[ad_1]

On-chain knowledge reveals the annual charge of change within the Bitcoin Puell Multiple has exited the bear market zone, an indication {that a} bull rally could also be right here.

Bitcoin Puell Multiple 365-Day Rate Of Change Has Shot Up

As identified by an analyst in a CryptoQuant post, this may very well be one of many first indications of the return of the bull market. The “Puell Multiple” is an indicator that measures the ratio between the day by day Bitcoin mining income (in USD) and the 365-day shifting common (MA) of the identical.

When the worth of this metric is larger than 1, miners are making extra revenue than the yearly common proper now. On the opposite hand, values under the brink indicate the revenues of those chain validators is lower than traditional.

As miner revenues shift, these holders grow to be kind of prone to promote BTC (relying on which means of the break-even mark the ratio has swung in), which is an element that may have an effect on the value of the crypto. Thus, when the Puell Multiple is larger than 1, BTC could also be thought-about overvalued, whereas being lesser than this worth may counsel the coin is undervalued.

The related indicator right here is just not the Puell Multiple itself however its charge of change (RoC). The RoC shows the pace at which any metric modifications its worth over an outlined interval.

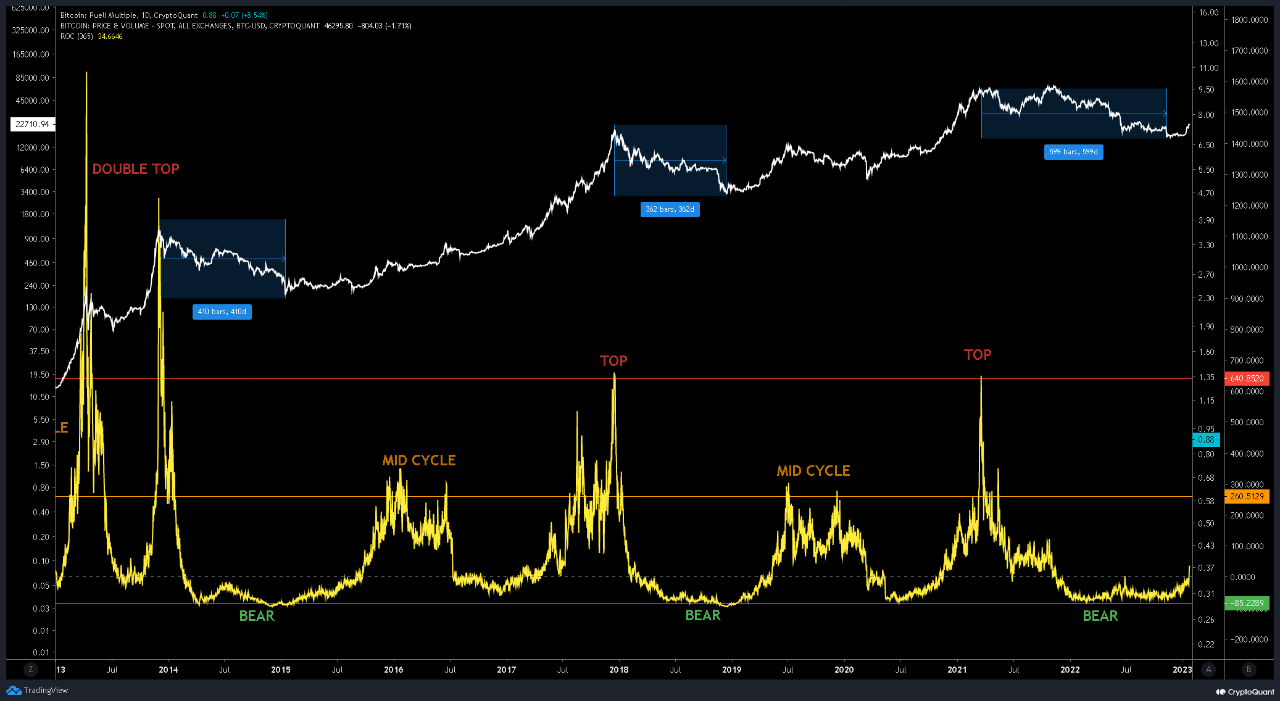

In explicit, the 365-day RoC of the Puell Multiple is of curiosity within the present dialogue. Here is a chart that reveals the pattern on this indicator over the course of the completely different Bitcoin cycles:

Looks like the worth of the metric has spiked in latest days | Source: CryptoQuant

In the above graph, the quant has marked the related zones for the Bitcoin Puell Multiple 365-day RoC. It looks as if tops have taken place within the crypto value every time the metric has touched the crimson line, whereas mid-cycle highs have been set across the orange line.

And it might seem that bear markets have lasted whereas the indicator has been across the inexperienced line. It additionally seems like transitions to and from bear markets have typically adopted the dotted line traditionally.

Recently, as Bitcoin has sharply rallied, miner revenues have additionally shot up, resulting in the Puell Multiple additionally observing an increase. As the chart shows, the 365-day RoC of the indicator has naturally seen some fast rise in latest days.

With this spike, the metric has lastly crossed above the dotted line, which may imply, if the previous sample is something to go by, that the bear market could also be coming to an finish, and the crypto may need began transitioning in direction of a bullish trend. The analyst notes, nevertheless, that it’ll nonetheless take some extra value motion earlier than this breakout could be totally confirmed.

BTC Price

At the time of writing, Bitcoin is buying and selling round $22,800, up 9% within the final week.

The worth of the crypto appears to have been shifting sideways in the previous few days | Source: BTCUSD on TradingView

Featured picture from Dylan Leagh on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link