[ad_1]

Bitcoin is trending sideways into the lengthy U.S. weekend with the value of BTC compressing round $19,500 and $20,500. The help across the decrease zone of this vary may be examined because the primary cryptocurrency struggles to protect its present ranges.

At the time of writing, Bitcoin (BTC) trades at $19,900 with a 1.4% revenue over the previous 7 days and sideways value motion within the final 24 hours. BTC’s value is closely underperforming different cryptocurrencies as Ethereum (11%), Cardano (14%), and Polkadot (10%), recorded vital earnings over the identical interval.

Data from Material Indicators hints at a possible native prime for Bitcoin on low timeframes as ask (promote) liquidity will get thicker round its quick ranges. Selling orders have swelled over the previous week as Bitcoin trades sideways and would possibly function as resistance stopping BTC to reclaim the realm north of $20,000.

As seen within the chart under, as ask liquidity will increase, bid (purchase) orders fade round $19,500 contributing to the weakening of this key stage, on low timeframes. The subsequent quick help is $19,000 which at the moment holds round $15 million in purchase orders.

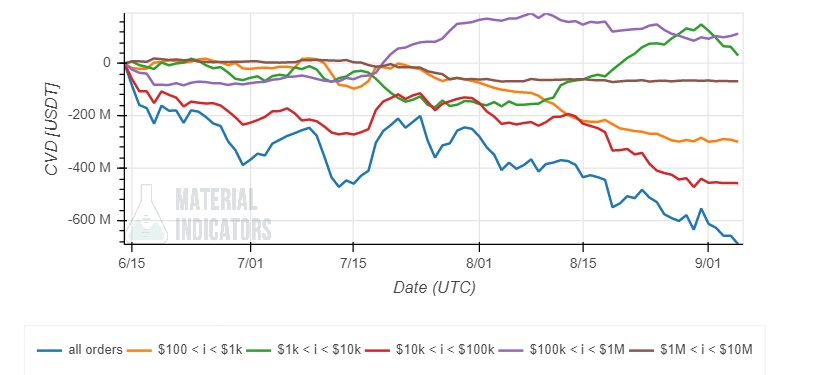

The spike in ask liquidity correlates with a rise in promoting strain from small buyers to Bitcoin whales. As the value of Bitcoin trended to the upside in August, bigger gamers took benefit of the reduction and “dumped” into the market.

Smaller buyers adopted, however with a slower response. Bitcoin whales have remained flat with bid orders of round $100,000 displaying a small uptick.

Additional information from a latest Glassnode report coincides with Material Indicators, Bitcoin whales have been promoting their cash as the value of Bitcoin developments to the upside. This is part of a second distribution section expertise by the crypto market following a capitulation occasion. Glassnode noted:

Following months of accumulation, the market managed to rally above $24k, nonetheless as coated in WoC 34 and WoC 35, this chance for exit liquidity was taken by way of distribution, and revenue taking.

Can Bitcoin Reclaim $20,000 In The Short Term?

The key space of resistance is $24,000, as talked about above, and $24,500 as whales with over 10,000 BTC are utilizing this zone to “aggressively distribute coins into the range”, the report famous. Bulls should push above these ranges to forestall additional draw back and presumably regain a few of the bullish momentum.

As a pseudonym customers have been noticing, that brief positions have been piling up as Bitcoin strikes round help between $19,500. Over the previous week, the market has liquidated thousands and thousands from wiped-out shorts as BTC’s value developments nearer to $20,000.

This would possibly present the market with sufficient ammunition for a brief squeeze above $20,000 and into the areas of vital resistance.

It took solely a 2% pump for $200 mil in shorts on Binance to fold.

What in tarnation are these guys doing. pic.twitter.com/Zn4g6qvBpm

— Byzantine General (@ByzGeneral) September 5, 2022

[ad_2]

Source link