[ad_1]

Data reveals the Bitcoin energetic addresses haven’t considerably elevated not too long ago, indicating that the present rally could also be unsustainable.

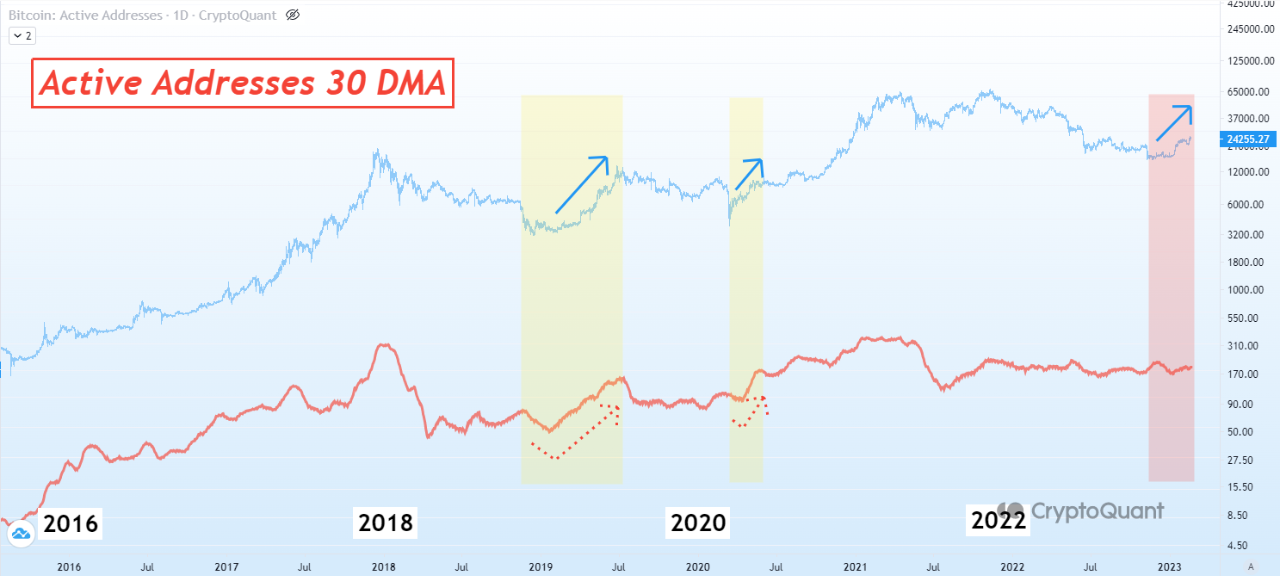

Bitcoin Active Addresses (30-Day MA) Stall Despite Rally

As an analyst in a CryptoQuant submit identified, earlier BTC rallies noticed the metric improve in worth. The “active addresses” is an indicator that measures the each day whole variety of Bitcoin addresses concerned in some transaction exercise on the chain.

The metric accounts for each the senders and receivers and counts distinctive addresses. It signifies that if an handle has made a number of transactions all through the day, it should nonetheless be included solely as soon as.

When the indicator is excessive, it usually means many addresses are collaborating in some community exercise. Such a pattern implies that the blockchain is attracting merchants and market members.

On the opposite hand, low values counsel there aren’t sufficient energetic customers on the community, which may point out that the overall buying and selling curiosity across the cryptocurrency is low.

Now, here’s a chart that reveals the pattern within the 30-day shifting common (MA) of Bitcoin energetic addresses over the previous couple of years:

The 30-day MA worth of the metric appears to have been largely shifting sideways in latest days | Source: CryptoQuant

As displayed within the above graph, the quant has highlighted the related sample seen throughout two earlier cases the place Bitcoin was in a restoration state. During the 2019 rally and retracement from the COVID-19 crash in 2020, the 30-day MA BTC energetic addresses noticed an uptrend.

This signifies that as the value trended upward in these cases, the person exercise additionally elevated, displaying that demand was returning to the cryptocurrency. This spike in exercise helped maintain the respective worth rallies operating and sustained.

In the case of the restoration from the COVID-19 crash, the person exercise additionally went on to see a number of extra rises later, in the end increase into the 2021 bull run. The present state of affairs is extra much like the 2019 rally, as that worth surge additionally occurred because the coin seemingly recovered from a bear market.

Since the present rally has fashioned, there have been no noticeable rises within the 30-day MA Bitcoin energetic addresses, suggesting that demand for the coin could not have modified regardless of the value improve.

“The “price” of an asset is set by the legal guidelines of provide and demand available in the market. Crypto markets aren’t any exception,” explains the analyst. “For asset prices to rise, market interest and demand must be supported.”

Unless the energetic addresses see a pointy improve within the coming days, the rally is probably not sustainable if the sample adopted in the course of the previous cases is something to go by.

BTC Price

At the time of writing, Bitcoin is buying and selling round $24,700, up 15% within the final week.

BTC strikes sideways | Source: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link