[ad_1]

Bitcoin worth lastly pushed by resistance at $27,000 following final week’s correction under $25,000. The largest cryptocurrency’s Tuesday climb appeared unstoppable because it blasted by the following resistance at $28,000.

The worth breached a subsequent hurdle at $29,000 however has retreated to commerce at $28,743 as traders usher within the European session. Prominent analysts like Michaël van de Poppe have attributed the sudden bullish outlook to Blackrock’s supposed debut into the crypto business.

Blackrock, a worldwide behemoth spanning many industries, filed an utility with the Securities and Exchange Commission (SEC) for a spot Bitcoin exchange-traded fund (ETF).

#Bitcoin exhibits some attention-grabbing constructions.

Held above the 200-Week EMA and bounced firmly from that space.

Secondly, earlier resistance turns into help, by which a brand new rally can begin.

Coming weeks we’ll see, however one other rally to $38K is on the playing cards. pic.twitter.com/q0RxP20wbl

— Michaël van de Poppe (@CryptoMichNL) June 20, 2023

Optimism has been constructing round this specific utility, regardless of the SEC having rejected many related proposals prior to now. The transfer additionally serves as validation of the crypto market to institutional traders, many of whom have for the reason that utility expressed curiosity out there.

Bitcoin Price Approaches $30,000 As Fidelity-Backed EDX Markets Begins Operations

In an attention-grabbing flip of occasions, Fidelity Investments in collaboration with Citadel Securities, has launched a cryptocurrency trade dubbed EDX Markets.

Although the time of this launch is suspect, simply after Blackrock’s ETF announcement, it hopes to serve brokers and traders piquing curiosity within the crypto market however want to keep clear of troubles that whisked FTX out of enterprise in November.

According to a associated report by the Wall Street Journal, EDX Markets began finishing up transactions prior to now few weeks – in a somewhat delicate method. The undertaking introduced 9 months in the past, lastly confirmed its official launch by a press release issued on Tuesday.

This initiation signifies {that a} phase of Wall Street establishments nonetheless maintains their crypto curiosity. This holds regardless of the substantial regulatory strain exerted by the SEC and a crypto market that has seen a big slowdown prior to now 12 months and a half.

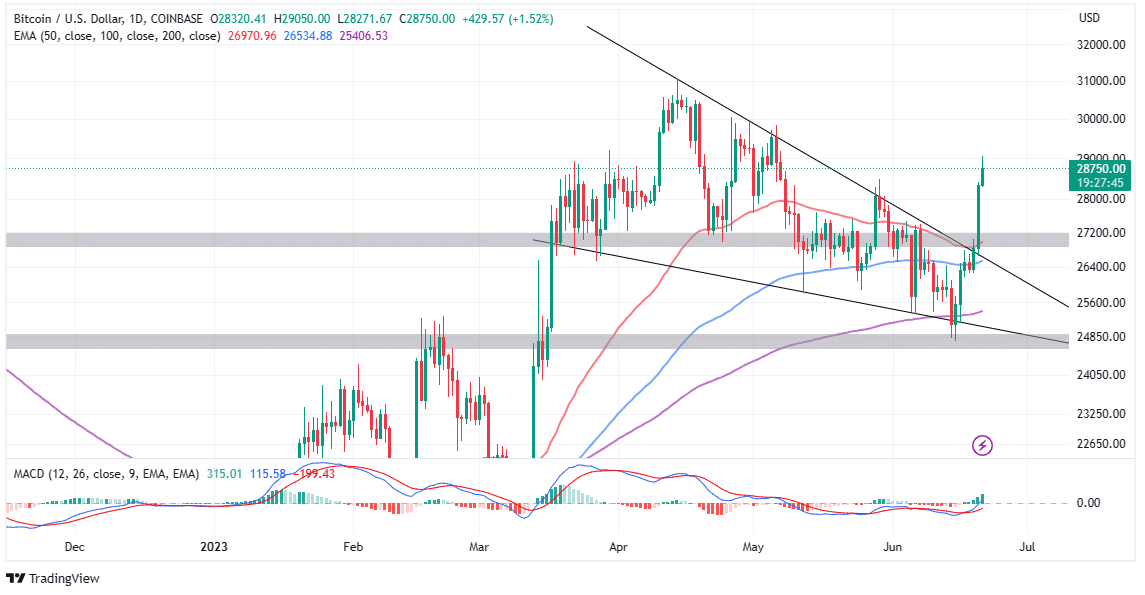

Meanwhile, Bitcoin price reacted positively to the news, confirming the breakout mentioned in our earlier evaluation. Long positions in BTC, triggered barely above the bullish pennant sample, or the 50-day Exponential Moving Average (EMA) round $27,000, instantly turned worthwhile as the most important crypto closed the hole to $29,000.

Is This The Beginning of a Bull Market?

The cryptocurrency market has been caught in a downward spiral for a couple of and a half years. While there have been many restoration makes an attempt, just like the aggressive Bitcoin price rally to highs marginally above $31,000 in April, market situations have usually remained depressed.

However, with the upswing to $29,000, Bitcoin worth could lastly shun the downtrend and usher in a bullish period with good points above $30,000. Notably, the Moving Average Convergence Divergence (MACD) indicator has validated a purchase sign on the identical each day chart.

For now, it will be prudent to watch for the Bitcoin worth to verify help at $28,000 or a breakout above $29,000 earlier than triggering new lengthy positions. This will assist keep away from sudden pullbacks which can culminate in losses.

If help at $28,000 is misplaced, traders could begin acclimating to a pointy drop to the following help at $27,000. However, it isn’t advisable to strongly quick Bitcoin, contemplating the emergence of institutional investors like Blackrock, Fidelity Investments, and Citadel Securities.

Related Articles

The offered content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link