[ad_1]

The Bitcoin long-term holder SOPR might recommend that the crypto has nonetheless solely gone one-third of the best way by the newest bear market.

Bitcoin 20-day SMA Long-Term Holder SOPR Has Only Been 86 Days Into Bottoming Zone

As identified by an analyst in a CryptoQuant post, the crypto remains to be solely 1/3rd of the best way into the 260 days common historic bottoming interval.

The related indicator right here is the “Spent Output Profit Ratio” (or SOPR in short), which tells us about whether or not the typical Bitcoin investor is promoting at a revenue or at a loss proper now.

The metric works by trying on the historical past of every coin being offered on the chain to see what worth it was final moved at. If this earlier promoting worth was lower than the newest BTC worth, then the coin has simply been offered at a revenue. While if the final worth was greater than the present one, then that individual coin realized some loss.

When the worth of the SOPR is larger than one, it means the market as an entire is promoting at a revenue proper now.

On the opposite hand, the indicator being lower than one implies the typical holder is transferring cash at a loss in the meanwhile.

The “long-term holders” (LTHs) is the Bitcoin cohort that features all traders who’ve held onto their cash for not less than 155 days with out promoting or transferring them.

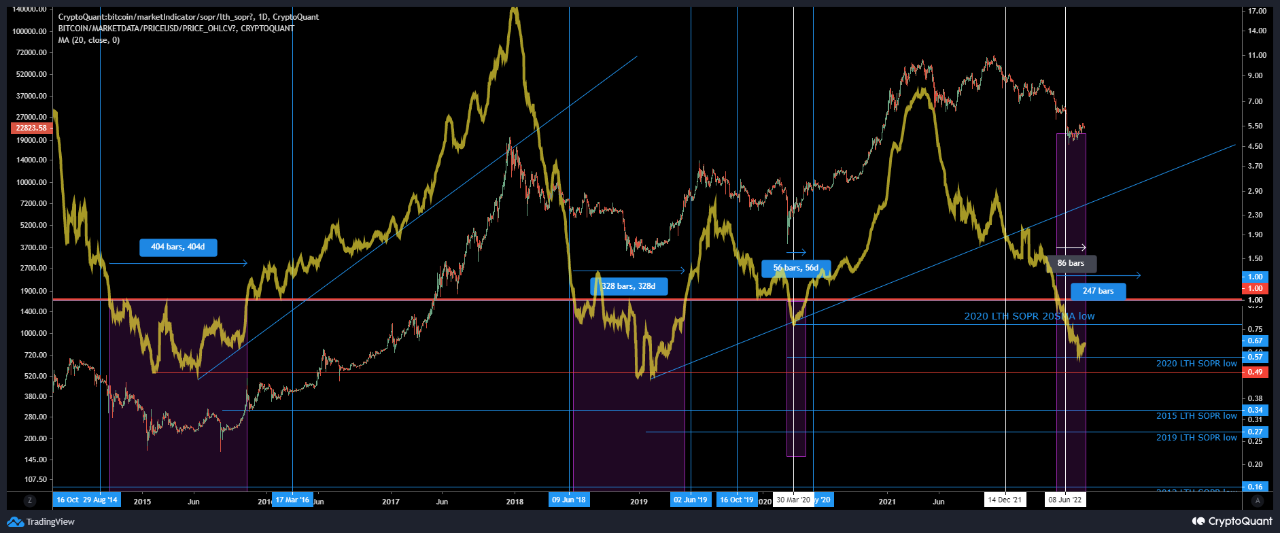

Now, here’s a chart that reveals the pattern within the BTC SOPR (20-day MA) particularly for these LTHs over the the final a number of years:

Looks like the worth of the metric has been fairly low lately | Source: CryptoQuant

As you may see within the above graph, the Bitcoin LTH SOPR (20-day SMA) dipped under the “one” mark some time again.

Also, within the chart the quant has marked all of the related zones of pattern for the indicator in relation to the bear market.

It looks as if historic bottoming durations have lasted at any time when the metric has been caught under the breakeven level.

On common, previous bear markets have lasted round 260 days primarily based on the LTH SOPR. In the present cycle, the coin has to this point been 86 days into the bottoming zone.

This would recommend that if Bitcoin ends this bear market in about the identical time as the typical, then the crypto remains to be solely one-third of the best way by.

BTC Price

At the time of writing, Bitcoin’s price floats round $23k, down 2% within the final week. Over the previous month, the coin has gained 13% in worth.

The worth of the crypto appears to have been transferring sideways throughout the previous couple of days | Source: BTCUSD on TradingView

Featured picture from mana5280 on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link