[ad_1]

Data reveals whereas Bitcoin has been correlated with the US inventory marketplace for a while now, the 2 haven’t moved in tandem lately.

Bitcoin Correlation With US Stocks May Be Weakening As BTC Has Been Moving Differently

As identified by an analyst in a CryptoQuant post, BTC has gone down previously week whereas shares have made some positive aspects.

A “correlation” between two belongings (or markets) exists when each their costs observe the identical common pattern over a time frame.

For Bitcoin, there was a robust correlation with the US inventory market over the last couple of years or so. The motive behind the markets changing into so tied is the rise of institutional buyers within the crypto.

Such buyers view BTC as a danger asset and pull out of the coin as quickly as there may be macro uncertainty looming over the market (therefore driving the crypto’s worth down together with the shares).

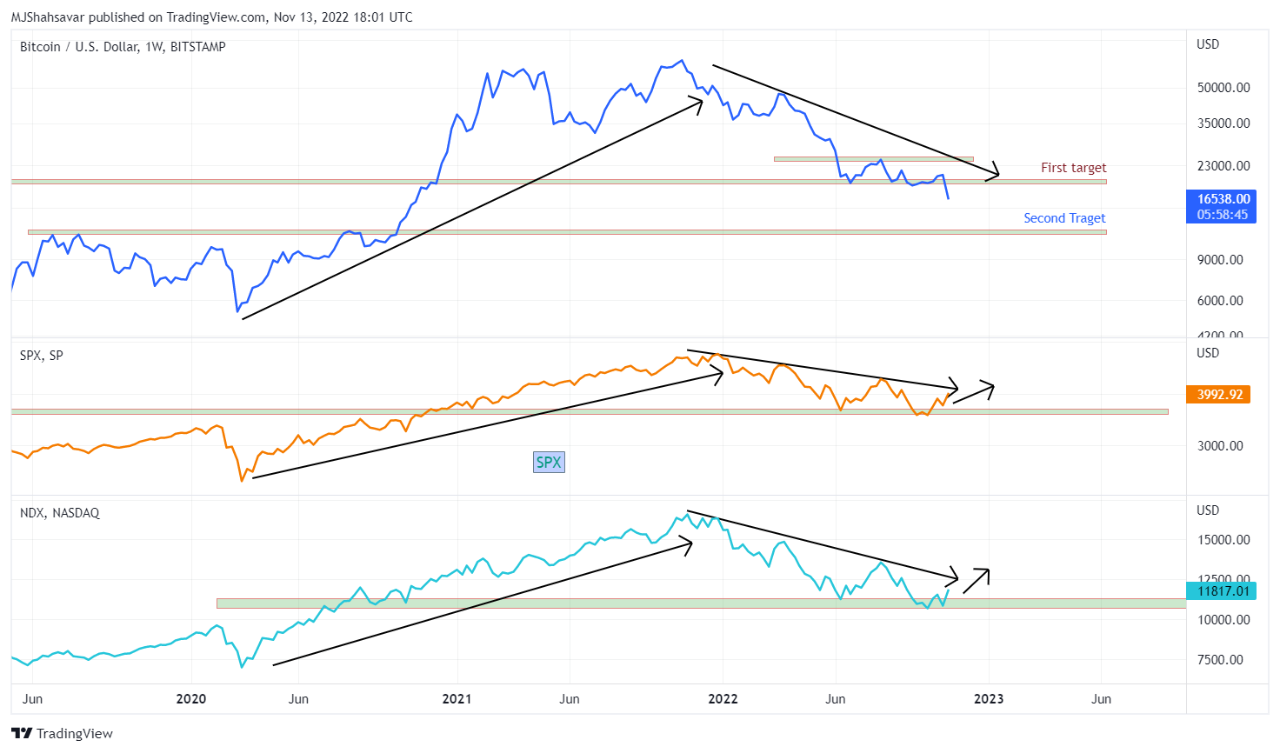

Here is a chart that reveals the costs of Bitcoin, S&P 500, and NASDAQ over the previous few years:

Looks just like the belongings have adopted related tendencies in current occasions | Source: CryptoQuant

As you possibly can see within the above graph, Bitcoin wasn’t correlated with the inventory market in 2019 and early 2020, nevertheless it all modified when COVID struck.

After the black swan crash that occurred in March 2020, the worth of BTC began following S&P 500 and NASDAQ.

Though, whereas BTC confirmed a similar common long-term pattern, the crypto continued to be rather more extremely risky than the shares.

The correlation has continued by means of the bear market, however the final week or so has turned out totally different.

While the US stock market has seen some uplift previously 7 days, Bitcoin has as an alternative taken a pointy plummet.

These markets exhibiting totally different conduct lately might counsel the correlation between them could also be decreasing.

With the most recent plunge, BTC has additionally misplaced the assist line of the earlier all-time excessive, one thing that has by no means occurred within the earlier cycles.

The quant within the submit notes that this current pattern is an indication of weak point within the crypto market, which might result in additional downtrend within the close to future.

BTC Price

At the time of writing, Bitcoin’s worth floats round $16.5k, down 20% within the final week. Over the previous month, the crypto has misplaced 15% in worth.

The beneath chart reveals the pattern within the worth of the coin over the past 5 days.

The worth of the crypto appears to have remained beneath $17k in current days | Source: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link