[ad_1]

Data reveals the Bitcoin spot buying and selling quantity has barely gone up after the rally however continues to be considerably decrease than the typical for the 2nd half of 2022.

Bitcoin Spot Trading Volume Has Gone Up A Bit This Week

As per the most recent weekly report from Arcane Research, there was low speculative exercise within the BTC market lately. The “trading volume” is an indicator that measures the whole quantity of Bitcoin being transacted on the Bitwise 10 exchanges on any given day.

While the amount on the Bitwise 10 exchanges is actually not all of the exercise there’s in your complete BTC market, the rationale why they’ve been chosen is that their information is probably the most dependable obtainable out of all of the platforms, and their volumes nonetheless present an honest approximation for what the pattern within the full sector seems like.

When the worth of the buying and selling quantity is excessive, it means numerous cash are being moved throughout these exchanges proper now. Such a pattern suggests merchants are lively within the Bitcoin market at the moment.

On the opposite hand, low values indicate not many traders are buying and selling the cryptocurrency. This sort of low exercise is usually a signal that the final curiosity within the coin is low in the meanwhile.

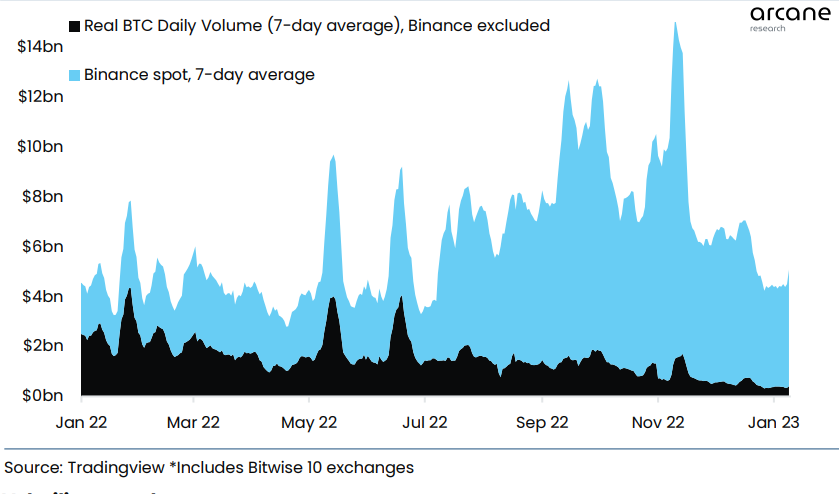

Now, here’s a chart that reveals the pattern within the 7-day common Bitcoin buying and selling quantity over the previous 12 months:

Looks just like the 7-day common worth of the metric hasn't been too excessive in current days | Source: Arcane Research's Ahead of the Curve - January 10

As displayed within the above graph, the Bitcoin 7-day buying and selling quantity lately slumped to low values because the crypto had been caught in infinite consolidation.

In the previous few days, nevertheless, the indicator has seen some development as the most recent rally within the value to $17,400 has barely renewed buying and selling curiosity within the coin.

Nevertheless, from the chart, it’s obvious that these present values are nonetheless considerably decrease than the typical noticed throughout the second half of final 12 months. This would recommend that not sufficient exercise has returned to the market but.

Usually, any rallies within the value require numerous merchants to be sustainable; there have been some cases prior to now the place a pointy value transfer wasn’t accompanied by a rise in buying and selling exercise, and so it wasn’t lengthy earlier than the motion misplaced momentum.

There hasn’t been any vital improve within the buying and selling quantity with the present rally, however the truth that there has nonetheless been an increase in any respect could also be a constructive signal for this transfer.

The report notes that one implication of the most recent low buying and selling volumes has been that the revenues of exchanges have taken a success. This has led to the crypto exchange Coinbase reducing round 950 positions, as announced yesterday.

BTC Price

At the time of writing, Bitcoin is buying and selling round $17,400, up 3% within the final week.

BTC appears to have noticed an uplift in the previous few days | Source: BTCUSD on TradingView

Featured picture from Traxer on Unsplash.com, charts from TradingView.com, Arcane Research

[ad_2]

Source link