newest knowledge on the US greenback index (DXY) and US 10-year treasury yield comes. CME Bitcoin futures contract trades to additionally open in the present day at 5 PM CT, giving additional steering on market path.

Read More: Crypto Market Crash — Here’s Why Bitcoin, ETH, SOL, XRP, SHIB Fell Sharply

The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link

✓ Share: