[ad_1]

Key Takeaways

- Crypto volatility is back up to ranges final seen when FTX collapsed in November

- $791 million of liquidations rocked traders between Thursday and Sunday

- $383 million of longs had been liquidated on Thursday and Friday, the most important 48-hour quantity of the 12 months

- News that deposits will likely be made complete at SVB propelled the market upwards late on Sunday, with $150 million of quick sellers liquidated as Bitcoin retook $22,000

- Despite Fed transfer stablising costs and 2023 exhibiting a bounceback, the long-term implications for the crypto market are detrimental right here and will concern traders

For as soon as, it’s not crypto doing the collapsing. Trad-fi was feeling unnoticed of the occasion, evidently, as the banking sector wobbled in an enormous means this weekend.

Silicon Valley Bank (SVB) isn’t any extra, in what quantities to the most important collapse of a US financial institution since 2008, when Lehman Brothers pulled its greatest Satoshi Nakamoto impression and disappeared into the ether (pun not meant).

While the drama might have centred in trad-fi, crypto bounced round aggressively over the weekend as a range of knock-on results rumbled. SVB was a crypto-friendly financial institution, as was Silvergate, which was introduced to even be winding down final night time.

This, as effectively as the truth that the whole monetary markets wobbled, meant crypto confronted a storm. We have dug into some of the actions right here at https://coinjournal.net/ to sum up the carnage.

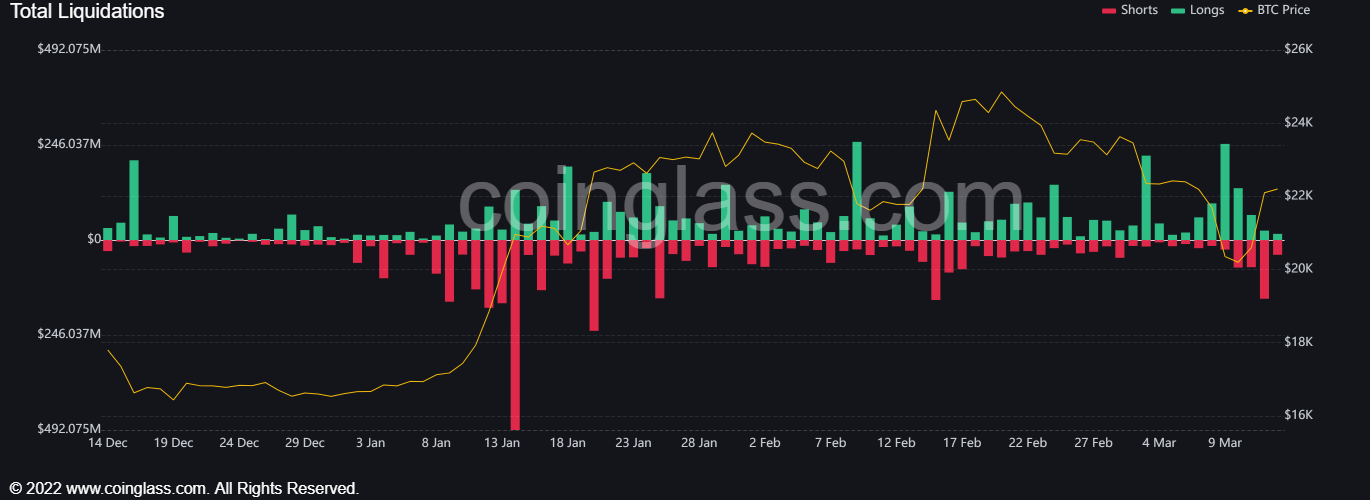

Liquidations

With violent worth swings, liquidations had been inevitable. Longs received caught out badly on Thursday and Friday, as the Bitcoin price fell south of $20,000.

There had been $249 million of lengthy liquidations throughout exchanges on Thursday, with Friday bringing an extra $134 million. The $383 million of lengthy liquidations was essentially the most in any 48 hour interval this 12 months.

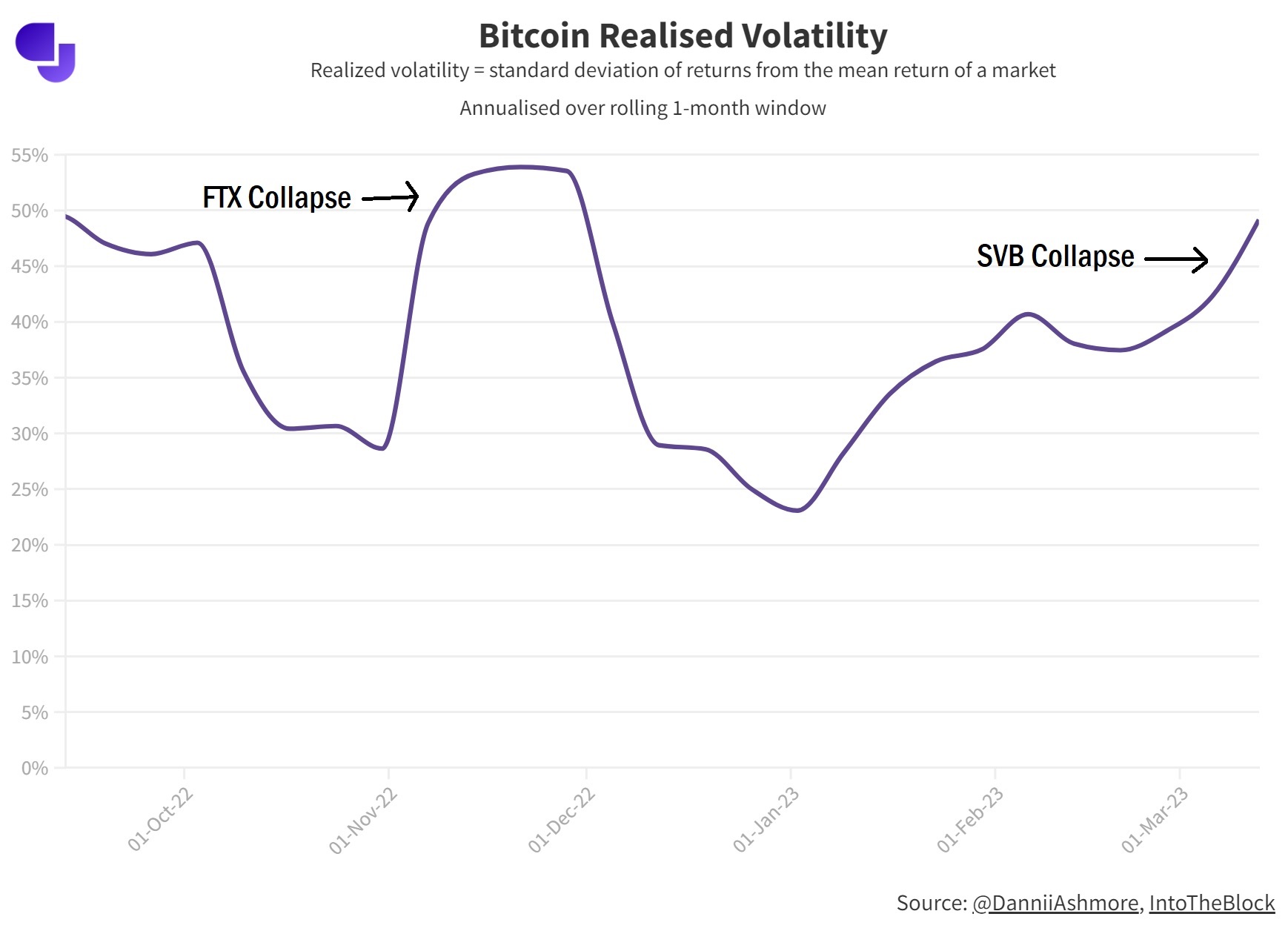

Volatility

Obviously, liquidations stem from volatility. Looking at Bitcoin to dissect the extent of the actions, the volatility is now back up to ranges final seen when FTX collapsed in November.

The chart beneath reveals that the metric had been rising steadily, earlier than SVB going poof kicked it back up to a mark 3-Day volatility mark of 50%, final seen when Sam Bankman-Fried’s enjoyable and video games had been revealed to the general public.

“We have been seeing relatively muted action in the crypto markets since the FTX collapse last November” mentioned Max Coupland, Director of CoinJournal. “The SVB event served to kick volatility back up to levels we last saw amid all the crypto scandals of last year – not only FTX, but Celsius, LUNA etc. The difference with this event is that the crash was sparked in trad-fi for a change”.

Crypto bounces back

But all is effectively that ends effectively. Or one thing alongside these traces, as regardless of SVB going below, the Fed introduced final night time, after a weekend of chaos, that each one deposits at SVB can be made complete.

The bail-out (if you happen to can name it that, as SVB remains to be going below) quelled up concern in the markets that the difficulty might develop into systemic. Crypto roared back, with Bitcoin spiking back up to $22,000 at time of writing. And this time, it was shorts who received caught offside, with $150 million liquidated throughout the market Sunday.

Perhaps the most important winner of all was the world’s second-biggest stablecoin, USDC. 25% of the stablecoin’s reserves are backed by money. Crucially, 8.25% ($3.3 billion) of reserves had been (are) trapped in SVB, with the stablecoin dipping beneath 90 cents on a number of main exchanges over the weekend.

1/ Following the affirmation on the finish of right this moment that the wires initiated on Thursday to take away balances weren’t but processed, $3.3 billion of the ~$40 billion of USDC reserves stay at SVB.

— Circle (@circle) March 11, 2023

At press time, the peg has been largely restored as the crypto market bounces upward, with Bitcoin north of $24,000.

What subsequent for crypto?

And so, the instant storm seems to have been weathered in cryptoland.

Nonetheless, the previous few days current as one more crushing blow. Three of the large crypto banks – SVB, Silvergate and Signature – are actually no extra. These banks allowed crypto companies to supply on-ramping from fiat into crypto 24/7 via their settlement providers, in distinction to the common banking hours of the banking sector.

Liquidity and quantity thus might dip even additional in the crypto market, after a 12 months that has already seen volumes, costs and curiosity in the area freefall.

Despite the Fed stepping in to shore up deposits and therefore stabilising the stablecoin market and wider crypto costs, the long-term future of the cryptocurrency trade in the US has taken one other heavy physique blow this weekend. And with the US being the most important monetary market in the world, that may be very unhealthy information.

Coupled with the regulatory clampdown by the SEC in the previous couple of months, 2023 has adopted 2022 in making a extra hostile and bearish surroundings for the sector at giant.

So crypto traders might have seen a bounceback in costs in the previous couple of months, however this seems to be largely macro-driven correlation with the inventory market, as the underlying occasions in the trade – regulation, extra bankruptcies, and crypto-friendly banks shuttering – haven’t been constructive.

If you utilize our knowledge, then we’d admire a hyperlink back to https://coinjournal.net. Crediting our work with a hyperlink helps us to preserve offering you with knowledge evaluation analysis.

[ad_2]

Source link