[ad_1]

Bitcoin has been slowing down on its bullish momentum over right this moment’s buying and selling session, however the crypto market continues to push to the upside. BTC’s value nonetheless information income within the final 24 hours and seven days with a 3% and three.3% respectively.

Related Reading | Bitcoin Breaks Above Realized Price Again, Bottom Finally In?

The cryptocurrency was in all probability affected by a decline within the legacy market. For the previous months, Bitcoin has displayed a excessive correlation with the S&P 500 and the Nasdaq 100.

The S&P 500 was seeing vital good points because the begin of July 2022 after a significant bearish value motion took it from round 4,800 to its present ranges at round 3,800. In the previous week, the index took a bearish flip which appears to be contributing to BTC’s value incapacity to interrupt resistance at $22,000.

On the opposite hand, the crypto market has been seeing optimistic developments. The second crypto by market cap Ethereum has a date for its extremely anticipated occasion, “The Merge”, traders have absorbed the promoting stress with out BTC’s value shedding its 2017 all-time excessive in excessive timeframes, there may be far much less leverage within the crypto market.

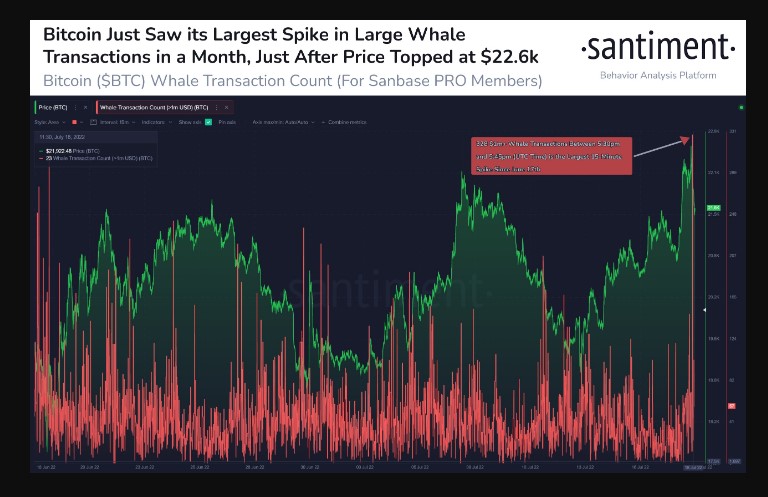

In addition, analysis agency Santiment information a rise in Bitcoin whales’ exercise. These giant traders have been triggering community exercise as they appear to build up BTC at its present ranges. On right this moment’s value motion, Santiment said the next whereas sharing the chart under:

About three hours in the past, the quantity of #Bitcoin transactions valued at over $1m spiked to its highest worth in over a month. Whale strikes are busy right this moment, and spikes comparable to this one can typically be a precursor to cost route shifts.

As NewsBTC reported, BTC whales have been extra lively appears BTC dropped to its present ranges. Addressees with over 10,000 BTC added 30,000 to their holdings.

Bitcoin Network Activity Needs More Fuel

Data from Mempool.Space signifies that a rise in Bitcoin community exercise has led to main rallies. This exercise is measured by transaction charges, and the way a lot customers are paying for sending a BTC transaction.

This metric trended to the draw back since mid-2021 however has begun displaying potential indicators of recovering over the previous month. Bitcoin transaction fees have been on the rise during the last 30 days doubtlessly hinting at extra community exercise and rising the change of future appreciation.

Related Reading | Liquidations Cross $230 Million As Ethereum Barrels Past $1,400

However, community exercise remains to be low in larger timeframes. Additional knowledge from analyst Ali Martinez information a decline within the variety of new BTC addresses. This metric stands at an 11-month low with a pointy improve within the BTC provide despatched to crypto exchanges. This typically interprets into promoting stress. The analyst said:

Generally, a gradual decline within the variety of new addresses created on a given blockchain results in decrease costs over time.

#Bitcoin | Nearly 32,000 $BTC, value roughly $672 million, have been despatched to recognized #crypto alternate wallets over the previous 4 days. pic.twitter.com/lXcKetuRLK

— Ali Martinez (@ali_charts) July 18, 2022

[ad_2]

Source link