[ad_1]

Crypto market noticed one other sudden market-wide selloff within the early US hours, with greater than $30 million liquidated in an hour. Bitcoin price slipped from $63,340 to a low of $61,600, extending the intraday drop to six%.

Ethereum price additionally briefly fell under $3,000 amid quite a few liquidation orders, triggered by weak sentiment forward of Bitcoin halving. Other prime altcoins together with BNB, SOL, XRP, DOGE, TON, ADA, and SHIB witnessed a 2-3% fall in costs inside an hour. Solana and Toncoin costs have tumbled 14% and 15% within the final 24 hours.

Why Bitcoin Price Fell Suddenly

The pre-halving correction in Bitcoin value coupled with macro and geopolitical elements pulls down BTC value, with no main shopping for from whales and enormous buyers.

Coinglass knowledge reveals greater than $330 million had been liquidated throughout the crypto market amid this sturdy correction. Of these, $260 million lengthy positions had been liquidated and practically $70 million brief positions had been liquidated on Tuesday.

Over 109K merchants had been liquidated and the biggest single liquidation order occurred on crypto trade OKX as somebody swapped ETH to USD valued at $5.97 million.

Bollinger bands (blue) indicator reveals BTC value is in a draw back development, failing to interrupt above the 20-simple shifting common (orange). Ichimoku Cloud reveals value proceed to maneuver below help and the promoting stress is rising as development reversed, with the cloud widening.

Also Read: BlackRock Co-founder Predicts Market Comeback

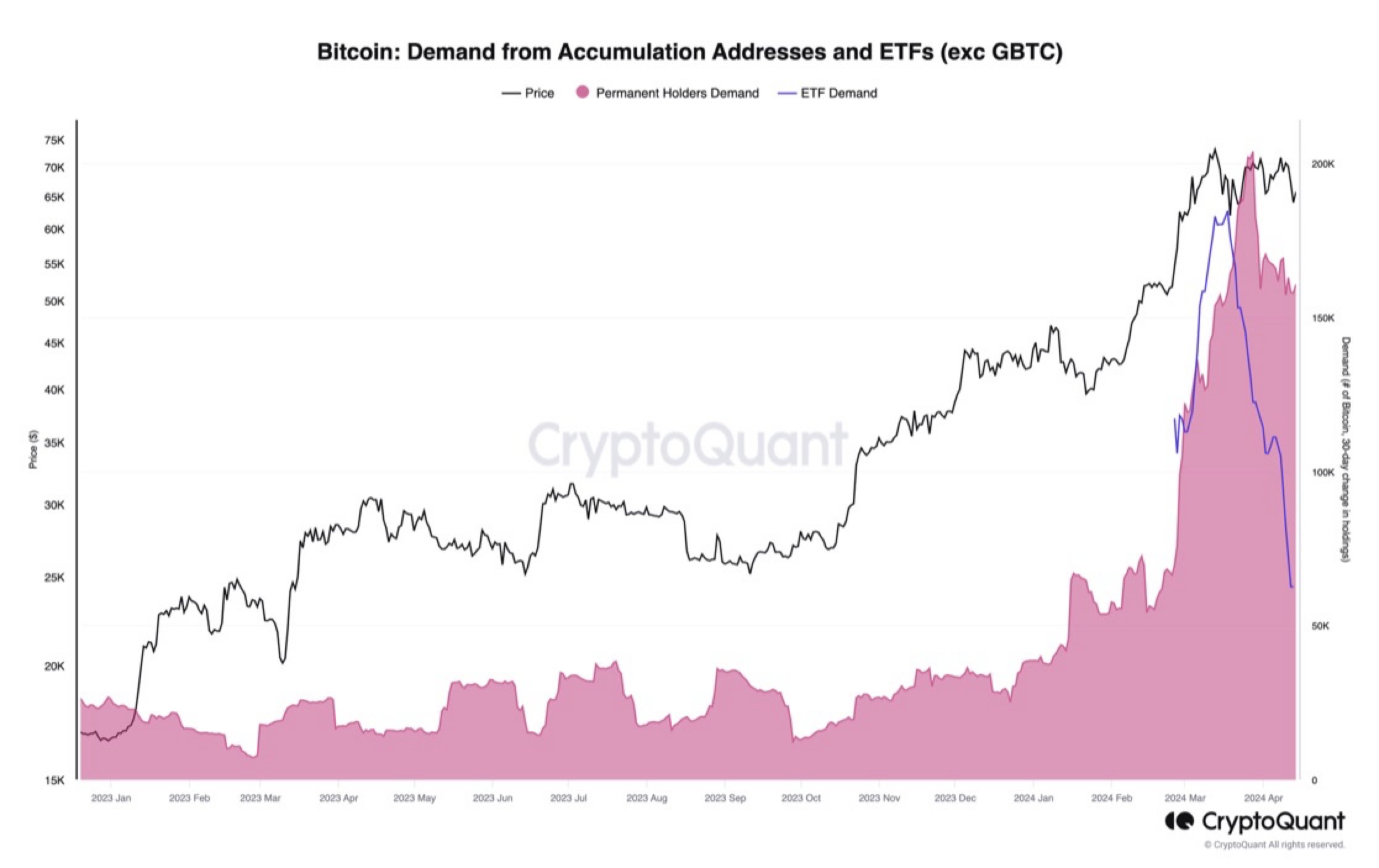

CryptoQuant head of analysis Julio Moreno joined different consultants reminiscent of analyst Markus Thielen to specific bearish sentiment creating on BTC. “Bitcoin demand growth has slowed down significantly, both from ETFs and other permanent holders,” stated Moreno. Bitcoin demand from accumulation addresses and ETFs has pale forward halving.

Analyst Predicts A Fall to $55K

Popular analyst Michael van de Poppe predicts a $55K stage is probably going as BTC value holds up on help after a decrease timeframe rejection. However, he believes Bitcoin will maintain close to present ranges and begin a gradual upward momentum. The bearish divergence stays legitimate as consolidation for the post-halving rally builds up.

The world macroeconomic occasions brought about US greenback index (DXY) to climb above 106.23, persevering with to rise increased. Whereas, the US 10-year Treasury yield jumped to a excessive of 4.663% at this time on open. As Bitcoin strikes reverse to DXY and Treasury yields, an increase in each DXY and 10-yr treasury yield has brought about a sudden fall in Bitcoin value under $62k, triggering a crypto market selloff.

Also Read: Ripple Vs SEC Lawsuit — Settlement Debates & XRP Price Fall Concerns

The offered content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.

[ad_2]

Source link

✓ Share: