[ad_1]

Bitcoin has been unable to interrupt above key resistance ranges at round $23,000. As a consequence, the cryptocurrency has been shifting sideways over the previous two days whereas preserving a few of its good points over the previous week.

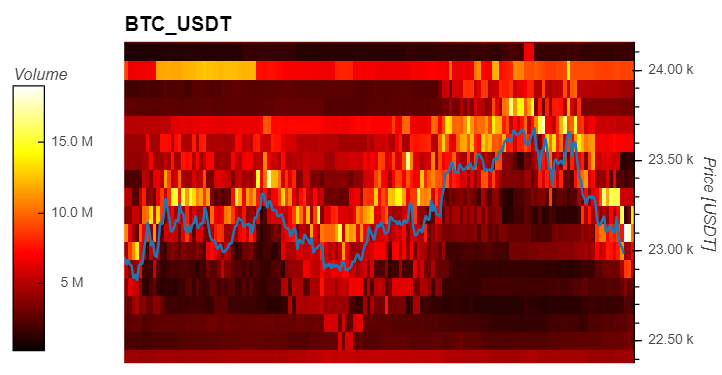

The slowdown in bullish momentum coincides with a rise in asks (promote orders) liquidity for BTC’s value above its present ranges and a spike in BTC’s provide inflows on crypto trade platforms. On quick timeframes, there are over $70 million in promote orders for Bitcoin from $23,000 to $24,000.

Related Reading | Crypto Market On The Mend: ApeCoin And Curve DAO Show Gains

These ranges appear poised to proceed working as resistance whereas the value of Bitcoin continues to push to the upside. BTC’s value has been tapping into the rapid zone at $23,100, however knowledge from Material Indicators information $18 million in promoting orders at this degree alone.

As seen under, BTC’s value is seeing much less liquidity under its present ranges with huge liquidity gaps at key ranges. This might trace at excessive volatility to the draw back if BTC continues to lose momentum and might’t break above $24,000 within the quick time period.

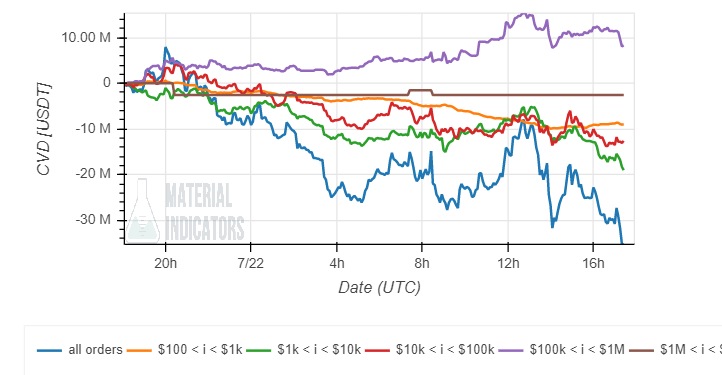

In addition, Material Indicators information a rise in promoting strain from traders with promote orders above $100,000. These traders had been accumulating BTC over the previous week exercising a whole lot of affect on the value motion.

As the chart under exhibits, these traders (in purple under) have begun promoting into the present value motion. In this timeframes, it appears too early to conclude if this development will proceed and if it’ll have a damaging impression on BTC’s value.

Analyst Ali Martinez concurred with the information proven above. Via Twitter, Martinez confirmed knowledge on the spike in promoting strain from BTC whales and miners with a decline within the variety of addresses with over 1,000 BTC and a 1% decline within the Bitcoin held by addresses related to miners.

Bitcoin Supply On Exchanges Rises, Hints At Further Weakness?

Further knowledge offered by Ali Martinez information a rise within the Bitcoin held by crypto trade platforms. This metric is taken into account bearish as these BTCs are sometimes unloaded into the market.

Related Reading | Ethereum Shows Signs Of Exhaustion, But Could It Still Touch $1,700?

Since July 12, the analyst mentioned, there was a spike of 27,000 BTC or $621 million despatched to those venues. Martinez commented the next on these metrics:

The enhance in open curiosity mixed with a decline in community development and rising promoting strain from whales and miners means that the latest Bitcoin value motion is pushed by leverage. These community dynamics enhance the likelihood of a steep correction.

[ad_2]

Source link