[ad_1]

The cryptocurrency market is again within the inexperienced after a number of days of doldrums, which Bitcoin (BTC) price used to consolidate the positive aspects and acquire extra liquidity. Investors additionally took the chance to build up extra BTC with the dips to the assist at $33,000 forward of the following bull run.

Bitcoin Price Wakes Up Post FOMC

It seems that the choice by the United States Federal Reserve to go away rates of interest unchanged between 5.25% and 5.5% on Wednesday affirmed the optimistic outlook available in the market since October.

Jerome Powell, the Fed chairman reiterated that the financial institution is “strongly committed” to bringing down inflation.

“Recent indicators suggest that economic activity has been expanding at a strong pace – well above earlier expectations,” Powell stated through the assembly.

The majority of the committee members consider that there’s a want for an additional price hike earlier than the 12 months ends whereas holding a decent financial coverage within the foreseeable future.

Bitcoin value resumed the uptrend following the FOMC meeting, rallying above $35,000 to commerce at a brand new yearly excessive. Up 3.3% within the final 24 hours, BTC is buying and selling at $35,383.

Altcoins like Ethereum, Cardano, and Solana adopted go well with, bringing to life their uptrends to commerce 2.1%, 7.8%, and 13.2%, respectively greater on the day.

Is The Bear Market Behind Us?

Bitcoin upholds assist above $35,000 permitting for consolidation to happen forward of one other macro uptrend. According to dealer and analyst, Rekt Capital, so long as Bitcoin stays above assist at $34,800, the following goal lies between $36,500 and $37,000.

#Bitcoin breaks out and reaches a brand new yearly excessive.

Not an enormous breakout, however so long as we keep above $34.8K, the following goal is $36.5-37K.#Altcoins to observe after. pic.twitter.com/3aCKwvoGXq

— Michaël van de Poppe (@CryptoMichNL) November 1, 2023

He is of the opinion that “the bear market is behind us” and predicts that initiatives within the decentralized finance (DeFi) sector might quickly start to rally.

#Bitcoin nonetheless consolidating above $35,000.

Slowly, however absolutely, extra #DeFi initiatives begin to rally.

I wouldn’t be shocked if we get a renewed DeFi summer season in 2024.

The bear market is behind us.

— Michaël van de Poppe (@CryptoMichNL) November 2, 2023

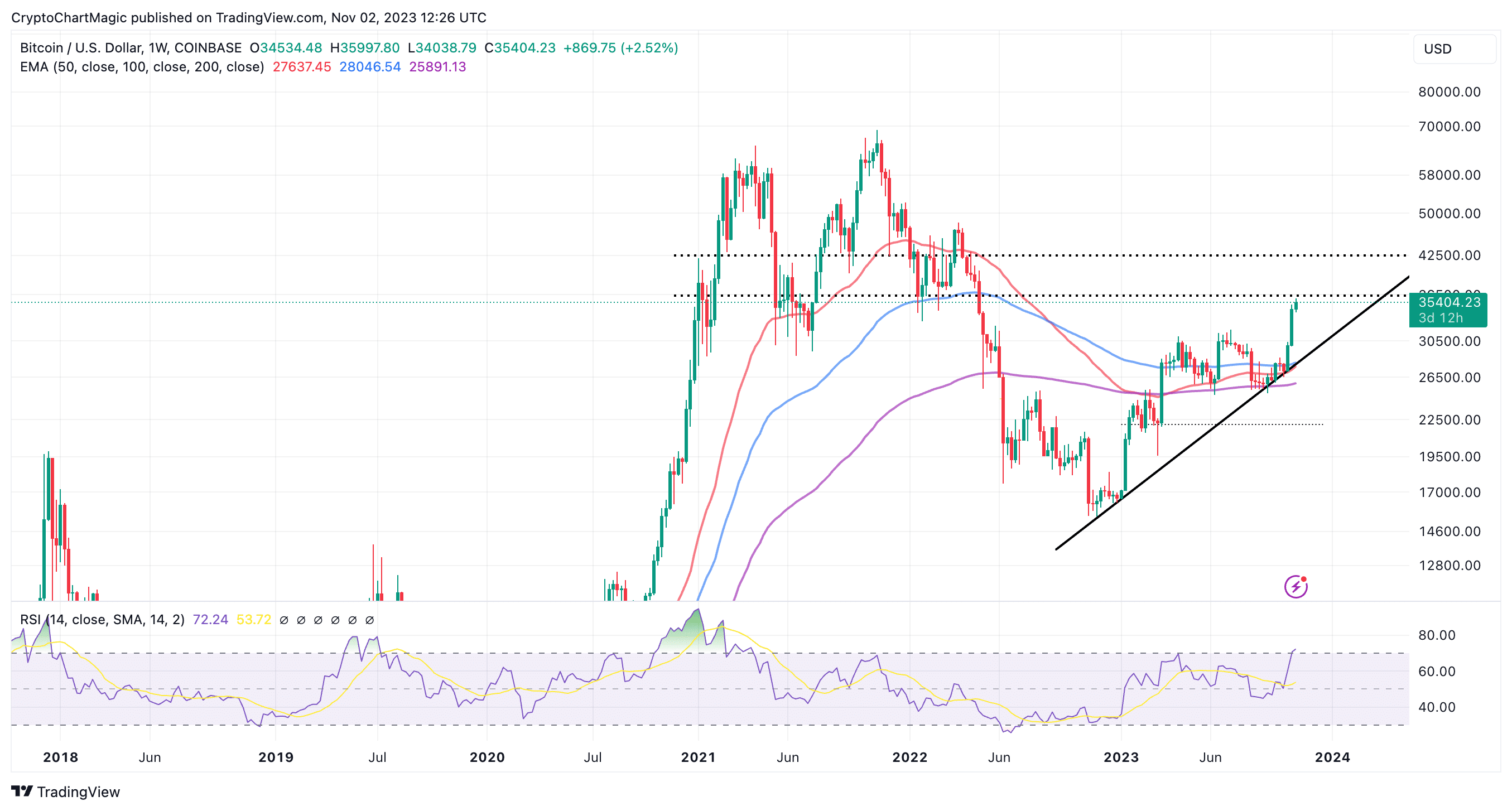

The Relative Strength Index (RSI) at 72 though starting to be overbought might stretch greater towards the 100 mark, as it’s the norm with bullish markets. In different phrases, so long as it sustains the uptrend, BTC value can be inclined to maintain the rally intact.

Traders ought to pay attention to an incoming bullish cross which might reinforce the bulls’ rising affect. This bullish sample happens when a short-term shifting common flips above a long-term shifting common. For occasion, the 100-week EMA (blue) reaching out to cross above the 200-day EMA on the weekly chart.

Can Bitcoin Price Hit $56k By Year-End?

Bitcoin’s rally began in October and now it has spilled into November. Investors consider that this restoration will proceed except an outdoor power emerges — extra like Sir Isaac Newton’s third regulation of movement.

In their newest observe to clients, researchers at crypto providers platform Matrixport implied that Bitcoin value has the potential to maintain shifting upward over the following two months in what they described because the “Santa Claus Rally.”

“As bitcoin tends to reach its peak by December 18th, we could call the six to seven weeks from early November to mid-December Bitcoin’s Santa Claus Rally,” Matrixport report acknowledged.

The exceptional rally to above $35,000 can majorly be attributed to optimism surrounding the potential greenlighting of spot ETF proposals by the SEC. Matrixport believes Bitcoin can rally by greater than 65% earlier than December 31 which suggests it might finish the 12 months upwards of $65,000.

“Based on these statistics, bitcoin continues to offer upside potential, and a +65% year-end rally would lift prices back to $56,000,” the researchers added within the observe.

Related Articles

- Breaking: US SEC Enforcement Division Subpoenas PayPal For PYUSD Stablecoin – Details

- Ripple CLO Stuart Alderoty And XRP Lawyers Mock SEC Chair Gary Gensler

- Europe’s Largest Bitcoin Mining Firm Northern Data Acquires 575M Euros

The publish Bitcoin Price Prediction: Will Year-End Rally Lift BTC To $56k? appeared first on CoinGape.

[ad_2]

Source link