[ad_1]

Past development of the Ethereum worth captured per byte metric suggests {that a} 50% drawdown from right here remains to be doable for ETH.

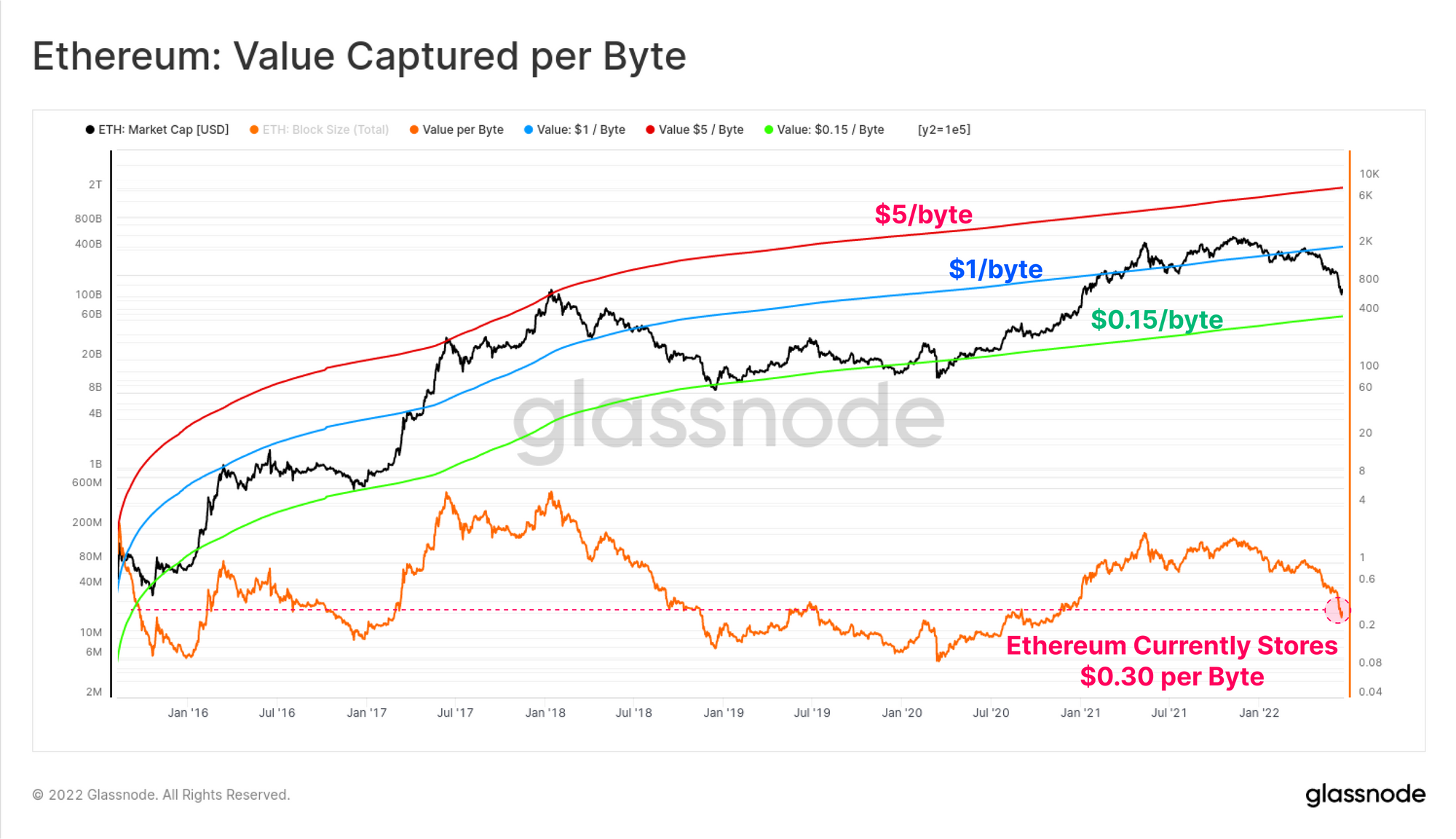

Ethereum Value Captured Per Byte Currently Stands At $0.30, Double The Previous Bear Bottoms

As per the newest information launched by Glassnode, ETH should probably have potential for an additional 50% plummet within the worth.

The “value per byte” is an indicator that measures the overall worth saved by Ethereum inside a single blockchain byte.

The metric was first coined by Permabull Niño, and its important objective is to mannequin how the worth capture-to-data effectivity of a blockchain adjustments over time.

When the worth of this indicator is excessive, it means the crypto is capturing a considerable amount of worth relative to a small information footprint proper now.

Related Reading | Ethereum Hashrate Plunges Over 10% As Mining Profitability Drops

Such a price can trace that the blockchain could be very environment friendly for the time being. On the opposite hand, a low worth being saved per byte suggests poor effectivity.

Now, here’s a chart that exhibits the development within the Ethereum worth captured per byte over the previous few years:

Looks like the worth of the indicator has declined in latest weeks | Source: Glassnode

In the above graph, the purple, blue, and inexperienced strains denote $5 per byte, $1 per byte, and $0.15 per byte, respectively.

Historically, Ethereum has shaped bear market bottoms round when the community has captured a price of $0.15 per byte.

Similarly, when the indicator has had a price of about $5 per byte, the crypto has topped out (nonetheless, not all tops occurred round this worth).

Most lately, the worth of the metric has sunk down and the ETH blockchain is now storing round $0.30 per byte.

Related Reading | How This Ethereum Lending Platform Was Attacked And Made A Deal With The Hacker

Clearly, the indicator is for the time being double the $0.15 backside line that the coin appears to have traditionally adopted.

This could recommend that Ethereum might nonetheless have room for as much as 50% extra decline earlier than the bear backside is lastly in.

However, the Glassnode report notes that that is solely assuming that there is no such thing as a elementary enchancment in worth seize by the community.

The Ethereum atmosphere right now is kind of totally different from a couple of years again; NFTs, DeFi, and different trendy infrastructure didn’t exist then.

So, due to these components, its doable the baseline for worth saved by the community is now larger, suggesting {that a} backside might happen at the next level than previously.

ETH Price

At the time of writing, Ethereum’s price floats round $1.1k, up 1% previously week.

The worth has largely moved sideways over the previous few days | Source: ETHUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link