[ad_1]

BeInCrypto seems at 5 altcoins that decreased the most from the total crypto market final week, particularly from Dec. 23 – 30.

These digital property have taken the crypto information and crypto market highlight:

- Chain (XCN) price has decreased by 33.83%

- Solana (SOL) price has decreased by 22.87%

- Aptos (APT) price has decreased by 15.36%

- Axie Infinity (AXS) price has decreased by 15.00%

- The Sandbox (SAND) price has decreased by 14.68%

XCN is The Worst Performing Altcoin

The XCN value has fallen beneath a descending resistance line since Sept. 27. The line precipitated a rejection on Nov. 1 (pink icon) resulting in the acceleration of the downward motion. This led to a brand new all-time low of $0.011 on Dec. 30.

There aren’t any reversal indicators in place. As a outcome, the downward motion will doubtless proceed. Reclaiming the $0.035 resistance space would point out {that a} bullish reversal has begun as a substitute.

SOL Breaks Below Crucial Support

The SOL price broke down from the $30 horizontal assist space throughout the first week of November. The downward motion has been swift, resulting in a low of $8 on Dec. 30.

If the downward motion continues, the subsequent closest assist space is at $4.20, a 55% drop from the present value.

The weekly RSI has simply dropped beneath 25 and has not generated any bullish divergence. This means that the development remains to be bearish and makes the continuation of the downward motion doubtless.

The SOL value has to reclaim the $30 space in order for the development to be thought-about bullish.

APT Resumes Downward Movement

The APT value has fallen beneath a descending resistance line since Oct. 23. More not too long ago, the line precipitated a rejection on Dec. 16 (pink icon) and broke down from the $3.95 assist space the subsequent day. This is a vital growth since the space had been in place since Nov. 8.

Similarly to SOL, the RSI fell beneath 30 and has not generated any bullish divergence.

If the downward motion continues, the closest assist space could be at $2.22, created by the 1.61 exterior Fib retracement of the most up-to-date bounce.

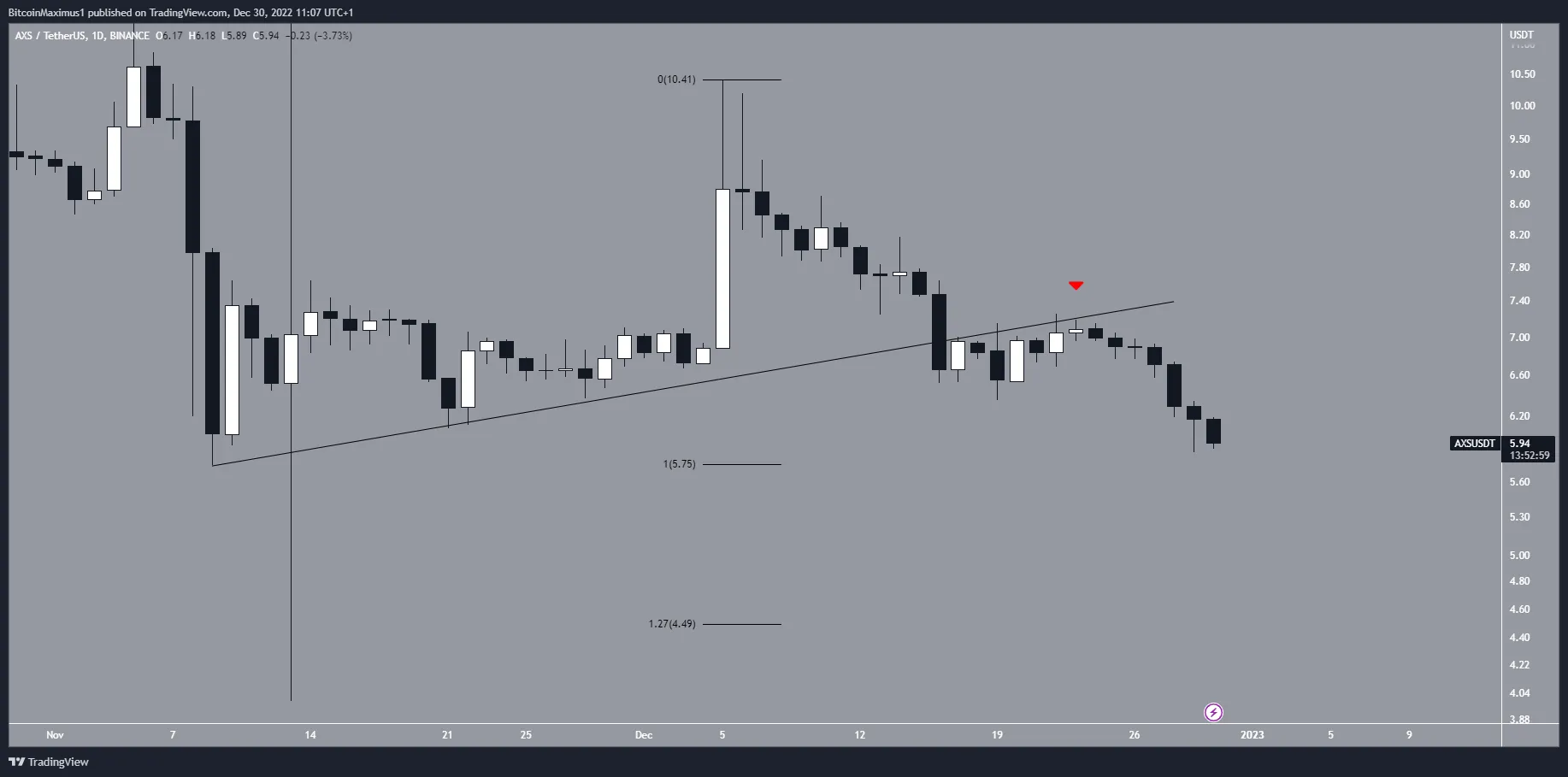

AXS Breaks Down From Ascending Support

The AXS value had elevated alongside an ascending assist line since Nov. 9. This upward motion led to a excessive of $10.40 on Dec. 5. However, the value has fallen since and broke down from the ascending assist line on Dec. 16.

After validating it as resistance on Dec. 22 (pink icon), the AXS value resumed its downward motion and is near a brand new yearly low. If the lower continues, the closest assist space could be at $4.50, created by the 1.61 exterior Fib retracement of the most up-to-date bounce.

Reclaiming the ascending assist line would imply that the development is bullish.

SAND Altcoin Could Fall by 45%

The SAND value has fallen beneath a descending resistance line since reaching an all-time excessive of $7.94 in Nov. 2021. The line precipitated a rejection in the first week of November (pink icon), breaking down from the $0.80 horizontal assist space in the course of. This led to a low of $0.38 on Dec. 29.

If the downward motion continues, the closest assist space could be at $0.21, a drop of 46% from the present value.

On the different hand, reclaiming the $0.80 resistance space would imply that the development is bullish as a substitute.

For BeInCrypto’s newest crypto market evaluation, click here.

Disclaimer

BeInCrypto strives to offer correct and up-to-date info, however it won’t be liable for any lacking info or inaccurate info. You comply and perceive that it is best to use any of this info at your individual threat. Cryptocurrencies are extremely unstable monetary property, so analysis and make your individual monetary choices.

[ad_2]

Source link