[ad_1]

Bitcoin News: The present Bitcoin (BTC) rally might maybe have been a results of reduction from the macroeconomic state of affairs and resistance to the shock occasions in crypto market in 2022. However, a gentle development for the reason that starting of January 2023 raised hopes of a protracted rally, marking an finish to the painful crypto winter of 2022. Despite the bullish environment, the highest cryptocurrency is at the moment under the important thing indicator of 200 day weekly shifting common (WMA). An vital commentary from on chain information might reply the rationale behind this habits in BTC.

Also Read: Solana ($SOL) Soars As Helium Sets Migration Date; Here’s More

The 200 WMA is essential for merchants because the indicator is mostly an indication of change in route for the asset. When there’s a clear sign from this indicator, it’s believed that there will likely be a long run change. This habits of BTC buying and selling under the 200 WMA was noticed very often all through 2022.

Bitcoin Active Addresses

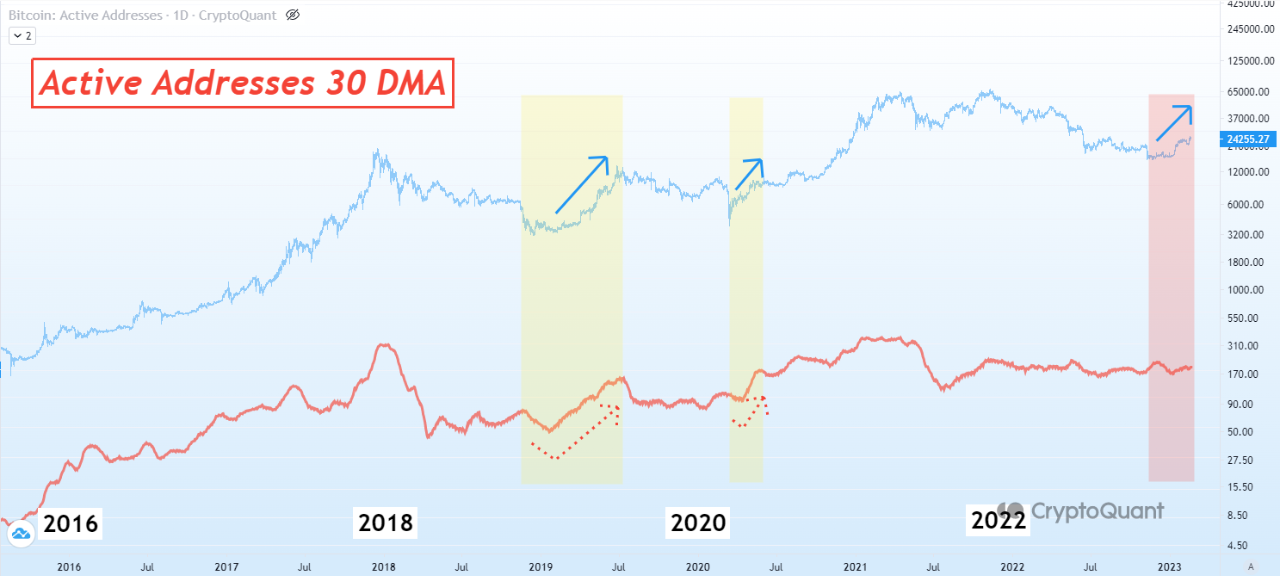

In what could possibly be an indication of lack of power for subsequent Bitcoin bull sample, on chain information reveals an attention-grabbing comparability from earlier BTC breakouts. Unlike the start of earlier bull cycles, the present cycle doesn’t even have sufficient energetic addresses primarily based on 30 day shifting common, or an increase in them, to justify a value motion in upward curve. As per Crypto Quant data, there isn’t a actual development within the variety of energetic Bitcoin addresses.

Currently, the BTC value is fluctuating across the $25,000 milestone however nonetheless fails to rise above the 200WMA. As of writing, BTC value stands at $24,783, down 1.09% within the final 24 hours, in keeping with CoinGape price tracker.

The introduced content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link