[ad_1]

Data reveals a considerable amount of leverage has been piling up within the Ethereum futures market as the value of the crypto breaks above $2k.

Ethereum Open Interest Surges To Highest Value In Last 4 Months

As identified by an analyst in a CryptoQuant post, the ETH futures market has seen the leverage sharply going up not too long ago.

The “open interest” is an indicator that measures the entire variety of Ethereum futures contracts at present open in all derivatives exchanges.

When the worth of this metric rises up, it means traders are opening up extra positions in the marketplace proper now. Since extra futures positions indicate that leverage can be going up available in the market, such a development can result in larger volatility within the value of the coin.

On the opposite hand, reducing values of the indicator counsel holders are closing up their positions in the mean time. This sort of development may end up in a much less risky worth of ETH.

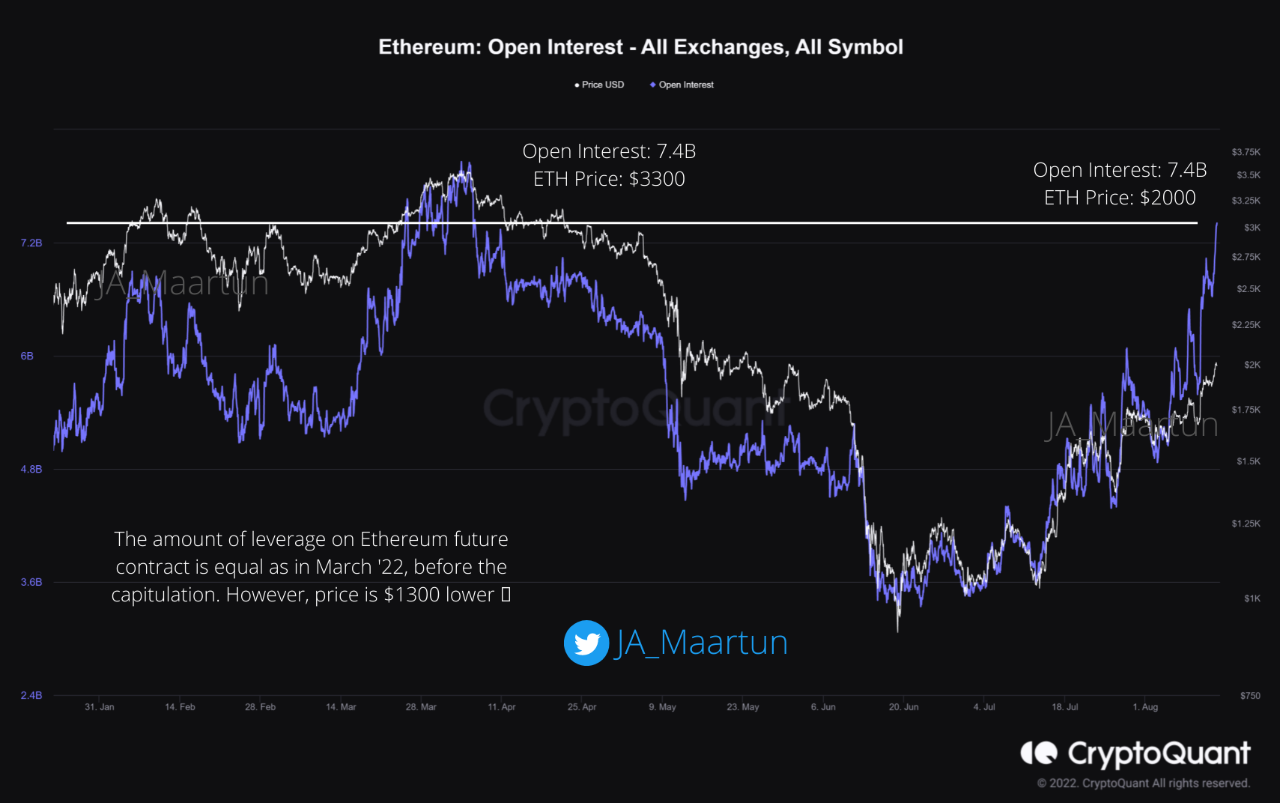

Now, here’s a chart that reveals the development within the Ethereum open curiosity over the course of 2022 up to now:

Looks like the worth of the metric has shot up in latest days | Source: CryptoQuant

As you’ll be able to see within the above graph, the Ethereum open curiosity has noticed some sharp uptrend throughout the previous couple of weeks.

The indicator has now reached a worth of seven.4 billion, the best it has seen over the past 4 months. However, there may be an fascinating comparability right here.

Around 4 months in the past, when such values had been beforehand noticed, the value of ETH was about $3.3k. But in the present day the value is simply $2k, round $1.3k lower than it was again then.

And but, the open curiosity is on the identical degree, that means the Ethereum market could be having the identical diploma of leverage this time as properly, whereas the value is way decrease.

When particularly excessive leverage accumulates within the futures market, any sharp swing within the value can liquidate a lot of positions without delay. These liquidations then additional amplify this value transfer, which liquidates extra positions.

In this fashion, liquidations can cascade collectively, and the occasion is named a “liquidation squeeze.” This is the explanation behind the volatility of an overleveraged market.

If a protracted squeeze does find yourself going down this time, then the most recent rally within the worth of ETH could hit the breaks.

ETH Price

At the time of writing, Ethereum’s price floats round $1.9k, up 5% prior to now week.

The worth of ETH appears to have gone up throughout the previous couple of days | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link