[ad_1]

Data exhibits the Bitcoin aSOPR has not too long ago been rejected from the impartial stage as weak spot continues to clutch the market.

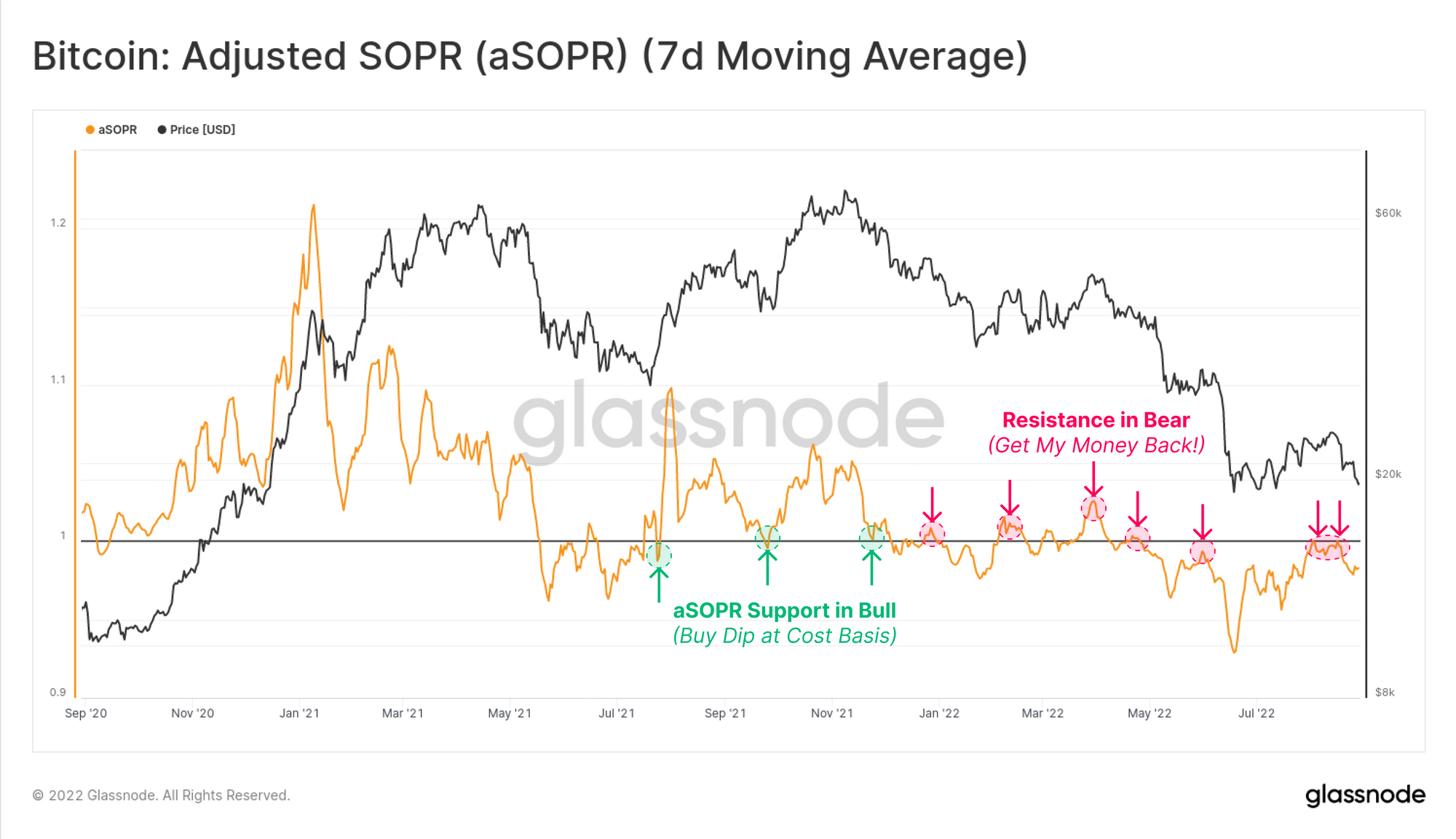

Bitcoin aSOPR Rebounds From The “1” Mark As Investors Sell The Rally

As per the most recent weekly report from Glassnode, the “get my money back” impact strikes the crypto as soon as once more as weak spot continues available in the market.

The “Spent Output Profit Ratio” (or SOPR in brief) is an indicator that tells us whether or not the general Bitcoin market is at present promoting at a revenue or at a loss.

When the worth of this metric is larger than one, it means the typical investor is promoting BTC at a revenue proper now.

On the opposite hand, the indicator’s worth being beneath the mark implies the market as a complete is realizing some loss in the meanwhile.

A modified model of the SOPR is the “Adjusted SOPR” (aSOPR), which filters out transactions of all these cash that moved once more inside an hour of being final transferred. This helps take away noise that doesn’t have any noticeable impacts available on the market.

Now, here’s a chart that exhibits the pattern within the Bitcoin aSOPR over the previous couple of years:

Looks like the worth of the metric has gone down in latest days | Source: Glassnode's The Week Onchain - Week 35, 2022

As you possibly can see within the above graph, the Bitcoin aSOPR appears to have adopted particular patterns throughout totally different phases of the market.

It looks like throughout bull markets the “aSOPR=1” line has often acted as help, whereas the extent has offered resistance throughout bear markets.

The cause behind this pattern is that the “1” worth represents the breakeven level for the market as at this level buyers are promoting neither at revenue nor at loss.

During bulls, when the metric reaches this level buyers begin “buying the dip” as they see worth in accumulating extra round their price foundation.

However, in bear durations, buyers reasonably favor to promote any rally as quickly as the worth will get again round their price foundation since holders see the breakeven mark as “getting their money back” (after dropping it to bear losses initially).

Most not too long ago, the Bitcoin aSOPR has as soon as once more failed a retest of this line, and rebounded again down. This exhibits that there’s nonetheless weak spot current available in the market and the bear continues.

BTC Price

At the time of writing, Bitcoin’s price floats round $20.3k, down 5% prior to now week.

BTC has noticed some uplift over the last day or so | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link