[ad_1]

On-chain knowledge exhibits the Bitcoin leverage ratio has surged as much as a brand new all-time excessive, suggesting the market may very well be heading in direction of excessive volatility.

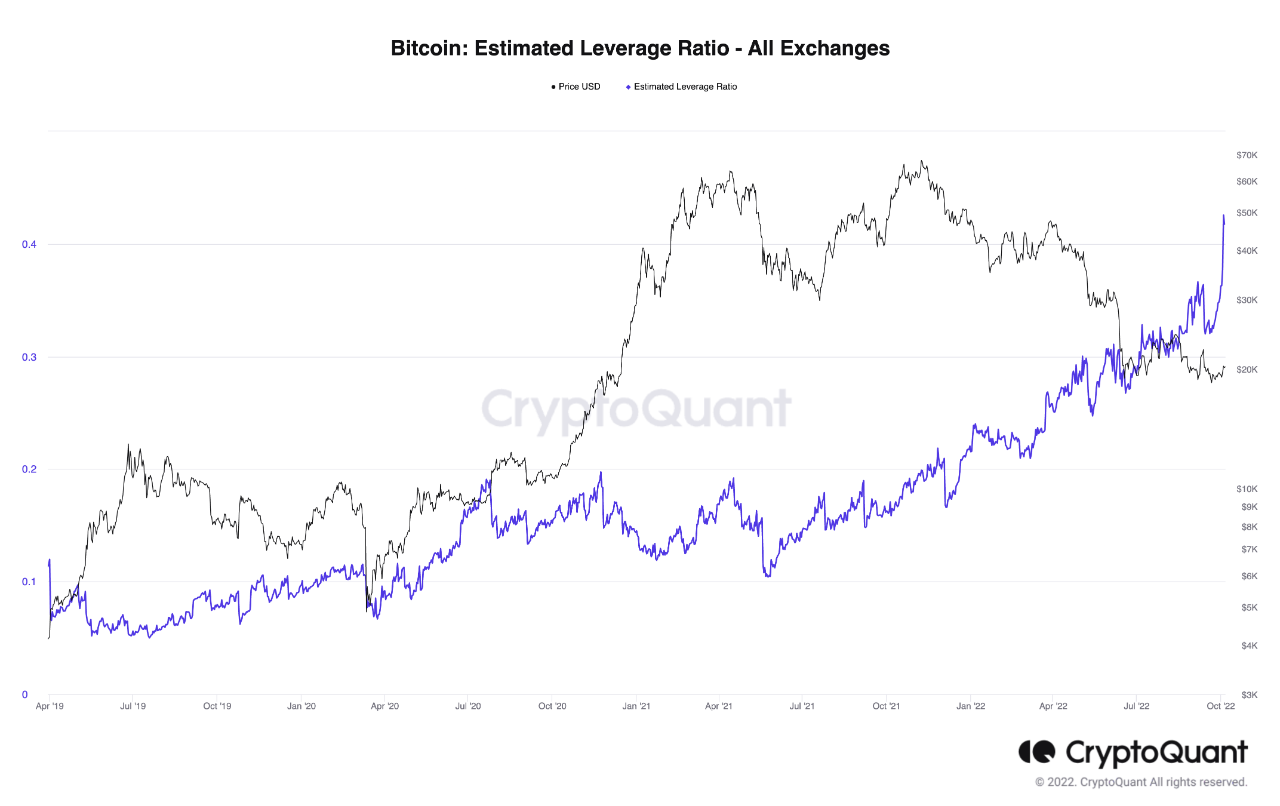

Bitcoin All Exchanges Estimated Leverage Ratio Sets New ATH

As identified by a CryptoQuant post, the funding price has remained impartial whereas the leverage has elevated available in the market.

The “all exchanges estimated leverage ratio” is an indicator that measures the ratio between the Bitcoin open curiosity and the derivative exchange reserve.

What this metric tells us is the typical quantity of leverage at the moment being utilized by buyers within the BTC futures market.

When the worth of this indicator is excessive, it means customers are taking a number of leverage proper now. Historically, such values have led to increased volatility within the worth of the crypto.

On the opposite hand, the worth of the metric being low suggests buyers aren’t taking excessive threat in the mean time, as they haven’t used a lot leverage.

Now, here’s a chart that exhibits the development within the Bitcoin leverage ratio over the previous few years:

Looks like the worth of the metric has been rising up throughout the previous few months | Source: CryptoQuant

As you possibly can see within the above graph, the Bitcoin estimated leverage ratio has shot up not too long ago and has attained a brand new ATH. This signifies that buyers are taking a excessive quantity of leverage on common.

The purpose overleveraged markets have often turned extremely risky up to now lies in the truth that such circumstances result in mass liquidations turning into extra possible.

Any sudden swings within the worth during times of excessive leverage can result in a number of contracts getting liquidated directly. But it doesn’t finish there; these liquidations additional amplify the value transfer that created them, and therefore trigger much more liquidations.

Liquidations cascading collectively in such a approach is named a “squeeze.” Such occasions can contain both longs or shorts.

The Bitcoin funding charges (the periodic price exchanged between lengthy and brief merchants) can provide us an concept about which course a potential squeeze could go in.

CryptoQuant notes that this metric has a impartial worth at the moment, implying the market is equally divided between shorts and longs. As such, it’s onerous to say something in regards to the course a potential squeeze within the close to future would possibly lean in direction of.

The Bitcoin volatility has in reality been very low in current weeks, however with such excessive accumulation of leverage, it could be a matter of time earlier than a risky worth takes over.

BTC Price

At the time of writing, Bitcoin’s worth floats round $19.6k, up 2% up to now week.

The BTC worth continues to development sideways | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link