[ad_1]

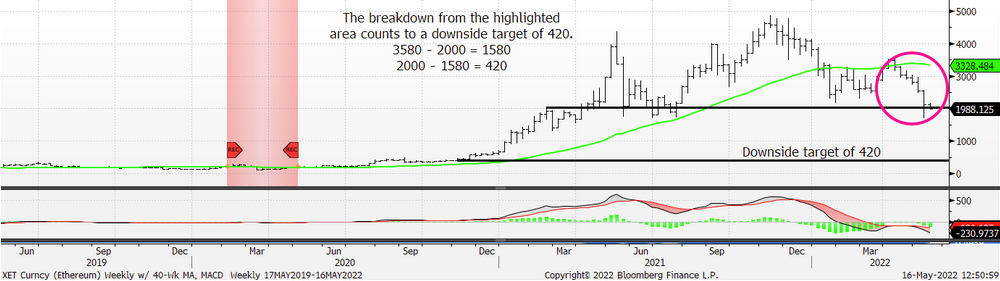

According to a latest Bloomberg article, John Roque of 22V analysis believes that Ethereum may fall to $420, a lack of 80% from its current worth, and right here’s why.

Ethereum May Fall 80%

The dealer believes Ethereum, which is presently buying and selling at $2,000, is about to interrupt via the assist zone and can almost definitely fall beneath $420. Roque drew consideration to a worth vary during which $3,580 is the highest and $2,000 is the underside.

With Ether falling beneath $2,000, it’s not throughout the beforehand specified vary and can start to fall to the subsequent vital chart assist at round $420.

Source: 22v Research

Because the second-largest cryptocurrency is quickly shedding worth, it has fallen beneath all transferring averages, together with the 50-, 100-, and 200-day strains. The above-mentioned indicators’ downward motion is a major bearish issue for any asset.

Ethereum can also be oversold on each the weekly and every day charts, based on Roque, which is why it can’t rally within the foreseeable future.

ETH/USD trades aroun $2k. Source: TradingView

While the analyst claims that Ethereum is principally “over” key assist ranges for the second largest cryptocurrency available on the market should still be seen. On the weekly chart, for instance, merchants have but to check 200-week common assist.

Related Reading | Bitcoin Indicator Hits Historical Low Not Seen Since 2015

ETH Exchange Supply Rising

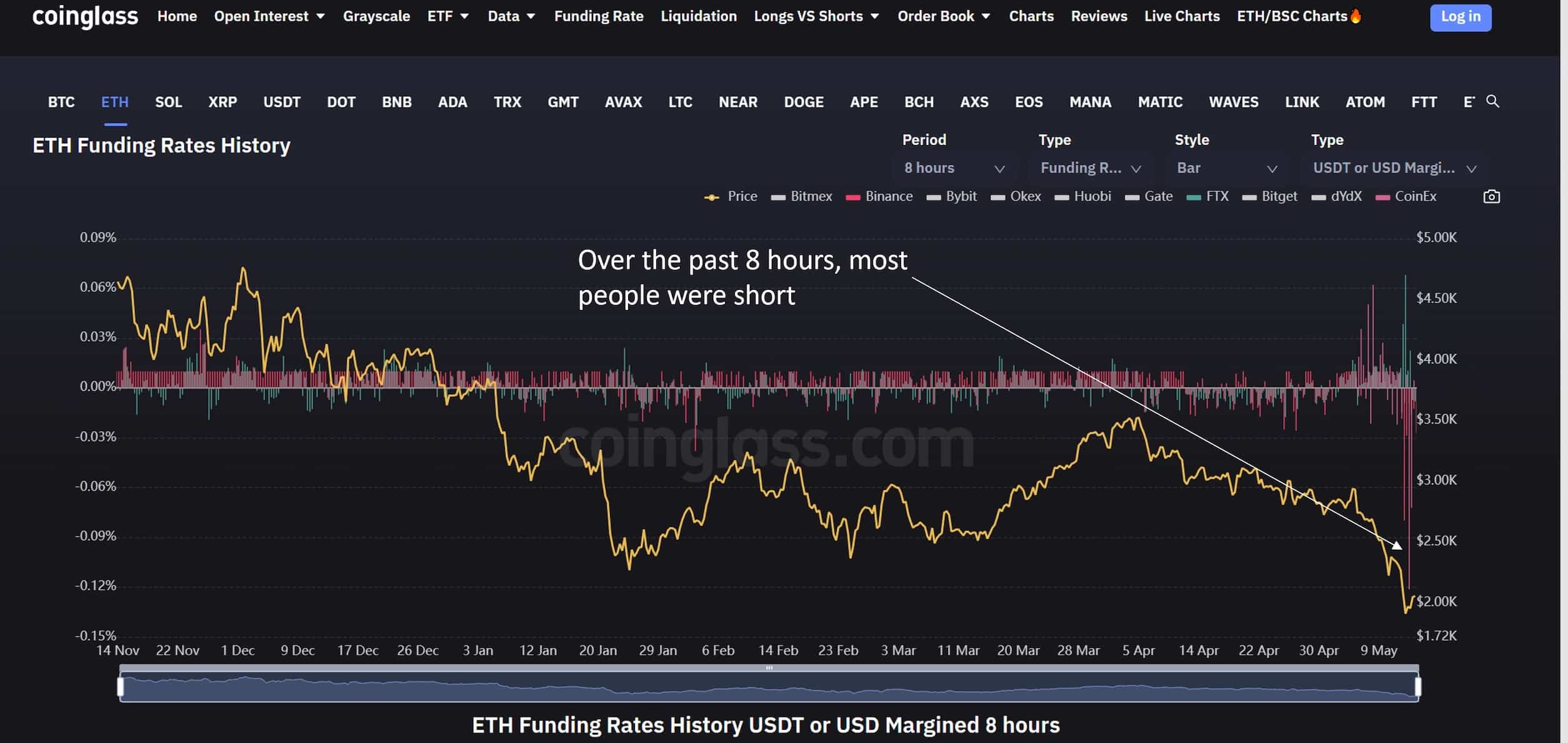

Santiment, an on-chain information supplier, provides us an perception into what Ethereum’s subsequent worth motion is likely to be (ETH). On an 8-hour chart, giant shorts for Ethereum at $2,000 have constructed up, based on the info supplier.

However, based on Santiment, this usually doesn’t work out with the shorter, and a brief squeeze is more likely to ensue. As a outcome, the value of Ethereum could rise once more.

Data exhibits funding charges historical past. Source: Santiment

The ETH change provide is one other merchandise to think about. Santiment observes:

“While we saw a nice drop in supply on exchanges for the past year or so, May 1st 2022 saw a huge increase in supply on exchanges as folks rushed to exit their positions, which is clearly reflected on the price itself.”

As a outcome, any future enhance within the change provide will trigger one other decline. This signifies that buyers are panicked and have given up completely. Although the state of affairs seems to be dire, this can be a wonderful time to fill new roles.

Related studying | Ethereum Hashrate Breaks All-Time High, Will Price Follow?

Featured picture from iStockPhoto, Charts from TradingView.com

[ad_2]

Source link